简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

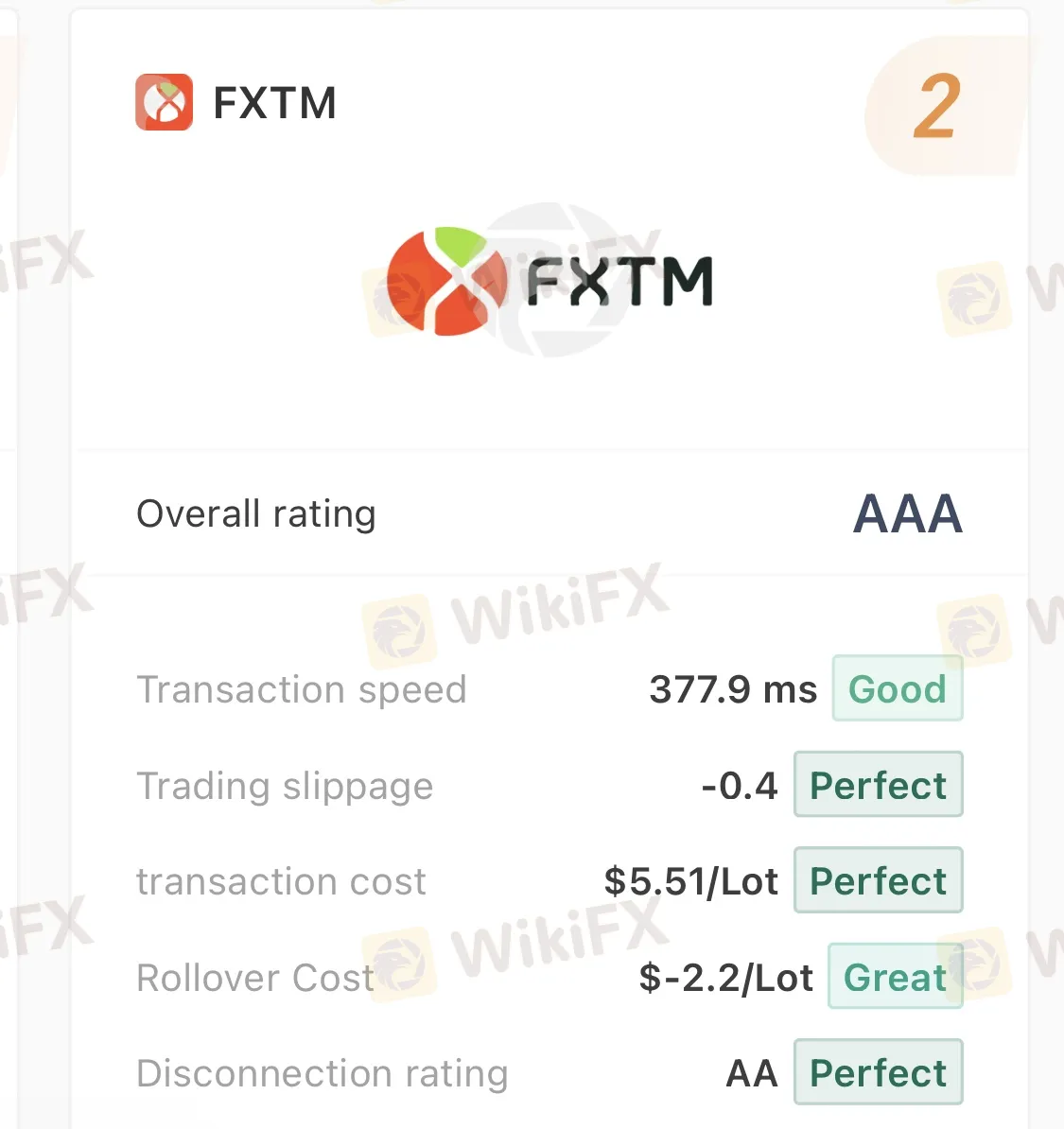

Which FX Broker Has The Best Trading Environment?

Abstract:During real-life execution, the biggest pet peeve of the majority of forex traders is the unstable trading environment which leads to slippages and delays which could severely affect one’s trading result. Therefore, it is important to take into account the trading environment provided by a forex broker before engaging with it.

WikiFX is a global forex broker query platform that holds verified information of over 36,000 forex brokers worldwide. Other than regulatory status and license, WikiFX also emphasizes the importance of finding a forex broker that can provide a steady trading environment, so the trading process and results will not get affected easily.

In conjunction with this, WikiFX will be introducing our top 3 forex brokers that have the best trading environment by evaluating the 5 factors below:

(i) transaction speed

(ii) trading slippage

(iii) transaction cost

(iv) rollover cost

(v) disconnection rating

Not only do these 3 forex brokers offer consistent trading environments, but they also possess a relatively high WikiFX score. This means that they are trustworthy due to their regulatory statuses, licenses held and any relevant information provided was proven to be valid and legit.

If you are a forex trader who is facing issues of an unsteady trading environment, do check out WikiFXs VPS at https://vps.wikifx.com/en/vps.html.

WikiFX believes that having a consistently optimal trading environment is every traders right, thus we are offering our VPS at an affordable price tag so everyone can afford it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

What Euro Investors Can't Afford to Miss

For euro investors, geopolitical factors, inflation data, and the European Central Bank's policy direction will determine the market trends over the next few months.

How Big is the Impact of the USD-JPY Rate Gap on the Yen?

The U.S. Federal Reserve's repeated rate cuts and the narrowing of the U.S.-Japan interest rate differential are now in sight. So, why is the U.S.-Japan interest rate differential so important for the yen’s safe-haven appeal, especially when global economic uncertainty rises?

Malaysian Man Killed in Alleged Forex Dispute-Related Attack

A 44-year-old Malaysian businessman, Wong Kai Lai, died after being attacked by about 20 men in Jenjarom, Kuala Langat, on 19 December. Police believe the attack may have been linked to a foreign currency exchange dispute.

Share Industry Insights and Discuss Forex Market Trends-Philippines

This month, we are excited to announce the posting activity, Share Industry Insights and Discuss Forex Market Trends! Share your Forex insights and not only grow alongside thousands of traders, but also have the chance to win generous rewards! Make your trading journey truly exciting — come join us now!

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Has the Yen Lost Its Safe-Haven Status?

Currency Calculator