简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Up to 800% Profit? No! Forbes Capital Scams many Malaysian Investors

Abstract:Withdrawal of funds has always been one of the issues of great concern for investors.

While withdrawal problems do occur from time to time when trading with regulated brokers, they occur more frequently when investors are trading with illegal platforms.

Recently, several Malaysian investors have told us that they have encountered withdrawal problems, and Forbes Capital is the broker involved in the dispute with them.

Unable to withdraw funds despite paying the required fees

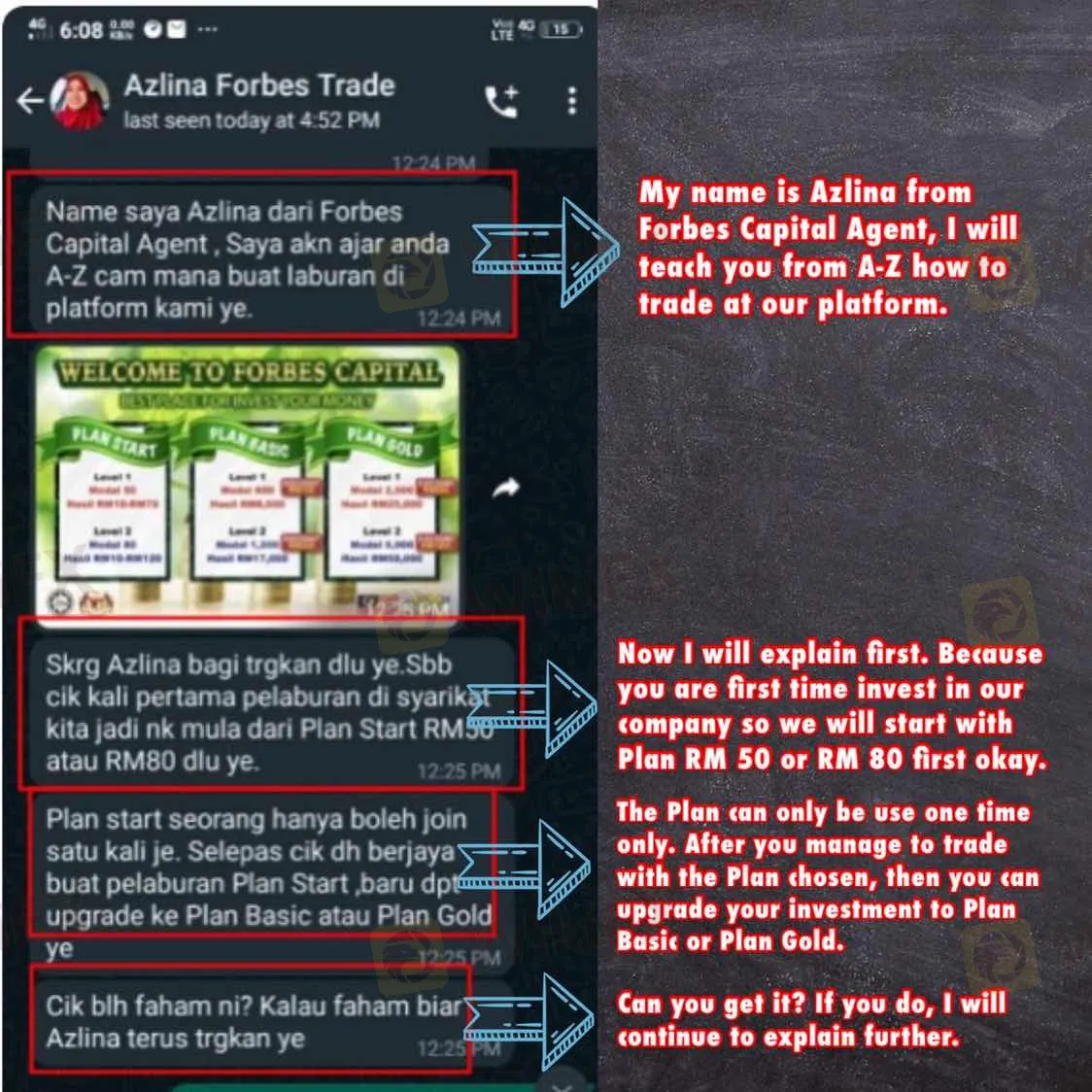

A user reported that he had inadvertently joined a WhatsApp group more than two months ago, where a so-called “professional teacher” shared trading strategies and signals, and dozens of group members often showed screenshots of their profits, echoing the teacher. The user at first just quietly watched them share screenshots, but after two months of looking at them, He was tempted and couldn't help investing. So he privately messaged a few of his groupmates to learn more about the situation. The groupmates all told him that they had made money following the teacher, and even made a lot of money. Then the victim opened an account with Forbes Capital based on their recommendations.

At first, he deposited only RM 35 (about $8) into his account, and it didn't take long for him to make a profit. The previous “teacher” then encouraged the victim to invest more money so that he could make more money, but the victim did not invest as the teacher said. In the meantime, his account continued to make profits of up to RM28,000 (about $6,402), a profit margin of 800%.

But will the “earned” money really go into the investor's pocket?

Forbes informed the victim that had had to top up his accounts with RM 3,000 (about $686) to withdraw the money. At this time, the victim, although suspected that this might be a scam, could not resist the temptation of huge profits and transferred the money to the other party as requested, but still could not withdraw his money. He submitted withdrawal requests for several times, but did not get any response, and finally had to quit the WhatsApp group.

More victims emerged

Another investor from Malaysia also had a similar experience with Forbes Capital. Just like the previous victim, her account was making a profit at first. But after some time, her account was inexplicably banned and she couldn't log in, no matter how she tried. The worst part was that she couldn't get back the RM3,000 principal she deposited.

Currently, Forbes Capital is still falsifying trading records and using them to advertise that investors can make large profits with this broker.

WikiFX always reminds you

Forbes Capital is an unregulated and fraudulent broker that has no authority to provide financial services to clients.

To stop users from withdrawing their funds, the fraudulent trading platform often demands various inexplicable fees and threatens not to allow withdrawals without paying them. However, even if the user does pay the fees, the account balance cannot be withdrawn. This is because the funds deposited by the victims are not used for trading, but go directly into the pockets of the scammers. And the so-called “profits” are just some fake figures. Moreover, claiming that money can be withdrawn by paying a fee is just a way to make a final profit.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator