简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HEDGING VS. STOP LOSS – 4 STOP LOSS TECHNIQUES

Abstract:Hedging strategies minimize risk by trading instruments in opposite directions. For example, holding a long and a short trade at the same time.

Hedging vs. Stop Loss

Hedging strategies minimize risk by trading instruments in opposite directions. For example, holding a long and a short trade at the same time.

They are greprotectat protection in bear markets. Traders can their assets by opening trades in opposite directions.

In a typical trading strategy, stop-losses are used to limit losses if the trade doesnt go as planned. This is one reason hedging strategies are useful. It allows a trader to keep their current position without closing the the trade.

Hedging in forex involves opening two positions on the same currency pair to reduce the risk of losses in one of the positions. For example, a trader may go long on a currency pair and simultaneously open a short position on the same currency pair. This means that if the market moves in one direction, the trader will be profitable in one position and will lose in the other. The net result is a reduction in overall risk exposure.

While A stop-loss order is a tool used by traders and investors to limit losses and reduce risk exposure. With a stop-loss order, an investor enters an order to exit a trading position that he holds if the price of his investment moves to a certain level that represents a specified amount of loss in the trade. By using a stop-loss order, a trader limits his risk in the trade to a set amount in the event that the market moves against him.For example, if a trader buys a currency pair at 1.2000 and sets a stop-loss order at 1.1950, the position will be automatically closed if the price falls to 1.1950. This ensures that the traders losses are limited to a predetermined amount.

Stop Loss Techniques

Hedging As Stop-Loss

Basically, hedging is when you open trades to offset another trade that you have already opened. The hedging methods require using a second instrument or financial asset to implement risk hedging strategies

For example, if you take one lot of EURUSD on a buy, you then hedge it for one lot of EURUSD sell. Obviously, youll be flat in the market. However, there are a few negative side effects. This is mainly due to spread changes and swap rate changes.

The value of your hedge will change slightly, but it‘s a good way of not letting your trade go into a deep drawdown because you lock your stop loss and give it away to recover. So hedging is very useful for limiting the risk and not having to leave the market. While it sounds simple, it’s actually a confusing process that involves a lot of practice. It takes a ton of focus on the market confirmation because once you enter a hedging situation, it can be tough to decide what side of the trade to cut and return to a bias on the market.

Once you close one side, you‘ll start earning or losing according to the opposite side. So you need to solidify your analysis and understanding of price so you know how to get out of the hedge. If you don’t have the right tools to decide, then hedging is probably not the best option.

Something else to know is how to cut losses. Once you hedge, it‘s usually only the negative profitable side. So if you’re hedging because you want to win both sides, it‘s not the right mentality because, eventually, you’ll have to cut one side.

In a real world, we wouldn‘t need to stop loss techniques because we’d all win and keep on winning. However, traders of all skill levels and experience will quickly tell you that such a utopia is not reality.

The non-fantasy market conditions we trade in are full of losses and, at times, devastating ones. Once we accept losses as a mainstay of the forex market, we can then look at reducing these losses. However, instead of eliminating loss (which is impossible), we need to manage loss and limit its potential destruction.

These are the four types of stop-loss techniques available to forex traders:

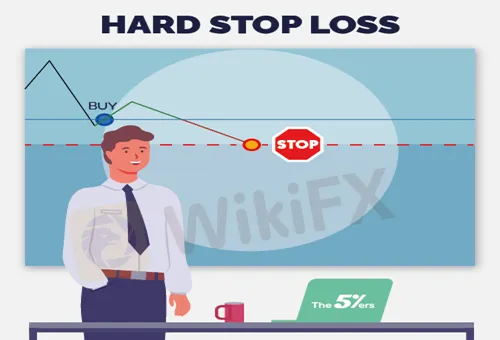

Hard Stop-Loss

This is the most commonly used approach when it comes to stopping loss. Its a simple setup that closes your position automatically when the price hits a certain level.

This is a reassuring method for many traders because it guarantees that if a price goes into an unexpected or prolonged fall, your position will automatically be stopped and contained at a certain level before the bottom of the plunge.

The downside with this is that often a price will go back in your favor after it‘s hit the stop loss. On the other hand, a hard stop loss may mean you’ll end up taking a loss for nothing.

It‘s important to stress that there’s no right or wrong with this method. It‘s just a question of what you’re most comfortablewith.

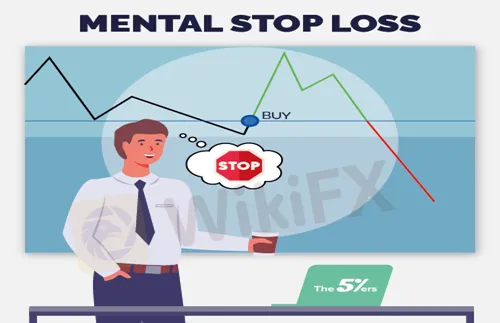

Mental Stop-Loss

This stop-loss technique will be more familiar to more experienced traders because it takes a lot of practice and works to implement successfully.

Rather than place a stop loss in the market system, traders who deploy mental stops execute the stops manually once a price is where it needs to be.

The benefit of this type of setup is that the trader has absolute control over the stop. If a price is not convincingly moving towards a predetermined stop, the veteran trader can decide not to place the stop until they receive stronger confirmation. This results in floating drawdowns and uncut trades. The trader stays in the game and has the chance to recover back to profitability.

The downside of this type of stop loss is that it requires constant monitoring of the market. Because nothing is left to automation, the trader has to always be on top of their trades.

This technique is also a bit tricky and should only be undertaken by the most experienced and learned traders. Without the proper knowledge, market events can slide a trade into a severe drawdown. This is especially true when the trader doesnt know how to cut losses.

No Stop-Loss

This isn‘t an ideal method for most people because you’ll end up spending a ton of time in negative, stressful positions. Sometimes it will work out for you, but it only takes one time not to throw you into a crippling position.

Many traders who don‘t use a stop loss claim that there will always be a period for recovery because the price fluctuates up and down. These traders anticipate and trade with incredible patience while they’re suffering through a drawdown.

For most traders, this is a self-deceiving practice because they dont have the mental strength to cut losses. Traders wind up in trouble when they play the market with an all-in mentality.

To work without a stop loss, you need to have a rigid guide for alternative risk management to compensate for the lack of stop loss. This usually involves very low leverage (less than 1 to 1 or even negative leverage). This alternate plan also involves price action condition to cut your trade, another form of mental stop loss.

Only well-trained and disciplined traders should even attempt to do this.

Finally, four types of stop-loss laid out above all have pros and cons. It‘s up to you to decide what’s best according to your personality at the end of the day. Some methods require more mental toughness, while some require more patience and practice.

What is clear is that any method you choose, you should stick to and practice. You should be aware of how it affects you emotionally. Work on your trading plan and action plan according to the mental reactions related to losses. Losses are a part of the game, and youll need to embrace that.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Review: Is IQ Option trustworthy?

IQ Option is catching our eye as it seems to be a trending topic. For those who want to know whether IQ Option is a reliable broker, WikiFX made this article to help you better understand this broker.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator