简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Client Opinions: What Do Investors Think About CHARTERPRIME?

Abstract:Even though there is a plethora of online FX and CFD brokers to choose from, not all of them can be trusted. The toughest aspect of making an investment is picking the actual one, but doing so is simple if you have some guidance in the beginning. Let's talk about how to stay away from CharterPrime and other questionable brokers today.

While there are many online FX and CFD brokers available, you cannot trust them all. Choosing the real one for your investment is the hardest part, but it's easy if you have some help ahead of time. Today, we'll go over ways to avoid signing up with a shady broker like CharterPrime.

A Brief Overview of CharterPrime

CharterPrime (https://www.charterprime.com/) is a St. Vincent and the Grenadines-based offshore brokerage corporation. The firm claims to have been in operation for almost a decade. Despite the fact that customers may trade in forex, metals, commodities, and indices, they only have access to the MT4 trading platform. However, the broker promotes account management services through PAMM accounts. In addition to traditional kinds of accounts, Shariah-compliant traders may sign up for a swap-free account. The broker also provides many payment options and VPS hosting.

Is CharterPrime a regulated company?

First, CharterPrime used to be registered in St. Vincent and the Grenadines, but that registration has since been taken away. Furthermore, CharterPrime maintains an ASIC license, however, please be aware that the broker is only permitted to undertake FX operations in Australia.

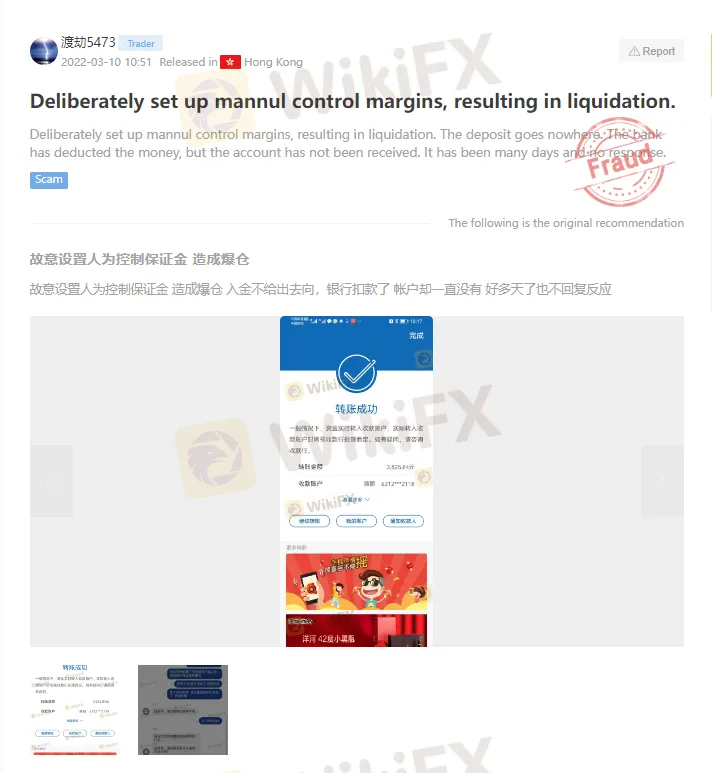

Client Response Got Their Traders

CharterPrime has received negative customer reviews. Along with bad execution of transactions and a lot of fees, it seemed like most customers had trouble getting their money out of the broker. Investors also said that they couldn't get in touch with the company to talk about their problems. Let's look at some screenshots below.

Check out for more of the complaints here: https://www.wikifx.com/en/exposure/exposure/0361525690.html

What Makes CharterPrime a Risky Broker?

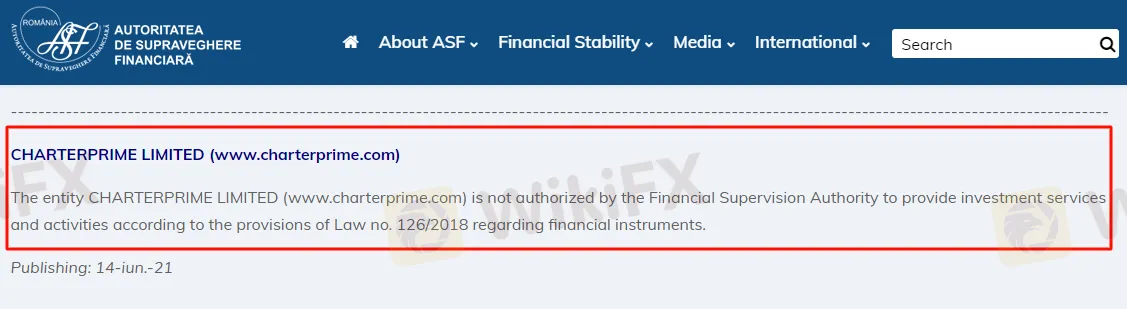

First, the broker has a license from the ASIC, but he is not allowed to sell financial services outside of Australia. The Romanian Financial Supervisory Authority, also known as ASF, has warned it, though, that it is not allowed to offer trading services.

Also, the company's registration with the SVG FSA is no longer valid, even though the company still says it has the registration.

Finally, the broker is accused of withholding payments from consumers for no apparent reason. Clients claim that the corporation initially delays withdrawal requests with bogus justifications before blocking access to their accounts.

How to Avoid Signing Up with Untrustworthy Brokers such as CharterPrime

The most crucial technique to determining whether a broker is reputable is to look into their license and regulation. Check a broker's regulatory status with the appropriate regulatory authorities. Reading customer reviews on the reliable Forex trading search engine websites like WikiFX and review sites or social media site that might also guide you in avoiding joining up with a suspect broker.

You could also compare your broker's price to industry averages to determine whether it is reasonable. You can also find out more about a broker by using their trading platforms and talking to their customer service.

In conclusion

Even though ASIC regulates CharterPrime, the many bad reviews and warnings from Romania make it hard for traders to trust the company. It is advised that you exercise caution before investing with this broker.

Check out for more of CharterPrime - https://www.wikifx.com/en/dealer/0361525690.html

Stay tuned for more Forex Trading News.

Download the WikiFX App from the App Store or Google Play Store to keep updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator