简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Admirals Provide Traders With The Opportunity To Use Premium Analytics' Updated AI Features

Abstract:Admirals, a retail Forex and CFD broker, has made the Premium Analytics website, which has key analytical tools to help traders and investors make trading and investment decisions.

Admirals, a retail Forex and CFD broker, has made a website called Premium Analytics that has key analytical tools to help traders and investors make trading and investment decisions.

Using Acuity's AI research, traders can gauge market sentiment.

Furthermore, they can read Dow Jones market news.

They can also validate their analysis using Trading Central technical signals.

The Premium Analytics Research Terminal also provides traders with clear Technical Analysis that is presented in a user-friendly manner.

Traders can also look at snapshots of market direction, such as when trends began and how long they lasted.

Traders can also find practical ways to interpret technical insights such as support and resistance trends or chart patterns.

Finally, Admirals' clients can quickly grasp current market sentiment with benchmarks indicating volatility strength and bullish or bearish moods.

If you open a live account with Admirals, you will be able to use the full version of Premium Analytics. You can use the basic version if you sign up for a demo account.

Log in to the Trader's Room and select Premium Analytics from the left-hand menu.

Remember that TipRanks analysis, which is now available on the Admirals app, recently provided clients with a way to trade based on data. Click on the stock in the app to see ratings from top analysts.

TipRanks is trusted by millions of investors worldwide. It keeps track of and measures the erformance of over 96,000 financial experts, like Wall Street analysts, hedge funds, and financial bloggers.

Traders can make better investment decisions if they focus like a laser on the quality of analysis that is needed. The top Wall Street analysts are ranked by name, sector, price targets, success rate, and average return.

About Admiral Markets

Admirals (Admiral Markets) was started in 2001 and is a global forex and CFD broker. It is overseen by a number of regulators in the various regions it serves. These regulators are the Financial Conduct Authority (FCA) of the United Kingdom, the Estonian Financial Supervision Authority (EFSA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), and the Jordan Securities Commission (JSC). The FCA and ASIC are top-tier financial regulators.

Admirals are considered safe because it has a long track record, discloses its financials, and its parent company, the Admirals Group, is listed on a stock exchange.

Admiral Markets on WikiFX

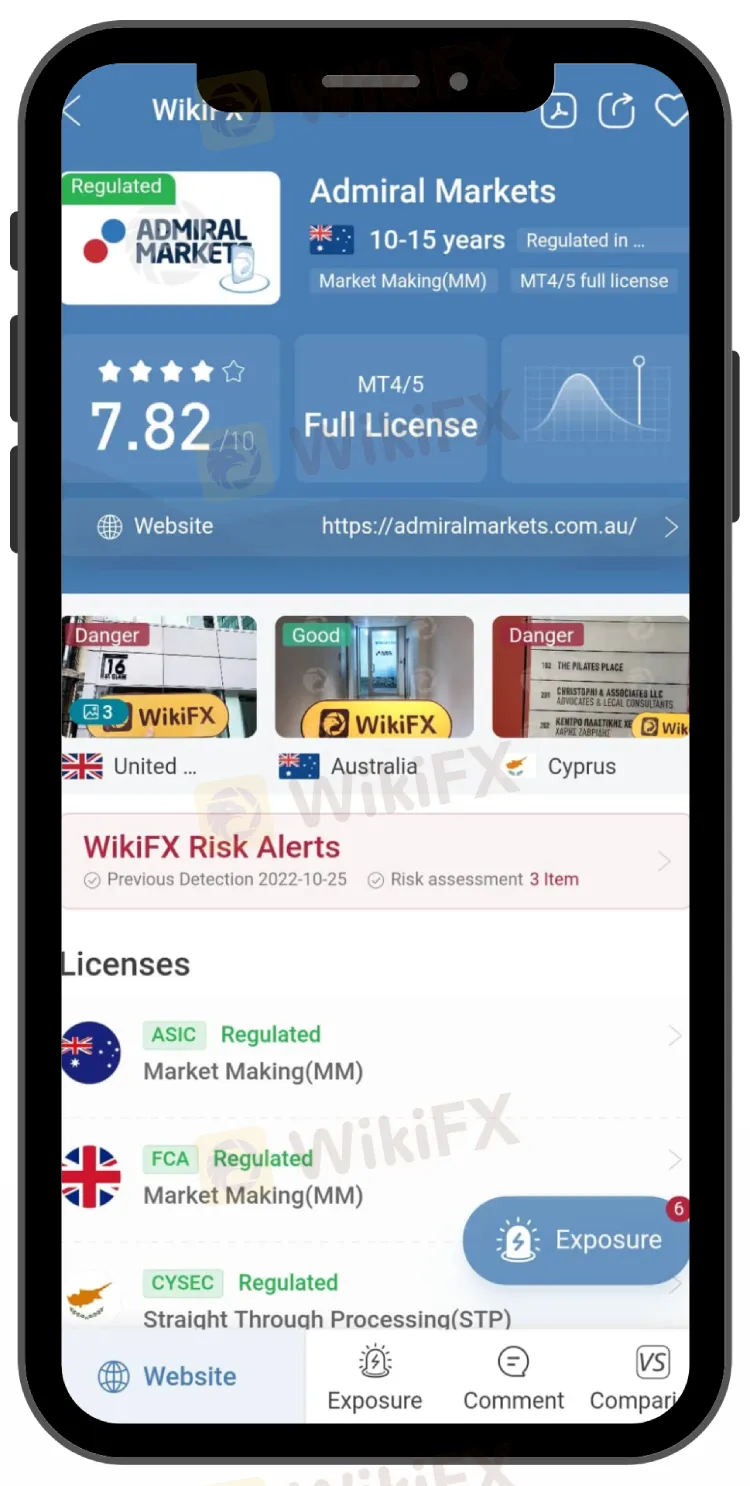

WikiFX is a free Forex trading search engine platform that provides detailed broker information to traders. Admiral Markets has a WikiFX risk rating of 7.82.

The WikiFX Platform lists more than 30,000 brokers, both regulated and unregulated. It also helps 30 financial regulators around the world solve all trading problems.

Check out for more of Admiral Markets here - https://www.wikifx.com/en/dealer/0361967978.html

Stay tuned for more Admiral Markets news.

Download the WikiFX App from the App Store or Google Play Store to stay up to date on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Currency Fluctuations: What It Means When a Country's Currency Rises or Falls

When a country’s currency appreciates or depreciates in value, it reflects the underlying shifts in its economy and global market dynamics. For forex traders, understanding what drives these fluctuations—and how to strategically prepare for them—can make the difference between profit and loss in an ever-volatile market.

M2FXMarkets Review 2024: Read Before You Trade

Avoid M2FXMarkets! Unregulated, dubious trading plans with daily returns of up to 25%. A low 1.25 WikiFX rating highlights serious concerns. Read why its risky.

Dukascopy Celebrates 20 Years of Trading Excellence and Innovation

Dukascopy marks 20 years of excellence in trading, offering JForex, MT4/5, 1,200+ instruments, and global banking, dedicated to trust and innovation.

What Currency Pairs to Watch During the U.S. Election Week

Track key forex pairs like EUR/USD, USD/JPY, and USD/MXN for insights on volatility and market sentiment during this U.S. election week, November 5, 2024.

WikiFX Broker

Latest News

One article to understand the policy differences between Trump and Harris

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

Currency Calculator