简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CMC Markets Expands Its 'INVEST' Offering And Introduces Flexible ISAs

Abstract:CMC Invest provides trading services for stocks listed in the United States and the United Kingdom. Customers now have more options for flexible savings accounts.

CMC Invest, a newly released stock trading platform from CMC Market, announced on Monday the addition of a new account dubbed Plus Plan. It enables investors to create Individual Savings Accounts (ISAs) in flexible shares and equities, as well as a currency wallet in US dollars (USD).

According to the press release, only a few companies supply adaptable ISAs. Clients may withdraw funds from their accounts and deposit them again within the same tax year without impacting their ISA limits.

CMC Invest's new service is intended for individual investors who wish to invest up to £20,000 per year while avoiding capital gains tax. The proposition is especially appealing in view of the reduction in the dividend allowance and the yearly capital gains tax exemption from £12,300 to £6,000 in 2023/2024 and £3,000 in 2024/2025.

“We want our consumers to feel empowered to make investment decisions that are right for them. That is why we are so thrilled to provide these new features. Other investing platforms do not normally provide flexible stocks and share ISAs; we are fortunate with our technology to be able to offer this to customers, providing them greater freedom to invest how and when they want” CMC Invest UK's Head, Albert Soleiman, said.

Those who want to join Plus Plan must pay a monthly custodial cost of £10. Additional commissions are not levied, according to the press release. CMC Invest offers a USD currency wallet in addition to its regular GBP wallet in order to minimize fees associated with currency conversions.

CMC's trading revenues increased by 27%.

CMC Markets released its interim financials for the six months from April to September two weeks ago, showing a 27 percent year-on-year growth in net trading revenue to £128.4 million. However, net income from the investment stream declined 14% to £20.8 million.

The entire net operating income was £153.5 million, up 21 percent year on year. The financial statistics matched the company's expectations.

CMC Markets is a publicly listed firm on the London Stock Exchange (LSE), and its shares have fallen by 7% since the start of the year.

About CMC Markets

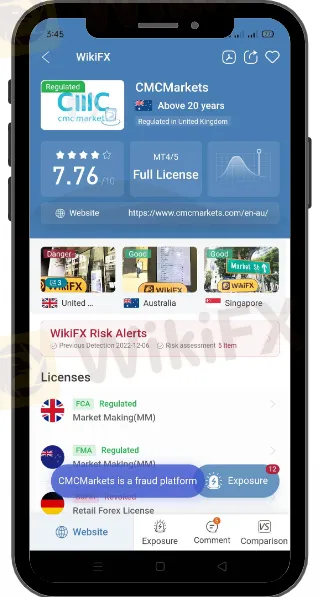

CMC Markets (CMC), formed in 1989, is a well-established, publicly listed, and highly rated forex broker in the United Kingdom that has effectively adapted to the ever-changing online brokerage scene. CMCX is the ticker symbol for the corporation on the London Stock Exchange (LSE). CMC, like many other forex brokers, does not allow US traders.

CMC Markets caters to all sorts of traders, from rookie retail traders hoping to dabble in the online trading arenas of forex, CFDs, and spread betting to seasoned veterans looking for exposure to a diverse range of products. The firm's fees are industry-competitive, and it rates high on numerous of our lists. The firm was named the Best Overall Forex Broker for 2020 by Investopedia, as well as the Best Forex Broker for Range of Offerings.

You can find out more about CMC Markets here: https://www.wikifx.com/en/dealer/0361475237.html

Stay tuned for more Forex Broker News.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

RM570,000 Lost in a Gold Trading Scam in Malaysia

In a distressing case of financial deception, a retired female teacher in Malaysia lost RM570,000 of her personal savings and pension to a gold trading investment scheme.

Many Social Media 'Investment Gurus' Are Scammers Preying on Malaysian Traders

Social media platforms have become breeding grounds for scammers posing as investment gurus, exploiting the growing interest in forex and cryptocurrency trading among Malaysians. Fraudulent "financial experts" often create the illusion of legitimacy by offering enticing stock analyses and promises of high returns.

Arumpro Capital Ltd Faces Regulatory Setbacks as CySEC Withdraws CIF Licence

The Cyprus Securities and Exchange Commission (CySEC) has officially withdrawn the Cyprus Investment Firm (CIF) licence of Arumpro Capital Ltd. The decision was finalised during a CySEC meeting on 11 November 2024, marking another chapter in the firm's ongoing regulatory challenges.

Webull Expands Trading Services to Japan via TradingView

Webull launches in Japan, offering low-cost trading for U.S. and Japanese securities via TradingView. Start trading with investments as low as $5.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator