简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FSCA: Beware of Solitix FX (Pty) Ltd

Abstract:The Financial Sector Conduct Authority (FSCA) warns the public about Solitix FX (Pty) Ltd and Mr Kevin Banks, urging caution in engaging with these entities for financial services-related activities due to their unlicensed status.

The Financial Sector Conduct Authority (FSCA) has issued a warning to the public concerning Solitix FX (Pty) Ltd (Solitix FX) and Mr Kevin Banks. Individuals are urged to approach financial services-related activities involving these entities with caution, as cautioned by the regulatory authority.

Recent information received by the FSCA indicates that Solitix FX and Mr Kevin Banks are engaged in providing forex trading services to members of the public. However, it is important to note that in South Africa, entities offering financial product trading services must hold a license from the FSCA.

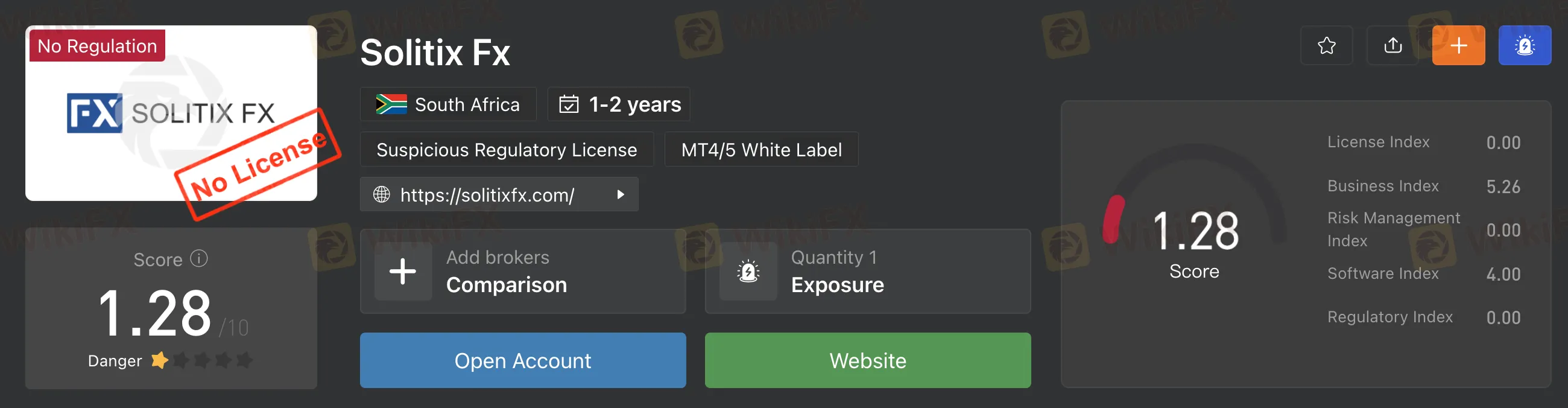

Based on WikiFX's database, we found that Solitix FX is a low-rated broker that does not possess any license.

Therefore, the FSCA advises individuals to exercise vigilance and avoid conducting any financial business with Solitix FX and Mr Kevin Banks until their licensing status has been confirmed. Engaging with unlicensed entities poses substantial risks since there is no regulatory oversight to ensure compliance with the necessary standards and protections.

The FSCA emphasizes that licensed financial service providers are subject to stringent regulations and requirements to safeguard consumers. These regulations encompass robust risk management practices, client fund segregation, and disclosing crucial information to clients.

By conducting business with unlicensed entities, consumers are vulnerable to potential fraud, financial loss, and the inability to seek recourse in cases of malpractice or misconduct. Thus, the FSCA encourages individuals to verify the licensing status of any financial service provider before engaging in transactions or investments.

Playing a crucial role in overseeing South Africa's financial services industry, the FSCA ensures that companies and individuals comply with the necessary regulations and standards. The authority's primary objective is to protect consumers and foster fair and transparent financial markets.

To aid the public in verifying the licensing status of financial service providers, the FSCA provides a comprehensive database on its official website. This database enables individuals to verify whether a particular entity is licensed and authorized to offer financial services in the country.

Furthermore, the FSCA advises the public to exercise due diligence when selecting financial service providers. This includes conducting research and reviewing a company's background, reputation, and track record before entering into any financial agreements or transactions.

The FSCA remains actively monitoring the financial services sector to identify and address potential risks and non-compliance. In cases where unlicensed entities are discovered, the authority takes appropriate enforcement actions, which may involve penalties, fines, or legal proceedings.

Should any member of the public possess information or concerns regarding Solitix FX (Pty) Ltd or Mr Kevin Banks, the FSCA strongly urges them to promptly report it. Such reporting assists the authority in its endeavours to safeguard consumer interests and preserve the integrity of the financial services industry.

Established in 2018, FSCA is a regulatory watchdog in South Africa tasked with overseeing the financial services industry, enforcing regulations, and safeguarding consumer interests in order to maintain fair and transparent financial markets.

In conclusion, the FSCA advises individuals to exercise caution when participating in financial services-related activities and to be cautious of unlicensed entities that offer forex trading services. By verifying the licensing status of financial service providers and conducting thorough research, individuals can significantly mitigate the risks associated with fraudulent activities or misconduct.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator