简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

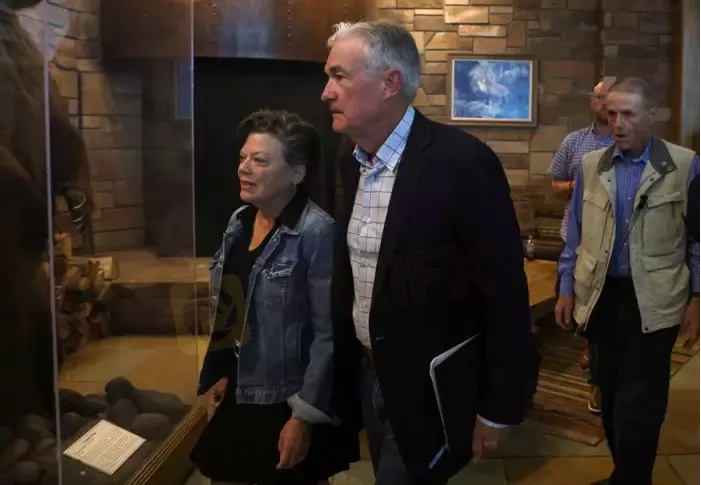

Marketmind: Fed Chair Powell hoping to do a Maradona

Abstract:Did Fed Chair Jerome Powell watch Diego Maradona’s second goal against England in the 1986 Football World Cup quarter final? And can his speech later on Friday match the Argentinian superstar’s trick?

Mervyn King, the former bank of England governor – and maybe more familiar to Powell than Maradona – famously linked that goal and monetary policy in a speech to illustrate how people react to what they think you are going to do rather than what you actually do.

King noted how Maradona ran in almost a straight line from within his own half to score as several English players anticipated – wrongly – where he was about to turn and lunged out of his way.

The logic is if the Fed sounds aggressive enough about its plans to hike interest rates to bring inflation under control, that will cause a market reaction in itself.

“There‘s an element of the Fed wanting to be seen to be talking tough, hoping ’the tougher we talk the less we have to tighten policy,'” said Ray Attrill head of FX strategy at National Australia Bank. “Its the Maradona theory of monetary policy.”

In the last couple of weeks markets have finally started listening to a string of Fed speakers saying they planned to keep on tightening monetary policy and not pivot towards worrying more about a recession, causing the dollar to regain some ground its lost and a equity rally to slow.

But there is still some exuberance left. U.S shares roses overnight, seemingly, as ING analysts, said “betting on Powell providing a lifeline, which seems like an optimistic point of view.”

If Powell sounds hawkish, as ING expects, “the most likely market reaction would be a rise in yields at both the front and back of the yield curve, a sell-off in equities and dollar strength as markets seem to have been positioning themselves for a more supportive set of comments”

Much of the macro news in Europe on Friday will be dwarfed by Powell‘s remarks, though in Britain there could be some reaction to the energy regulator’s announcement of how eye-watering the jump in a cap on energy prices will be, likely further boosting inflation in an already struggling British economy.

Fuel price increases are passed on to British consumers through a price cap, calculated every three months.

In Asian trade, shares gained about 0.5% following the U.S. gains, currencies were calm.

Key developments that could influence markets on Friday:

German GfK consumer confidence

UK power regulator publishes next energy price cap level

Sweden unemployment rate

Italian, Norwegian consumer confidence

U.S. personal consumption, Core PCE price index for July

U.S. Michigan sentiment index final for August

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Review: Is FxPro Reliable?

Founded in 2006, FxPro is a reputable UK-based broker, trading on various market instruments. In this article, we will help you find the answer to one question: Is FxPro reliable?

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Trading frauds topped the list of scams in India- Report Reveals

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator