简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

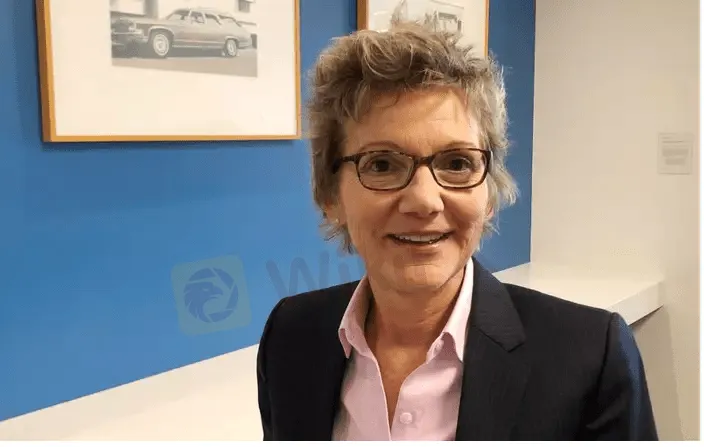

Fed’s Mary Daly says it’s too early to ‘declare victory’ over inflation

Abstract:San Francisco Fed President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation after new data showed a reprieve in consumer price pressures, the Financial Times reported on Wednesday.

San Francisco Federal Reserve Bank President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation, the Financial Times reported on Thursday.

Dalys remarks comes as U.S. consumer prices remained unchanged in July due to a sharp drop in the cost of gasoline, delivering the first notable sign of relief for weary Americans who have watched inflation climb over the past two years.

In an interview with the Financial Times, Daly did not rule out a third consecutive 0.75% point interest rate rise at the central banks next policy meeting in September, however, she said that a half-percentage point rate rise was her “baseline”. (https://on.ft.com/3SEkQ7E)

“Theres good news on the month-to-month data that consumers and business are getting some relief, but inflation remains far too high and not near our price stability goal,” the newspaper quoted Daly as saying during the interview conducted on Wednesday.

She also maintained that interest rates should rise to just under 3.5 per cent by the end of the year, according to the report. The fed funds rate, the rate that banks charge each other to borrow or lend excess reserves overnight, is currently in the 2.25%-2.5% range.

Slowing U.S. inflation may have opened the door for the Federal Reserve to temper the pace of coming interest rate hikes, but policymakers left no doubt they will continue to tighten monetary policy until price pressures are fully broken.

The Fed is “far, far away from declaring victory” on inflation, Minneapolis Federal Reserve Bank President Neel Kashkari said at the Aspen Ideas Conference, despite the “welcome” news in the CPI report.

Kashkari, the Fed‘s most hawkish member, said he hasn’t “seen anything that changes” the need to raise the Feds policy rate to 3.9% by year-end and to 4.4% by the end of 2023.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

“Seeing Diversity, Trading Safely”: WikiEXPO Dubai 2024 Opens New Horizons for the Fintech Industry

Dubai, UAE — The WikiEXPO Dubai 2024, hosted by WikiGlobal, successfully concluded on November 27, attracting wide attention from the global financial technology sector. The event was co-organized by WikiFX and the Australian Computer and Law Association (AUSCL), with strong support from the Mauritius Financial Services Institute (FSI) and the government of Liberland. Through an innovative hybrid model of online and offline participation, WikiEXPO Dubai 2024 achieved an impressive 1,267,886 online views and gathered 3500+ on-site participants, bringing together 550+ industry leaders and attracting close coverage from over 1300+ global media outlets.

BaFin Issues Warning Against Clone Broker Exploiting Pepperstone's Identity

The German Federal Financial Supervisory Authority (BaFin) has recently flagged a fraudulent clone of the licensed retail FX and CFD broker Pepperstone. This fake entity, operating under the domain pepperstone.life, has been offering financial and investment services without obtaining the necessary regulatory authorisation.

TikTok: A Rising Hub for Investment Scams in Malaysia

The Royal Malaysian Police (PDRM) have raised concerns over the increasing use of TikTok by criminal syndicates to lure victims into investment scams.

Webull Canada Expands Trading Hours with Options Trading

Webull Canada now offers extended trading hours from 4 a.m. to 5:30 p.m. ET, plus options trading. Gain flexibility and manage risk in an ever-changing market.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator