简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Caution! Capitalonefx is an Unlicensed Forex Broker

Abstract:Scam exists in any financial markets and the forex market is no exception.

Newly Established Less than 2 Months

Although Capitalonefx shows its history started from 2018, we found it was actually established less than 2 months. You can see from the domain check result:

Misleading Licenses

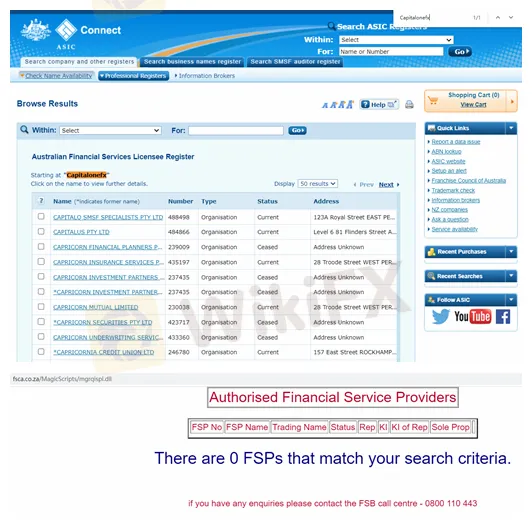

Capitalonefx states that it offers investment services including forex, share CFDs, commodities and indices under the regulation of the FCA, ASIC and FSCA.

Searching with Capitalonefx on the FCA Registry, we found no license matching results but a warning record. The UK's financial watchdog added Capitalonefx to its alert list, saying that this firm is not authorised by it and is targeting people in the UK on 24 March 2022.

Checking with the name Capitalonefx on ASIC Registry and FSCA Registry, we found no results.

That is to say - the firm is running without any licenses.

Based on the information, we can conclude that Capitalonefx is a scam.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

Following the successful auction of 30-year government bonds by the UK, the yield on 30-year bonds surged, reaching its highest level in 25 years. This increase reflects growing concerns in the market over the government's fiscal policies and large-scale debt issuance.

Beware of Fraudulent Letters: Malaysia’s Securities Commission Issues Warning

The Securities Commission Malaysia (SC) has raised an alarm over fraudulent letters and emails falsely claiming to be from the regulatory body. These fake communications are allegedly tied to illicit investment schemes that seek payments from unsuspecting investors.

Singapore’s New Law Allows Police to Freeze Scam Victims’ Bank Accounts

Singapore has enacted a new law enabling police to freeze bank accounts of scam victims as a last-resort measure to prevent financial losses.

Rising U.S. Corporate Bankruptcies Deepen Economic Concerns

In 2024, 686 U.S. companies filed for bankruptcy, marking the highest number since 2010.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator