简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exploring the Causes of the U.S. Dollar's Unexpected Strength

Abstract:The recent unexpected rise of the US dollar may be attributed to global uncertainties, potential reversal of Federal Reserve policies, and investor positioning. Factors such as US debt-ceiling concerns and inflation fears are fueling the currency's value despite market expectations of its decline.

Despite market agreement that the US dollar will decline, the currency stunned everyone by rising 2% in the previous month. This comes at a time when US inflation seems to be stabilizing and the Federal Reserve is indicating a halt in interest rate rises. Is the dollar's strength transitory or indicative of a change in economic conditions?

An Array of Contributing Factors

The surprise spike in the US dollar might be ascribed to a number of causes. The variety of global uncertainties is foremost among them, ranging from the battle over the US debt limit to the health of banks and the future of the global economy. Such concerns boost the dollar's allure as a safe haven, raising demand and, as a result, value.

The dollar index, which compares the US currency to six others, has risen by around 2% since mid-April, hitting approximately 103, albeit it is still nearly 10% down from the 20-year high of 114.78 sets last September. This rise is mostly related to market concern over the coming US debt-ceiling issue.

Uncertainties Around the Debt Ceiling

Democrats and Republicans are getting closer to reaching a deal on expanding the $31.4 trillion borrowing ceiling, but the possibility of a calamitous US debt default remains. This situation, coupled with concerns over potentially vulnerable banks, is pushing markets towards safer assets like bonds, gold, and dollars.

Esther Reichelt, the currency strategist at Commerzbank, states, “The recent USD strength is largely driven by increased safe-haven demand in view of 'unknown unknowns.'” Questions regarding the depth of vulnerabilities in U.S. regional banks and the potential fallout from the debt ceiling crisis have fueled this demand.

A Potential Fed Reversal?

While some analysts attribute the dollar's strength to “safe-haven” demand, Alvin Tan, head of Asia FX strategy at RBC Capital Markets, expresses skepticism. He contends that if such fears were at work, the stock market would exhibit a comparable uneasiness, which it has not. Instead, the S&P 500 index has been stable since mid-April and has gained more than 8% this year.

Fears that the Fed has yet to thoroughly combat inflation, according to Tan, may possibly be impacting the dollar's ascent. According to a recent University of Michigan study, consumer inflation expectations hit a five-year high of 3.2% in May, driving bond rates and the currency higher.

The Role of Investor Positioning

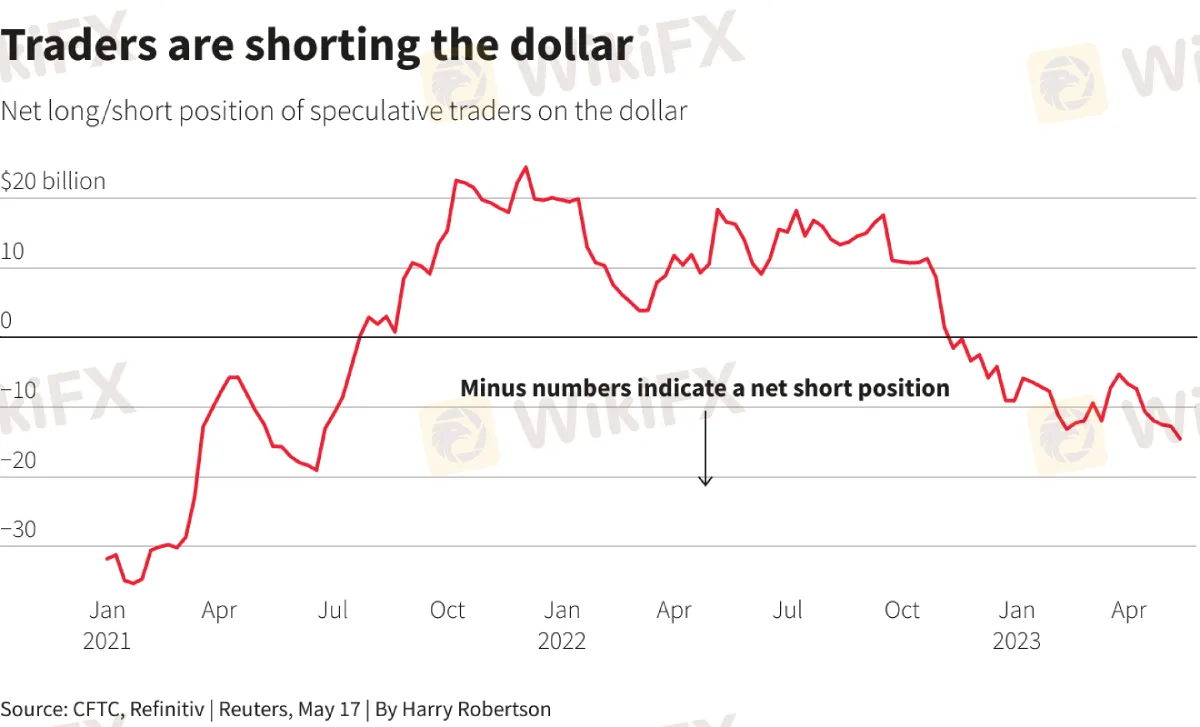

In an ironic twist, investor positioning against the dollar may be another factor contributing to its resurgence. Last week, the net short bets against the dollar by hedge funds and speculators amounted to $14.56 billion, marking the most significant such position since mid-2021.

This position could inadvertently drive a dollar rally. A minor rise in the dollar's value may force traders to close their short positions, leading to more dollar purchases and a subsequent increase in its value. As Chester Ntonifor, FX strategist at BCA Research, noted, “The dollar is very, very oversold.”

Conclusion

The U.S. dollar's recent rise, contrary to market expectations, highlights the complex and sometimes contradictory influences that shape currency movements. The interplay between technical and economic factors, coupled with geopolitical uncertainties, can lead to unexpected outcomes, underscoring the necessity of ongoing market vigilance.

Download and install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App here: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator