简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CNMV's Fight Against Unscrupulous Financial Brokers

Abstract:The article discusses the role of the CNMV in governing Spain's stock exchanges and protecting the financial system and investors. However, it also highlights the ongoing issue of unlicensed organizations operating in the Spanish financial markets, posing risks and endangering investors.

The Spanish National Securities Market Commission, or Comisión Nacional del Mercado de Valores (CNMV), is in charge of monitoring and governing the country's stock exchanges. Its goal is to safeguard the Spanish financial system's effectiveness and openness while also defending investors and preserving market equilibrium.

Unlicensed Organizations Endangering Spanish Financial Markets and Investors

Despite the CNMV's efforts, unlicensed organizations are still able to function in the Spanish financial markets, endangering investors and the financial system's image.

Entities that function without the required CNMV permission are known as unauthorized organizations. These organizations may include dishonest businesses, unlicensed agents, or investment advisers.

WikiFX as a global forex brokers regulatory inquiry app has also been receiving negative reports about the listed entities and has found out that they are unregistered and have no authorization to do financial business even with international authorities.

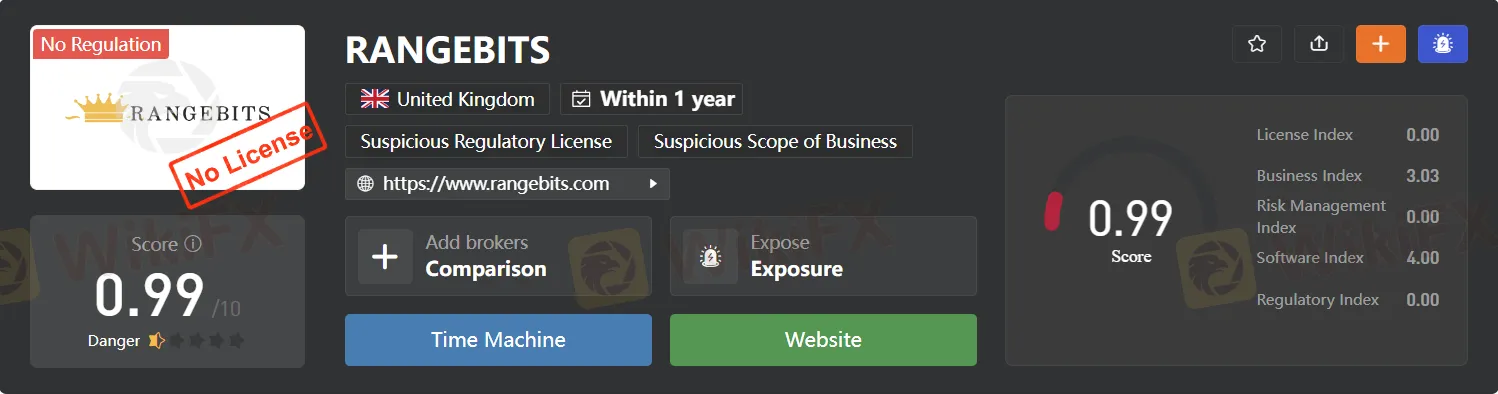

RANGEBITS

GLOVES INVESTS

GOLDMINES

MARKET GOLD

Risks for Investors with Unlicensed Organizations in Spain

The potential for deception is one of the primary dangers connected to illegal organizations. These organizations have the potential to mislead investors by making inflated return promises, fast profit guarantees, or aggressive sales techniques. After taking the money from investors, they might vanish with it or use it for illegal activities, leaving investors with nothing.

Unauthorized parties can subject investors to additional risks, such as badly handled or uncontrolled assets, in addition to scams. These assets are vulnerable to poor administration, money being wasted, or even failure, if proper supervision isn't provided.

Investors should always confirm that the organizations they are interacting with are approved by the CNMV in order to safeguard themselves. You can review the CNMV's public registry of approved organizations or get in touch with the CNMV personally to accomplish this.

It is crucial that the CNMV keep up its efforts to find and punish illegal organizations. This can be accomplished by stepping up monitoring, working with other foreign law enforcement agencies, and launching public awareness initiatives.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator