简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Technical Analysis: Price is Heading Towards Buying

Abstract:Gold futures snapped a three-session winning streak on Friday, despite a weaker dollar. Investors are watching developments at the annual Jackson Hole Economic Symposium, expecting the event to provide guidance on monetary policy. The price of the yellow metal has struggled to maintain any momentum after surpassing $1,800 earlier this month. The price of gold tried to recover but its gains stopped towards the resistance level of $1765 per ounce before collapsing towards the support level of $1734 per ounce following Jerome Powell's statements.

Gold futures snapped a three-session winning streak on Friday, despite a weaker dollar. Investors are watching developments at the annual Jackson Hole Economic Symposium, expecting the event to provide guidance on monetary policy.

The price of the yellow metal has struggled to maintain any momentum after surpassing $1,800 earlier this month.

The price of gold tried to recover but its gains stopped towards the resistance level of $1765 per ounce before collapsing towards the support level of $1734 per ounce following Jerome Powell's statements.

Gold price was relatively flat during the week's trading and remains down roughly 4% year-to-date. As for the price of silver, the sister commodity to gold, it tried to stay above the $19 level at the end of last week's trading. The price of the white metal posted a weekly gain of 1.4%, narrowly avoiding a bear market. The economic data cannot support the divergent gold prices because the statistics cannot support or oppose any argument for further increases or decreases in interest rates. For now, financial markets will be keeping a close eye on what happens at the Fed's annual retreat in Wyoming.

A report indicated that consumer demand in the United States is diminishing, which may affect the economy in general as the fourth quarter approaches. And according to the Census Bureau, US personal spending rose just 0.1% in July, below market estimates of 0.4%. And that was less than a 1% gain in June. This represents the weakest number this year. Personal income rose by 0.2% last month, missing economists' expectations of 0.6%. While it was the sixth straight monthly gain, it was the worst reading since January's 0% growth.

U.S. Treasury yields turned amid a mixed performance, with the benchmark 10-year yield rising 2.1 basis points to 3.045%. And one-year bond yields fell 0.1 basis point to 3.362%, while the 30-year bond yield rose 2.1 basis points to 3.255%. And a rising rates environment is usually bearish for gold because it raises the opportunity cost of owning commodity, as it doesn't yield a return.

For other metals markets, copper futures rose to $3.7655 a pound. Platinum futures fell to $865.00 per ounce, while palladium futures rose to $2144.00 per ounce.

The price at gold is traded is being affected by the reaction from the release of the economic data. Michigans American consumer confidence index for the month of August exceeded expectations at 55.2, settling at 58.2. This affected the price of the yellow metal as investors turned to risk trading. While the personal income and spending data was disappointing, investors remained positive after the impressive data announced earlier in the week.

Initial US GDP data for the second quarter came in stronger than expected on a quarterly and annual basis. On the other hand, initial and ongoing jobless claims came in below estimates, boosting market optimism once again. Durable goods for July missed expectations at 0.6% with a change of 0%, while non-defense capital goods orders for aircraft was higher than the 0.3% expected by the analysts, with a change of 0.4%.

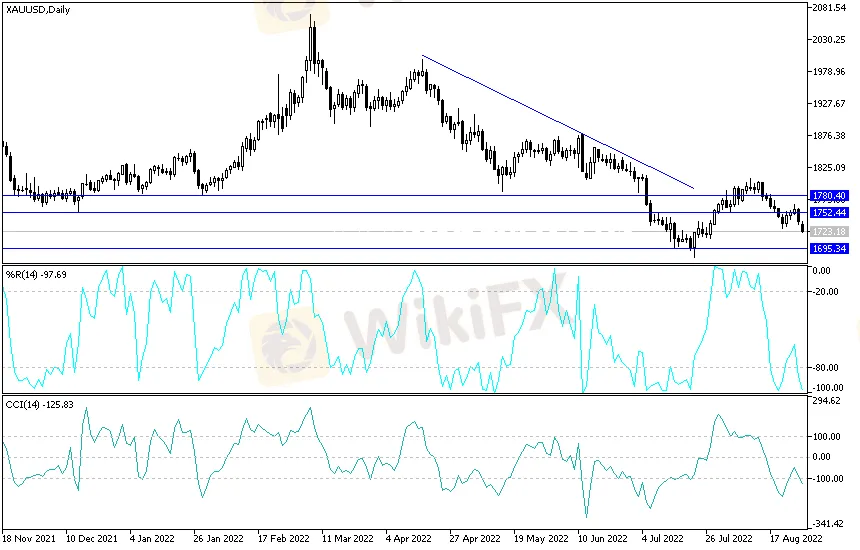

Technical analysis of the price of gold:

In the near term and according to the performance on the hourly chart, it seems that the gold price is trading within the formation of a sharp downward channel. This indicates a strong downward momentum in the short term in market sentiment. Therefore, the bears will target short-term profits at around $1734, or lower at $1730, while the are looking to pounce on potential rebound profits at around $1.741, or higher at $1746.

In the long term and according to the performance on the daily chart, it seems that the price of gold is trading within the formation of a downward channel. This indicates a significant long-term bearish bias in market sentiment. Therefore, the bears will target long-term profits at around $1714 or lower at $1690 per ounce. On the other hand, the bulls will target potential reversal profits at around $1759 or higher at $1782 per ounce.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

Italian Regulator Warns Against 5 Websites

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

What Are the Latest Trends and Strategies in Philippine Gold Trading?

Currency Calculator