简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fast Profit

Abstract:Fast Profit is a brokerage firm that operates in the financial markets. The company is based in the United States and has been established for approximately one to two years. Fast Profit offers its services under a suspicious regulatory license, which raises concerns about the level of oversight and protection for clients.

| Fast Profit | Basic Information |

| Registered Country/Area | United States |

| Founded Year | 1- 2 years ago |

| Company Name | Fast Profit |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips |

| Trading Platforms | MT5 |

| Tradable Assets | Forex, Stocks, Cryptocurrencies, CFDs |

| Account Types | A live account |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | Phone, Email, Social Medias |

| Payment Methods | VISA, Sticpay, Skrill, Neteller, Perfect Money, MasterCard, Bitwallet |

| Educational Tools | None |

Overview of Fast Profit

Fast Profit is a brokerage firm that operates in the financial markets. The company is based in the United States and has been established for approximately one to two years. Fast Profit offers its services under a suspicious regulatory license, which raises concerns about the level of oversight and protection for clients.

To open an account with Fast Profit, a minimum deposit of $100 is required. This relatively low entry requirement may be appealing to traders with limited capital. The maximum leverage offered by Fast Profit is 1:500, allowing traders to amplify their positions in the market.

Fast Profit provides a trading platform known as MT5 (MetaTrader 5), which is a widely recognized and popular platform among traders. This platform offers advanced features and tools that enable traders to execute their trading strategies effectively.

In terms of tradable assets, Fast Profit offers a range of options, including forex currency pairs, stocks, cryptocurrencies, and CFDs (Contracts for Difference). This diverse selection allows traders to access different markets and explore various investment opportunities.

Fast Profit offers a single type of live account, which may limit options for traders seeking account customization. Unfortunately, there is no demo account available, which means potential clients cannot practice trading strategies or familiarize themselves with the platform risk-free.

Customer support at Fast Profit can be reached through phone and email. However, the availability and responsiveness of their customer support team may vary, and it is advisable to manage expectations accordingly.

Pros and Cons of Fast Profit

Fast Profit has some noteworthy advantages, such as offering high leverage of up to 1:500 and a user-friendly MT5 trading platform. These features can be appealing to traders looking for increased trading opportunities and a reliable platform. However, it's important to consider the downsides as well. One major concern is the lack of regulation by recognized authorities. Transparency regarding spreads and fees is limited, and unfortunately, there is no demo account available for traders to practice their strategies without risking real money. Moreover, reports of severe withdrawal problems and delays have been circulating, indicating potential difficulties in accessing funds.

| Pros | Cons |

| High leverage up to 1:500 | Lack of regulation by recognized authorities |

| MT5 trading platform | Limited transparency and information on spreads and fees |

| No demo account provided for practice trading | |

| Reports of severe withdrawal problems and delays | |

| Limited types of trading accounts | |

| No online chat support | |

| Suspicious regulatory license |

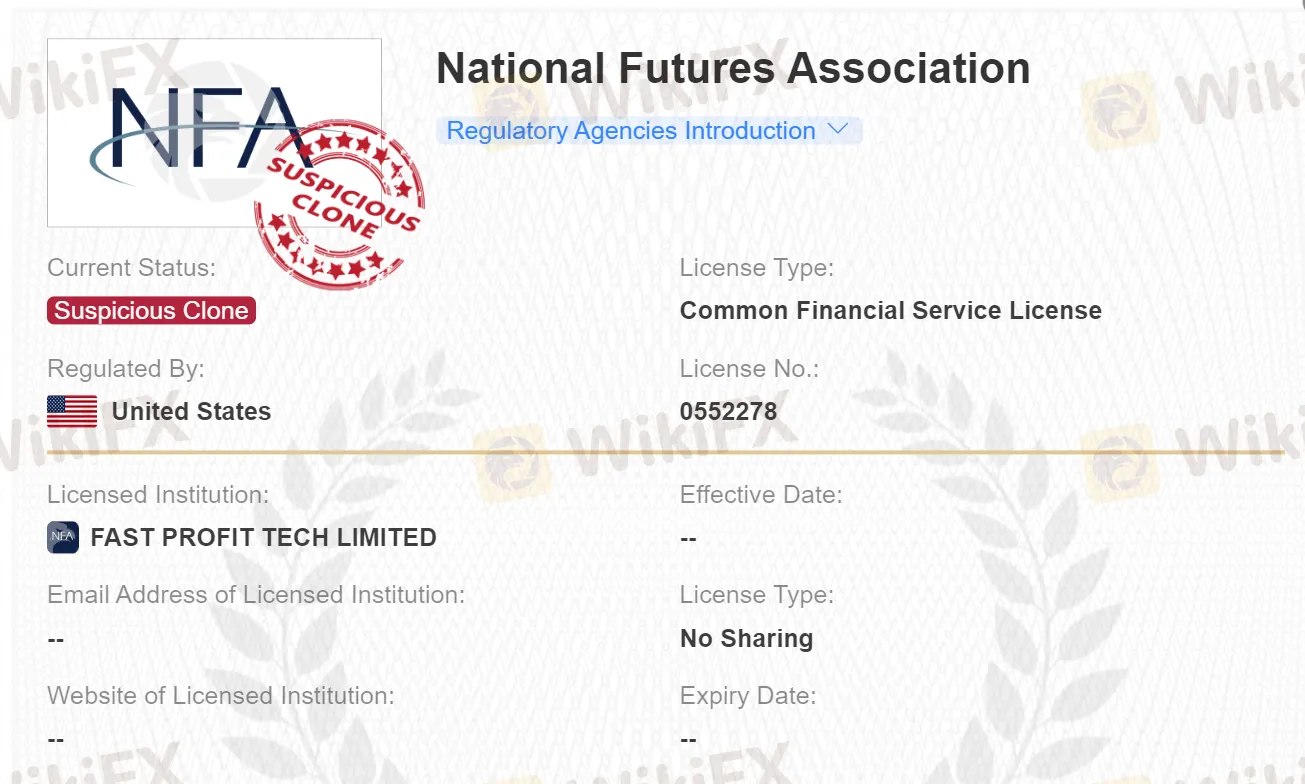

Is Fast Profit legit or a scam?

Fast Profit operates under the claim of holding an NFA (National Futures Association) license with a regulatory license number of 0552278. However, upon conducting a search on the NFA website using this license number, it becomes apparent that the information provided by Fast Profit is misleading and inaccurate. This discrepancy leaves no room for doubt that Fast Profit operates without proper regulation.

Market Intruments

Fast Profit offers a range of market instruments for trading, providing clients with various options to diversify their portfolios. The broker covers Forex, Stocks, Cryptocurrencies, and CFDs (Contracts for Difference). These instruments represent different asset classes and allow traders to speculate on the price movements of currencies, stocks, digital currencies, and other underlying assets.

Forex trading involves the buying and selling of different currency pairs, enabling traders to take advantage of fluctuations in exchange rates.

Stocks provide an opportunity to invest in shares of publicly traded companies, allowing traders to participate in the performance of specific businesses.

Cryptocurrencies have gained popularity in recent years, offering traders the chance to trade digital assets such as Bitcoin, Ethereum, and others.

CFDs allow traders to speculate on the price movements of various financial instruments without owning the underlying asset.

Account Types

Fast Profit simplifies its account offerings by providing a single live account option for traders. This account type caters to both beginner and experienced traders alike, granting access to the broker's trading platform and various market instruments. The live account requires a minimum deposit of $100, making it accessible for traders with different budget sizes.

Fast Profit, unfortunately, does not provide demo accounts for clients to practice trading without risking real money. This absence of a demo account feature can be a limitation for traders, especially those who are new to the financial markets or wish to test their strategies before committing actual funds.

How to open an account?

To open an account with Fast Profit, you will need to follow a simple process.

First, visit the broker's website and locate the account opening section.

Then, click on the “Open Account” or similar button. You will be directed to an online application form where you need to provide personal information such as your name, contact details, and identification documents. Additionally, you may need to choose the type of account you wish to open, such as a live account.

Once you have completed the form and submitted the required documents, your account will be reviewed and approved by Fast Profit. You will receive further instructions on how to fund your account and start trading.

Leverage

Leverage is an important aspect of trading, and Fast Profit offers leverage of up to 1:500. This means that traders can potentially amplify their trading positions by 500 times the amount of their initial investment. High leverage can be appealing to some traders as it allows for larger potential profits, but it also carries higher risks. Traders should exercise caution and have a solid understanding of leverage before using it in their trades.

Spreads & Commissions (Trading Fees)

Fast Profit attracts potential users by advertising competitive spreads starting from 0.0 pips. However, the broker does not provide specific details regarding the spread and commission structure on its website. This lack of transparency raises concerns about the accuracy of their claims and the potential for hidden costs. Traders should exercise caution and seek additional information from the broker to fully understand the trading fees involved, including spreads and any potential commission charges.

Non-Trading Fees

Regarding non-trading fees, Fast Profit's website does not provide explicit information about such fees. It is advisable for traders to carefully review the terms and conditions or contact customer support to inquire about any potential non-trading fees, such as withdrawal fees, inactivity fees, or account maintenance fees.

Trading Platform

Fast Profit operates on the MT5 trading platform ( available on desktop and mobile version), a widely recognized and robust platform in the financial industry. MT5 offers advanced features and tools, including comprehensive charting capabilities, real-time market data, and a user-friendly interface. Traders can leverage these features to conduct technical analysis, execute trades efficiently, and monitor market trends. Familiarizing oneself with the MT5 platform is essential for maximizing the trading experience with Fast Profit.

Deposit & Withdrawal

Fast Profit offers a variety of deposit and withdrawal methods to cater to the diverse needs of its clients. The available options include popular payment systems such as VISA, Sticpay, Skrill, Neteller, Perfect Money, MasterCard, and Bitwallet.

However, it is worth noting that Fast Profit does not provide specific information regarding the associated fees and processing time for deposits and withdrawals.This lack of transparency raises concerns as traders may not have a clear understanding of the costs involved or the expected timeframe for their transactions to be processed.

Customer Support

Fast Profit provides different avenues for traders to seek assistance and support. One of the primary methods of communication is through email. Traders can contact the customer support team by sending an email to support@fastprofitfx.us. This allows for written correspondence, enabling traders to communicate their inquiries or concerns.

Additionally, Fast Profit offers a phone number for direct communication. Traders can reach the customer support team by dialing +1 970 548 8207. This phone option allows for more immediate interaction and the opportunity to discuss queries or issues in real-time. Additionally, Fast Profit maintains a presence on various social media platforms, including Twitter, Facebook, Instagram, and others.

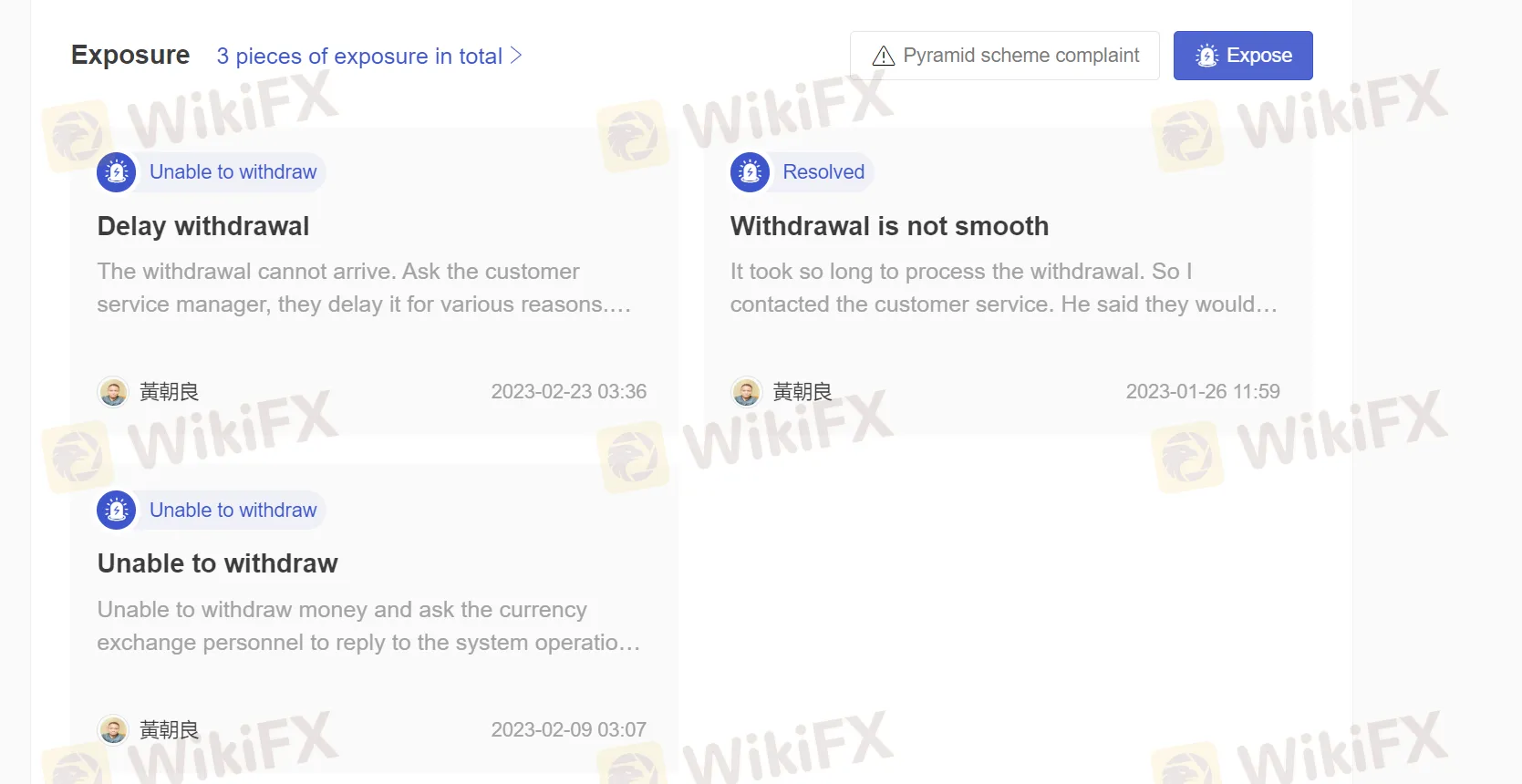

User Exposure

Fast Profit has garnered attention from users due to reported issues related to withdrawal problems. Some users have experienced delays in their withdrawal processes, which can be concerning and frustrating for traders seeking timely access to their funds. Such delays can lead to uncertainties and raise questions about the broker's reliability.

Additionally, there have been reports of withdrawal requests not being processed smoothly, further adding to the concerns of users. Instances of withdrawal requests facing obstacles or not being fulfilled as expected can lead to a lack of confidence in the broker's ability to manage transactions effectively.

Is Fast Profit suitable for beginners?

Fast Profit may not be ideal for beginners due to several factors. The absence of a demo account deprives new traders of a risk-free environment to practice and gain confidence. Without this valuable tool, beginners may face challenges in acquiring practical experience.

Moreover, Fast Profit has been associated with withdrawal issues, including delays and disruptions, which can raise concerns for novice traders who prioritize reliable access to their funds. Such uncertainties can hamper the trading experience and create unnecessary stress.

Furthermore, Fast Profit lacks comprehensive educational tools that are crucial for beginners seeking to expand their knowledge and improve their trading strategies. Access to educational resources can significantly contribute to the learning process and overall growth.

Is Fast Profit suitable for experienced traders?

No, Fast Profit may not be ideal for experienced traders due to the following reasons.

Firstly, the lack of regulatory oversight raises concerns about the broker's credibility and accountability. Experienced traders typically prefer working with regulated brokers to ensure the safety of their funds.

Secondly, Fast Profit offers limited account types and does not provide detailed information about available trading instruments. This may not meet the diverse needs and preferences of experienced traders who require a wide range of options to implement their trading strategies effectively.

Additionally, the reported issues related to withdrawals and customer support can be frustrating for experienced traders who value smooth and efficient transaction processes. These traders rely on timely access to their funds to execute trades and manage their portfolios.

Conclusion

In conclusion, Fast Profit is a broker that raises several concerns and considerations for potential traders. The absence of proper regulatory oversight is a significant drawback. The absence of a demo account also hinders the opportunity for traders to practice and test their strategies without risking real money, which can be a disadvantage for those who value learning and experimentation.

Another notable concern is the reported issues related to withdrawals and customer support. The delays and difficulties faced by some users in withdrawing their funds, coupled with limited customer support options, can lead to frustration and inconvenience for traders, especially during critical trading situations. In this way, traders who prioritize regulatory compliance, a wide range of account types and trading instruments, efficient customer support, and a seamless withdrawal process may find other regulated brokers more suitable for their trading needs.

FAQs

Q: Is Fast Profit a regulated broker?

A: No, Fast Profit is not regulated by any recognized regulatory authorities.

Q: What is the minimum deposit required to open an account with Fast Profit?

A: Fast Profit requires a minimum deposit of $100 to open a live trading account.

Q: Does Fast Profit offer a demo account for practice trading?

A: No, Fast Profit does not provide a demo account for clients to practice trading without risking real money.

Q: What payment methods are accepted for deposits and withdrawals with Fast Profit?

A: Fast Profit accepts various payment methods, including VISA, Sticpay, Skrill, Neteller, Perfect Money, MasterCard, and Bitwallet. However, specific information regarding associated fees and processing times is not provided.

Q: How can I contact Fast Profit's customer support?

A: Fast Profit can be reached through email at support@fastprofitfx.us or via telephone at +1 970 548 8207. Additionally, the broker has a presence on social media platforms such as Twitter, Facebook, and Instagram.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator