简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

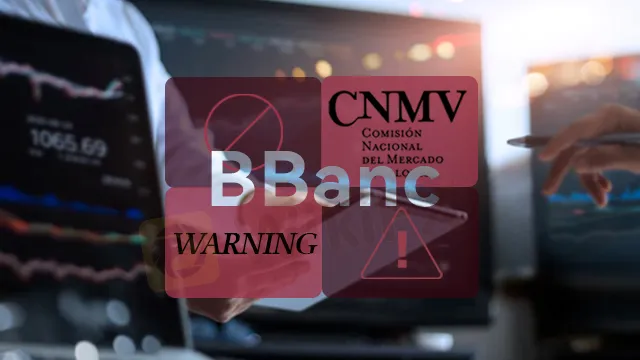

Negative Reviews: Regulators in Europe Warn the Fraudulent FX Broker BBanc

Abstract:Winning award means being recognized - the same is true in the forex market. And that's why many brokers like to prove themselves as trustworthy company by showing their awards.

Risky Leverage

BBanc claims that it can offer traders ultra-low spreads and leverage up to 1:500. For earning more profits at one time, many investors prefer brokers that provide high leverage like BBanc. But high returns often come with high risks. This is the reason why financial regulators impose strict limits on the leverage offered by the brokers they regulate.

Two Warnings Within a Month

Bbanc claims that it is owned and operated by Primis LLC, a company registered with the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA) under registration number 1860 LLC 2022, and authorized and regulated by the Island of Moheli. However, no forex regulators on the Island of Moheli.

There is an SVG FSA registered company matched. Nevertheless, SVG FSA does not authorize foreign exchange supervision or accept complaints. Investors' funds can not be protected by laws even though the broker has registered with SVG FSA.

What's more, BBanc has also recently caught the attention of regulators in Europe.

On 1 July 2022, the France Financial Authority (AMF) added BBanc to its forex black list, confirming BBanc was not authorized to provide forex services or products in France.

On 1 August 2022, BBanc was warned by the National Securities Market Commission in Spain (CNMV).

Bad Reviews

Complaints against BBbanc are everywhere on the Internet. Many of the victims told their stories, reminding other investors to stay away from the broker.

A victim was asked to pay commission when withdrawing and the victim did so. However, it seems that he or she may not get the money back since BBanc is a scam.

This trader was told that he or she owed fees when he or she wanted to refund. And the trader accused BBanc of being “liars and thieves”.

BBanc even harassed investors when they didn't do what BBanc says. And this investor was also been asked to pay more money to withdraw.

Investing is risky enough, so do not let scammers have your money! It is always useful to check the licenses of the brokers before you trade with them.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Risk Management: Turning Potential Into Profit

In Forex Trading, Without Effective Risk Management, You Risk Huge Losses and the Complete Depletion of Your Account.

Is it a good time to buy Korean Won with the current depreciation?

The exchange rate of the South Korean won in 2025 is expected to be highly uncertain, influenced primarily by the dual challenges of economic slowdown and political instability.

US Dollar Surge Dominates Forex Market

The global forex market continues to show volatility, with the U.S. dollar fluctuating last week but overall maintaining a strong upward trend. How long can this momentum last?

Oil Prices Soar for 5 Days: How Long Will It Last?

Last week, the global oil market saw a strong performance, with Brent crude and WTI crude prices rising by 2.4% and around 5% respectively. Oil prices have now posted five consecutive days of gains. But how long can this rally last?

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

What Are The Top 5 Cryptocurrency Predictions For 2025?

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

Currency Calculator