简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NAGA

Abstract:NAGA was founded in 2015 by Yasin Qureshi and Benjamin Bilski. The company conducted an initial public offering in 2017, surpassing $50 million in a few months on the Frankfurt stock exchange. The brokerage is currently headquartered in Limassol, Cyprus. NAGA offers a wide range of tradable assets. With over 1000 options including Stocks, Indices, Forex, Commodities, and ETFs, traders have a diverse selection to choose from. It offers maximum leverage of up to 1:1000, and the minimum deposit requirement is $250. NAGA provides multiple trading platforms, including NAGA Trader Mobile, NAGA Trader for Web, as well as the popular MT4 and MT5 platforms. Traders can access a demo account for practice trading and benefit from the availability of educational tools such as a Trading calculator, Economic calendar, Earnings calendar, Blog, Daily hot news, NAGA Learn, Glossary, Currencies Encyclopedia, Currency Converter, eBooks, and Webinars. Customer support is offered through email, live chat,

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Founded Year | 2015 |

| Company Name | NAGA |

| Regulation | Not regulated |

| Account Types | Six VIP trading account types |

| Minimum deposit | $250 |

| Maximum leverage | 1:1000 |

| Trading Platforms | NAGA Trader Mobile, NAGA Trader for Web, MT4, MT5 |

| Tradable Assets | Over 1000 options including Stocks, Indices, Forex, Commodities, and ETFs |

| Demo Account | Available |

| Customer Support | Email, live chat, telephone support |

| Payment Methods | Bank wire transfer, credit/debit cards, cryptocurrencies |

| Educational Tools | Trading calculator, Economic calendar, Earnings calendar, Blog, Daily hot news, NAGA Learn, Glossary, Currencies Encyclopedia, Currency Converter, eBooks, Webinars |

Overview of NAGA

NAGA was founded in 2015 by Yasin Qureshi and Benjamin Bilski. The company conducted an initial public offering in 2017, surpassing $50 million in a few months on the Frankfurt stock exchange. The brokerage is currently headquartered in Limassol, Cyprus. NAGA offers a wide range of tradable assets. With over 1000 options including Stocks, Indices, Forex, Commodities, and ETFs, traders have a diverse selection to choose from. It offers maximum leverage of up to 1:1000, and theminimum deposit requirement is $250.

NAGA provides multiple trading platforms, including NAGA Trader Mobile, NAGA Trader for Web, as well as the popular MT4 and MT5 platforms. Traders can access a demo account for practice trading and benefit from the availability of educational tools such as a Trading calculator, Economic calendar, Earnings calendar, Blog, Daily hot news, NAGA Learn, Glossary, Currencies Encyclopedia, Currency Converter, eBooks, and Webinars. Customer support is offered through email, live chat, and telephone, and various payment methods, including bank wire transfer, credit/debit cards, and cryptocurrencies, are supported. It's important to note that NAGA is not regulated, and traders should carefully consider this factor when evaluating the platform.

Is NAGA legit or a scam?

An essential aspect to consider for a broker's security is its regulatory credentials. NAGA was previously fully licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), which provided a level of oversight and protection for traders. However, there is currently uncertainty surrounding the platform's regulatory status, as there have been reports or indications that the regulation information may be associated with suspicious or cloned entities. This lack of clarity raises concerns about the platform's credibility and the level of investor protection it can offer. Traders should exercise caution and thoroughly research the current regulatory status of NAGA before considering opening an account or engaging in trading activities on the platform. It is advisable to seek information from reputable sources or consult with financial authorities to ensure the broker's regulatory compliance and the safety of funds.

Pros and Cons

NAGA has several advantages and disadvantages for traders to consider. It offers trading experience with its wide range of tradable assets and multiple trading platforms, allowing traders to diversify their portfolios and choose the most suitable platform for their needs. The availability of a demo account enables users to practice trading strategies. Additionally, NAGA provides a comprehensive range of educational resources, including free tools and resources, to enhance traders' knowledge and skills. It offers maximum leverage of up to 1:1000, and theminimum deposit requirement is $250.

However, it's important to note that NAGA operates without regulation, which may raise concerns for some traders. Moreover, traders should be aware of potential fees, such as the flat fee and additional fees on copied trades, as well as possible charges and limits associated with withdrawals.

| Pros | Cons |

| Wide range of tradable assets | Not regulated |

| Multiple trading platforms available | Flat fee and additional fees on copied trades |

| Demo account for practice trading | Potential withdrawal charges and maximum withdrawal limits |

| Diverse range of educational resources | |

| Multiple deposit and withdrawal methods | |

| Comprehensive customer support | |

| Free and multiple educational resources | |

| Generous maximum leverage of up to 1:1000 |

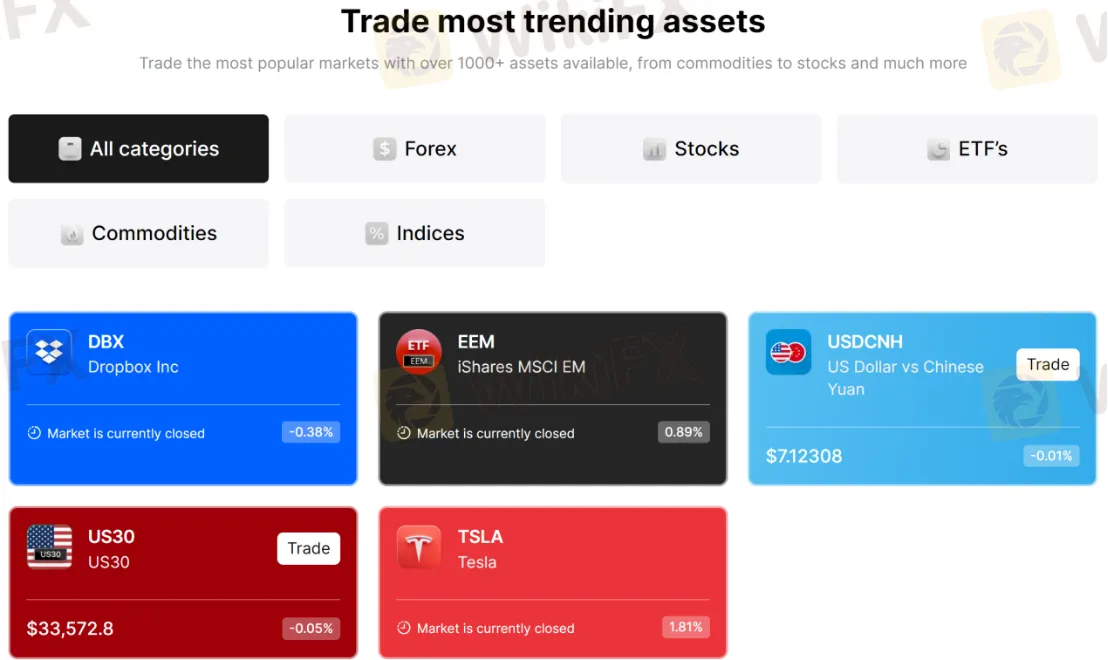

Market Instruments

NAGA is a comprehensive trading platform that provides a wide range of products and services to its users. One of its key strengths is the extensive selection of assets it offers, which includes over 1000 options. These assets encompass various categories such as Stocks, Indices, Forex, Commodities, and ETF's. By offering such a diverse range of assets, NAGA enables traders to access different markets and opportunities, allowing for portfolio diversification.

Account types

NAGA offers a choice of VIP trading accounts:

· Iron – $250 minimum deposit, earn $0.12 per copied trade on all instruments, earn $0.50 per copied trade on premium forex pairs, $5 withdrawal fee, daily 5 trading signals

· Bronze – $2,500 minimum deposit, earn $0.15 per copied trade on all instruments, earn $0.60 per copied trade on premium forex pairs, $4 withdrawal fee, daily NAGA 5 trading signals, PI dashboard

· Silver – $5,000 minimum deposit, earn $0.18 per copied trade on all instruments, earn $0.70 per copied trade on premium forex pairs, $3 withdrawal fee, daily 10 trading signals, PI dashboard, one-on-one tutoring (2 per month)

· Gold – $25,000 minimum deposit, earn $0.22 per copied trade on all instruments, earn $0.80 per copied trade on premium forex pairs, $2 withdrawal fee, daily 15 trading signals, PI dashboard, one-on-one tutoring (4 per month), premium eBooks and contests

· Diamond – $50,000 minimum deposit, earn $0.27 per copied trade on all instruments, earn $1.00 per copied trade on premium forex pairs, $1 withdrawal fee, daily 20 trading signals, PI dashboard, one-on-one tutoring (7 per month), premium eBooks and contests, profile awareness boost

· Crystal – $100,000 minimum deposit, earn $0.32 per copied trade on all instruments, earn $1.20 per copied trade on premium forex pairs, $1 withdrawal fee, unlimited daily NAGA trading signals, PI dashboard, one-on-one tutoring (unlimited), premium eBooks and contests, profile awareness boost.

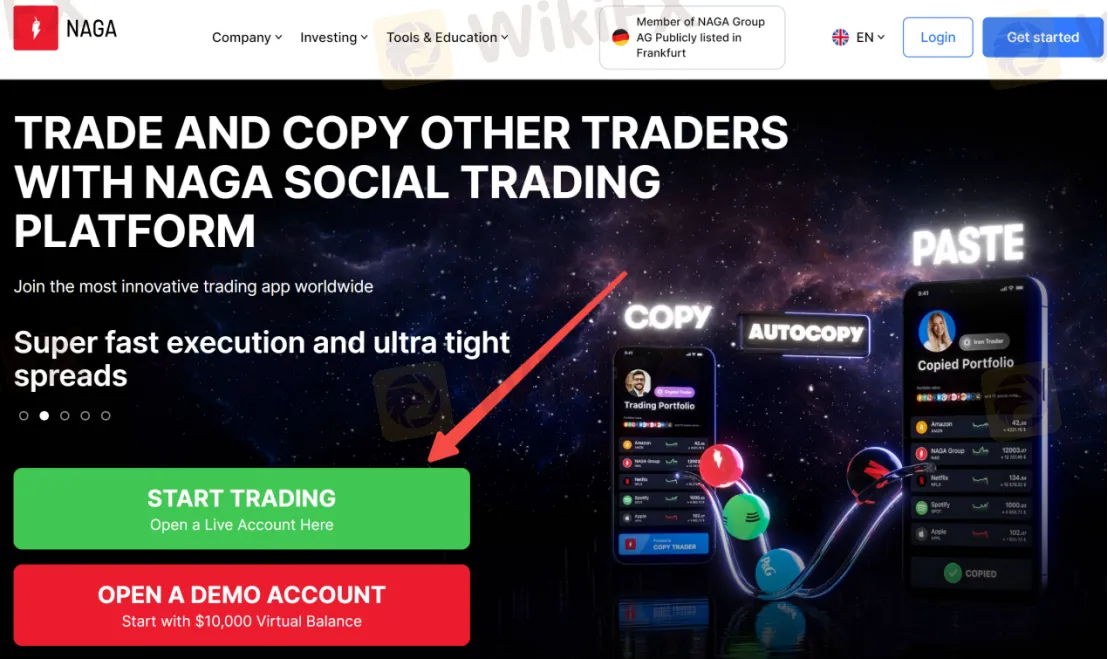

How to Open an Account?

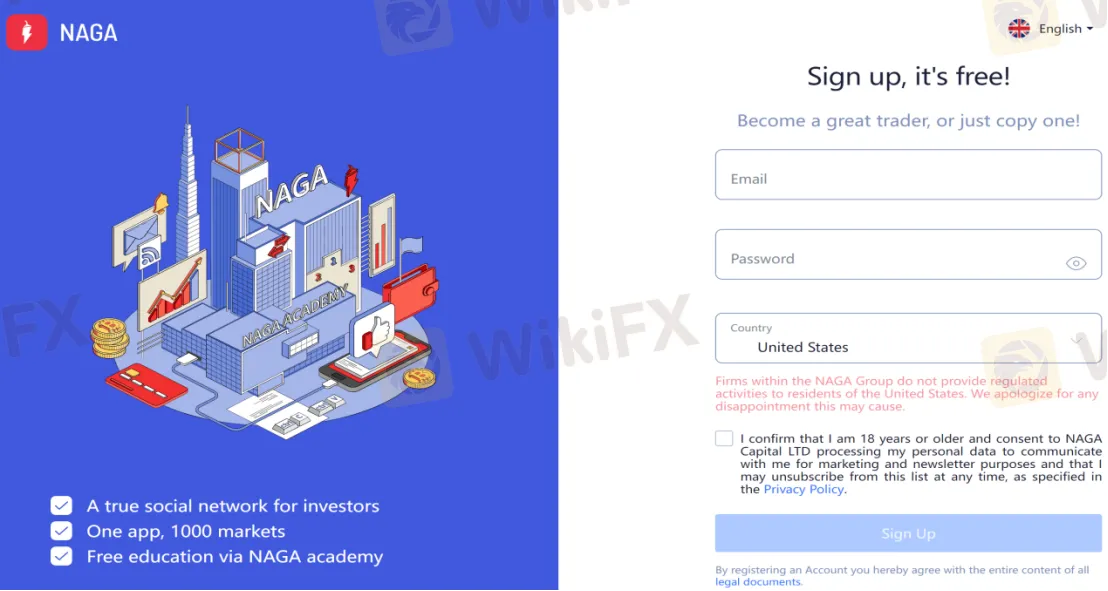

To open an account with NAGA, you can follow these steps:

1. Visit the NAGA website: Go to the official NAGA website using a web browser on your computer or mobile device.

2. Click on “START TRADING”: Look for the button on the website's homepage or in the navigation menu, and click on it.

3. Fill out the registration form: Provide the required information in the registration form, which typically includes details such as your name, email address, and password.

4. Verify your email address: After submitting the registration form, you will receive an email from NAGA containing a verification link. Click on the link to verify your email address.

5. Complete the account verification process: Depending on the regulatory requirements, you may need to provide additional information and documentation to verify your identity.

6. Fund your account: Once your account is verified, you can proceed to fund your NAGA account. NAGA typically offers multiple deposit methods, such as bank transfer, credit/debit cards, or electronic payment services. Choose the method that suits you best and follow the instructions to make a deposit.

7. Start trading: Once your account is funded, you can start trading on the NAGA platform. Familiarize yourself with the platform's features, choose your preferred financial instruments, and execute your trades based on your trading strategy.

Leverage

NAGA offers a maximum leverage of up to 1:1000, allowing traders to potentially amplify their returns. However, it's important to note that high leverage also entails high risk. While increased leverage can magnify profits, it can equally magnify losses. Traders should exercise caution and carefully consider their risk tolerance and trading strategies before utilizing high leverage. It is advisable to use leverage responsibly and employ risk management techniques to mitigate potential losses. Understanding the risks associated with high leverage is crucial for maintaining a balanced and sustainable trading approach.

Fees

NAGA offers a fee structure that includes variable spreads with zero commission on most assets. For forex trading, typical spreads are around 1.8 pips, while indices also have a similar fee structure, although spreads may vary depending on the specific market. When it comes to CFD trades, NAGA charges a commission of €2.50 (or the equivalent in the respective currency) for each in/out transaction.

In addition to these trading fees, NAGA implements a flat fee of €0.99 on all trades that are copied by users. This fee applies regardless of the size or value of the trade. Furthermore, trades that generate a profit equal to or greater than €10 incur an additional 5% fee.

Trading Platforms

NAGA offers a diverse range of trading platforms, including NAGA Trader Mobile, NAGA Trader for Web, MT4, and MT5 to cater to users trading needs.

NAGA Trader Mobile provides a convenient trading experience through the NAGA iOS or Android applications. With these mobile apps, traders can conveniently access their NAGA accounts on the go. Whether you are using a smartphone or tablet, you can enjoy the full range of trading features and functionalities, including real-time market data, charting tools, and order execution.

For those who prefer trading from their web browsers, NAGA Trader for Web is the ideal solution. This platform allows users to trade from any device with an internet connection and a compatible browser. Whether you are using a desktop computer, laptop, or even a tablet, you can access the NAGA trading platform directly through your preferred web browser.

NAGA also supports the popular MetaTrader4 (MT4) platform, which is widely recognized for its robust features and extensive technical analysis tools. MetaTrader4 offers a comprehensive suite of tools, including customized charts, automated trading capabilities, and a wide range of indicators.

In addition to MT4, NAGA also supports MetaTrader5 (MT5). With MT5 integration, NAGA users can trade on one of the most advanced and versatile trading platforms available. MetaTrader5 offers enhanced features compared to its predecessor, including additional order types, improved charting options, and expanded time frames.

Deposit & Withdrawal

NAGA provides users with a diverse range of over 20 deposit and withdrawal methods, ensuring convenience and flexibility. The specific options available may vary depending on the user's country of residence. These methods include instant options such as bank wire transfer, credit/debit cards (Visa, Mastercard, and Maestro), cryptocurrencies like Bitcoin, NAGA Coin, and Ethereum, as well as alternative payment methods such as Skrill, Giropay, and Neteller. On the other hand, withdrawal requests are typically processed within the same day or the following day, except for those submitted outside of working hours.

While NAGA does not charge any deposit fees, it's important to note that withdrawal charges may vary based on the user's level within the platform. Furthermore, the maximum withdrawal amount is determined by the specific payment method chosen by the user.

Overall, NAGA's wide range of deposit and withdrawal methods cater to users' preferences and needs. However, users should be mindful of potential withdrawal charges and ensure they are aware of the maximum withdrawal limits associated with their chosen payment method.

Customer Support

For customer support, NAGA offers multiple contact channels to assist users. You can reach out to their team via email at support@nagamarkets.com. Additionally, a live chat feature is available on the website, easily accessible at the bottom of the page. If you prefer a direct conversation, you can contact them by telephone at +357 25 041410.

In addition to these channels, NAGA maintains an active presence on various social media platforms including Facebook, Instagram, Twitter, YouTube, and LinkedIn. By following their accounts, traders can stay updated with the latest news, product announcements, and market insights shared by the broker. These platforms provide an additional means of staying connected and informed about the developments within the NAGA ecosystem.

Educational Resources

NAGA provides a comprehensive set of educational resources and tools to assist traders. These tools include a Trading calculator, Economic calendar, and Earnings calendar, which aid in making informed trading decisions. The platform also offers a range of educational resources, such as a Blog, Daily hot news, NAGA Learn, Glossary, Currencies Encyclopedia, Currency Converter, eBooks, and Webinars. These resources aim to enhance traders' knowledge and skills, allowing them to stay up to date with market trends and make well-informed trading strategies.

However, it's worth noting that while NAGA offers a wide array of educational resources and tools, there are some limitations. For instance, the availability and quality of these resources may vary, and traders should carefully evaluate their relevance and accuracy.

Conclusion

In conclusion, NAGA is a brokerage platform founded in 2015 that offers a wide range of tradable assets and multiple trading platforms, including NAGA Trader Mobile, NAGA Trader for Web, MT4, and MT5. It provides a demo account for practice trading and offers various educational resources to enhance traders' knowledge and skills. NAGA supports multiple deposit and withdrawal methods and provides customer support through email, live chat, and telephone. However, a significant disadvantage is that NAGA is not currently regulated, raising concerns about the platform's credibility and investor protection. Traders should carefully consider this factor and conduct thorough research before engaging with the platform. Additionally, there may be potential fees, including a flat fee and additional fees on copied trades, as well as charges and limits associated with withdrawals.

FAQs

Q: Is NAGA a trustworthy platform or a scam?

A: The regulatory status of NAGA is suspicious clone, and traders should exercise caution.

Q: What trading platforms does NAGA offer?

A: NAGA provides multiple trading platforms, including NAGA Trader Mobile, NAGA Trader for Web, MT4, and MT5.

Q: What deposit and withdrawal methods does NAGA support?

A: NAGA offers over 20 deposit and withdrawal methods, including bank wire transfer, credit/debit cards (Visa, Mastercard, and Maestro), cryptocurrencies like Bitcoin and Ethereum, and alternative payment methods like Skrill, Giropay, and Neteller.

Q: How can I contact NAGA's customer support?

A: You can contact NAGA's customer support through various channels. Reach out via email at support@nagamarkets.com, utilize the live chat feature on the website, or call them directly at +357 25 041410. NAGA also maintains an active presence on social media platforms, including Facebook, Instagram, Twitter, YouTube, and LinkedIn.

Q: What educational resources are available on NAGA?

A: NAGA offers a comprehensive set of educational resources, including a Trading calculator, Economic calendar, Earnings calendar, Blog, Daily hot news, NAGA Learn, Glossary, Currencies Encyclopedia, Currency Converter, eBooks, and Webinars.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Italy’s CONSOB ordered seven unauthorized investment websites blocked, urging investors to exercise caution to avoid fraud. Learn more about their latest actions.

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

STARTRADER warns against counterfeit sites and apps using its brand name. Protect yourself by recognizing official channels to avoid fraudulent schemes.

Dukascopy Bank Expands Trading Account Base Currencies

Dukascopy Bank now offers AED and SAR as base currencies for trading, expanding options for clients to fund accounts in Dirham and Riyal.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator