简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

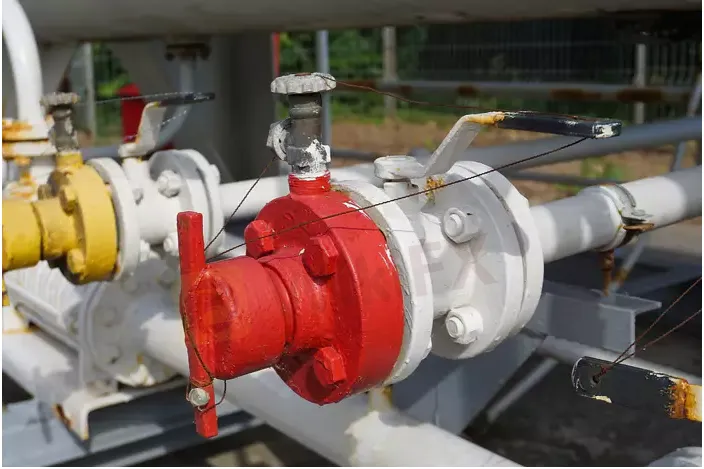

Natural Gas Gains Ground Ahead Of The EIA Report

Abstract:Natural gas managed to settle above the $7.00 level.

Key Insights

Natural gas is moving higher while traders wait for the release of the EIA report.

The weather forecast remains unfavorable for high natural gas consumption.

A move above the resistance at $7.20 will push natural gas towards the 20 EMA at $7.35.

Natural Gas Continues To Rebound

Natural gas prices continue to rebound ahead of the EIA report, which is expected to show that working gas in storage increased by 113 Bcf.

Interestingly, traders look ready to ignore rising inventories and are pushing natural gas prices towards recent highs. It should be noted that the weather forecast remains unfavorable for high natural gas demand.

In Europe, natural gas prices rebound despite resumption of Russian gas exports to Italy. Prices have been moving lower in recent weeks as demand for natural gas declined due to factory closures. However, demand should pick up relatively soon as temperatures get colder and the heating season begins.

In the U.S., the EIA report will determine natural gas price dynamics. At this point, it looks that the market is comfortable with the above-mentioned analyst consensus, which expects a build of 113 Bcf. However, natural gas prices may find themselves under significant pressure if the actual build is closer to the 120 Bcf level.

Natural Gas Must Settle Above $7.20 To Have A Chance To Gain Sustainable Upside Momentum

Natural gas managed to get above the $7.00 level and is moving towards the next resistance, which is located at $7.20. In case natural gas manages to settle above this level, it will head towards the next resistance, which is located at $7.35. A successful test of this level will push natural gas towards the resistance at $7.50.

On the support side, the previous resistance level at $6.90 will serve as the first support level for natural gas. If natural gas declines below this level, it will move towards the next support at $6.75. A move below the support at $6.75 will open the way to the test of the support at $6.55.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator