简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Winning Combination: BlackBull Markets and TradingView Take Charting and Trading to New Heights

Abstract:New Zealand's BlackBull Markets has expanded its partnership with TradingView, granting clients who trade at least one lot per month complimentary access to TradingView Pro. This collaboration integrates BlackBull Markets into TradingView's trading panel, offering users advanced charting tools, real-time data, and the ability to trade directly through charts

New Zealand's BlackBull Markets, a well-known FX and CFDs broker, has broadened its collaboration with the renowned charting and trading platform, TradingView. This partnership expansion will allow traders to have access to valuable resources and tools.

As a human trader, I can appreciate the value that comes with using advanced software like TradingView Pro. While the basic version is free, BlackBull Markets' clients who trade at least one lot per month will receive complimentary access to TradingView Pro, the premium version.

This subscription-based service provides an incredible assortment of charting tools, backtesting capabilities, and bespoke technical indicators, as well as real-time data from numerous exchanges and marketplaces. It's a terrific approach for traders like myself to remain up-to-date on market movements.

Users are not uncommonly charged for real-time access to market data feeds, which generally include fees for aggregated market data providers and some exchange fees. TradingView Pro can be subscribed to on a monthly or annual basis and comes with different pricing tiers based on the features and tools provided. Pro users can enjoy all the perks of a basic account with additional features and capabilities.

Since the initial integration in 2022, BlackBull Markets users have had access to over 300 tradable instruments, such as Forex, Index, and Single Stock CFDs, Commodities, Precious Metals, and Energy. BlackBull Markets, founded in 2014, is an ECN broker based in New Zealand and is licensed by the New Zealand Financial Markets Authority and the Financial Services Authority (FSA) of Seychelles. They offer hundreds of tradeable instruments on the MT4 and MT5 platforms.

This partnership is more than just integrating charting tools; it brings a more comprehensive collaboration with BlackBull Markets. This includes incorporating BlackBull Markets into the TradingView platform as a supported broker in the trading panel, allowing users to trade directly through charts without leaving the site.

For those of us who are both TradingView users and BlackBull Markets brokerage customers, we can receive customized alerts on breaking news, connect with other users, share our thoughts, and keep an eye on the most active stocks of the day.

TradingView today has over 30 million monthly active users and paying clients in over 180 countries, thanks to a growing community of data-driven investors. It's gone a long way from its humble beginnings in 2011 with just 2,000 visits each day.

TradingView includes an online shop where customers may buy access to third-party tools in addition to its basic services. In recent years, the platform has grown in prominence as it has effectively promoted itself as a producer of seamless HTML5 charts spanning a broad variety of asset classes. As a fellow trader, I can confirm the usefulness of this collaboration, and I'm forward to seeing how it develops in the future.

About BlackBull Markets

BlackBull Markets is a New Zealand-based online brokerage that provides trading services for Forex, CFDs, and commodities. Founded in 2014, BlackBull Markets has quickly gained a reputation as a reliable and transparent broker with competitive pricing and excellent customer support.

In terms of regulation, BlackBull Markets is licensed and regulated by New Zealand's Financial Markets Authority (FMA). This adds an additional layer of protection for customers while also ensuring that the broker acts in a transparent and ethical way.

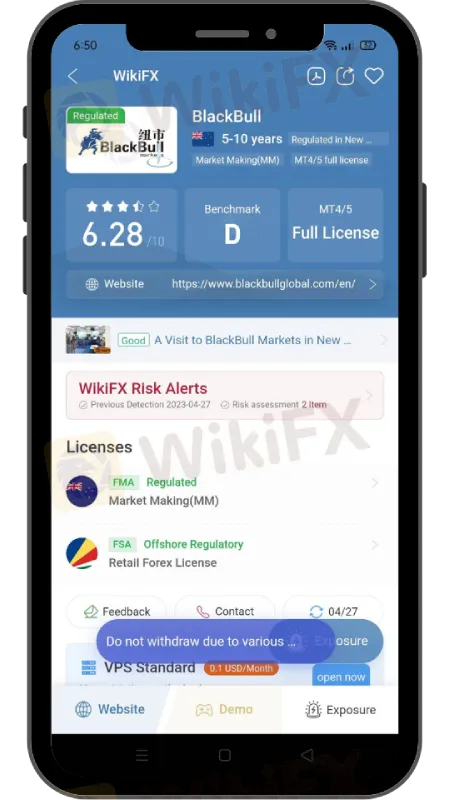

BlackBull Markets has been given a rating of 6.28 on WikiFX, an online platform dedicated to assessing and rating Forex brokers around the world. While BlackBull Markets is known for offering a range of trading services, including Forex, commodities, and indices, its relatively low rate compared to the other brokers may be attributed to a lack of licenses held by the company.

Download and install the WikiFX App on your smartphone to stay updated on the latest brokers news.

Download the app here: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Italian Regulator Warns Against 5 Websites

Currency Calculator