简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Why You Should Stay Away from QUOTEX?

Abstract:The so-called brokerage Quotex is nothing more than an outright scam, please stay away from it!!!

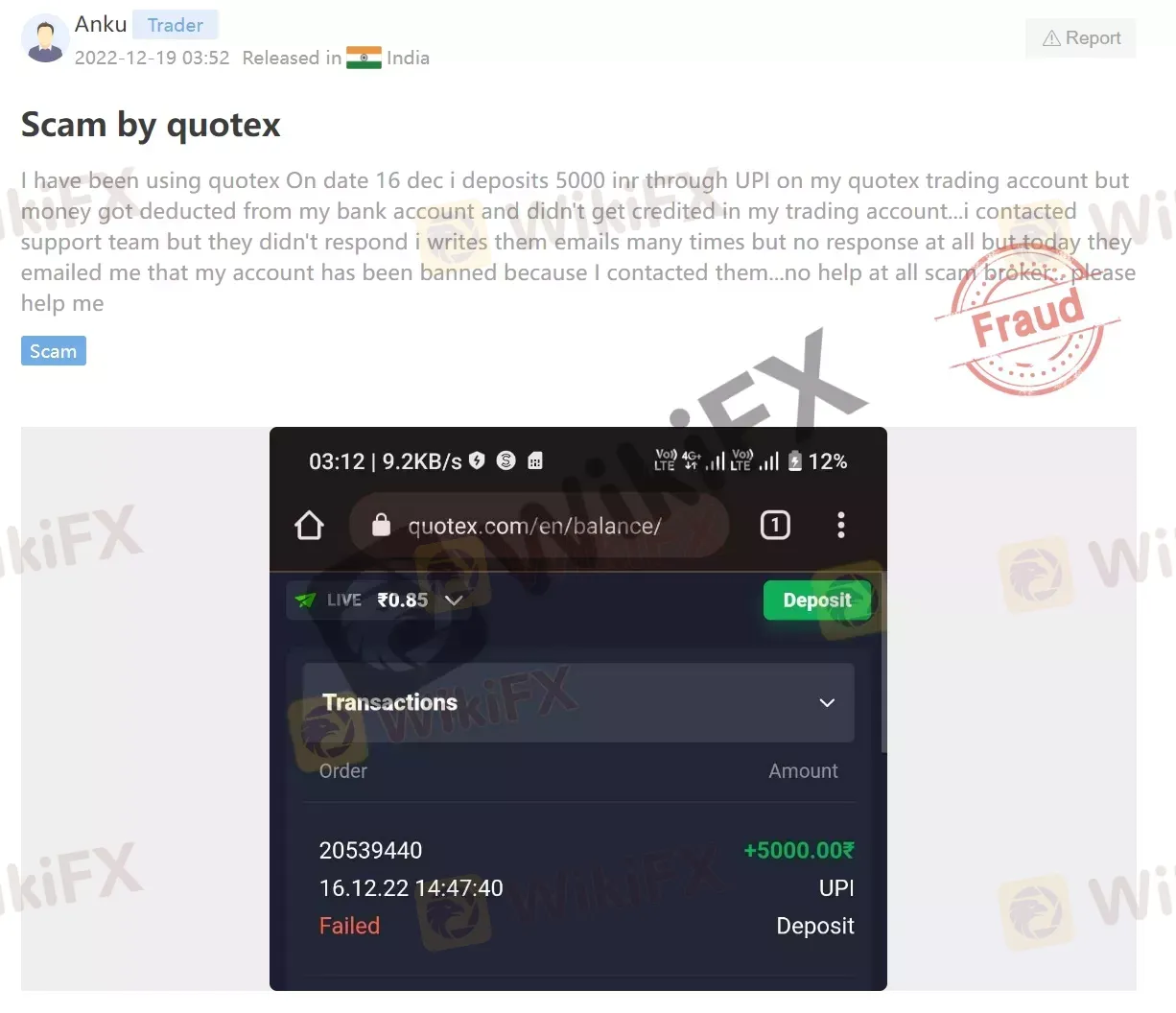

Just now, WikiFX received another exposure from an investor in India, who said that the trader could not withdraw money for various reasons with Quotex platform. Here is a screenshot of his remarks.

“I have been using quotex On date 16 dec i deposits 5000 inr through UPI on my quotex trading account but money got deducted from my bank account and didn't get credited in my trading account... ”The investor added: “i contacted support team but they didn't respond i writes them emails many times but no response at all but today they emailed me that my account has been banned because I contacted them...no help at all scam broker... please help me.”

In fact, we received many requests to Wikipedia from investors who complained that Quotex was a complete scam, and that some investors are still completely caught up in the scam and don't even know it. We wrote this article today specifically for investors to draw attention to the fact that they should stay away from this brokerage because it really is a brokerage with a lot of dark history and illegal trading.

With such complex regulatory information, how should investors distinguish between good and bad traders? It's as simple as typing the name of the broker into WikiFX before you invest, you will see every aspect about this broker. WikiFX also provides a comprehensive score based on license, business, risk control, software and regulatory, which is benefit for investors to make judgments.

Now let's search “Quotex ” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX(https://www.wikifx.com/en/dealer/1290453790.html), Quotex currently has no valid regulatory license and the score is rather negative - only 1.29/10! WikiFX will give brokers a composite score in five categories: license index, business index, risk control index, software index and regulatory index. Since Quotex does not have any supervision and does not obtain a regulatory license, the license index, risk control index and regulatory index all score 0, and the final total score is 1.29 (out of 10). Investors can see the overall situation through WikiFX, with higher scores indicating a more reliable broker.

Quotex has alleged to be registered in St. Vincent and the Grenadines, an offshore broker based in St. Vincent and the Grenadines – a favorite location for scam brokers. The local financial regulator, SVGFSA, has warned investors on multiple occasions that it does not regulate forex brokers and does not impose any sort of laws in the sphere of forex trading (this regulator only monitors the banking sector). For this reason, brokers registered in the country are far from the most reliable choice – since they do not have to meet any sort of requirements or answer to anybody.

Please note that WikiFX is also reminding the majority of users: low score, please stay away!

The number of the complaints received by WikiFX have reached 4 for this broker in the past 3 months. Please be aware of the risk!

From all the above information we can know that trusting a broker like QUOTEX Forex is simply not worth it – you will certainly end up robbed. WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing.

You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed. In addition, scam victims are advised to seek help directly from the local police or a lawyer.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator