简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker's Review on ACE FX

Abstract:In this article, we will look into ACE FX and its validity to determine whether it is a reputable broker to invest in or one of the forex market's scams.

What exactly is WikiFX?

Wikifx is a tool for searching worldwide company financial information. Its primary duty is to give the included foreign exchange trading organizations with basic information search, regulatory license searching, the credit assessment, platform identification, and other services.

Wikifx has created a big data solution that unifies data gathering, data screening, data aggregation, data modeling, and data productization using public data from government agencies, sophisticated sniffer systems, and scientific computer algorithms. Wikifx may then assess the supervision and risk levels of the associated organizations across several dimensions and give matching security solutions to individual users, corporate users, and government agencies.

On the other hand,

WikiFX lists approximately 37,000 brokers, both licensed and unregistered, and collaborates with 30 financial authorities. The data in the WikiFX database is sourced from legitimate regulatory bodies like the FCA, ASIC, and others. Fairness, impartiality, and facts are also emphasized in the released information. WikiFX does not charge public relations fees, advertising costs, ranking fees, data cleaning fees, or any other unreasonable expenses. WikiFX will do everything possible to keep the database consistent and synchronized with authoritative data sources such as regulatory bodies, but cannot promise that the data will always be up to date.

WikiFX's objective is to give its readers and traders reliable broker information. Apart from that, WikiFX may assist in resolving any forex trading concerns with brokers. WikiFX offers a Right Protection Center that handles all complaints against traders to expose and resolve them using financial rules. who has been involved with WikiFX for a long time? For further information, go to the Right Protection Center page.

In this article, we will look into ACE FX and its validity to determine whether it is a reputable broker to invest in or one of the forex market's scams.

What is ACE FX and its regulation?

The homepage of the website does not reveal who is behind this supposed broker or where it is headquartered. There is no mention of the company's name or location whatsoever. The “Contact” section includes the firm name ACE FX LIMITED as well as a UK address. A broker must be licensed by the Financial Conduct Authority to operate in this area (FCA). However, there is no such firm in the regulator's database.

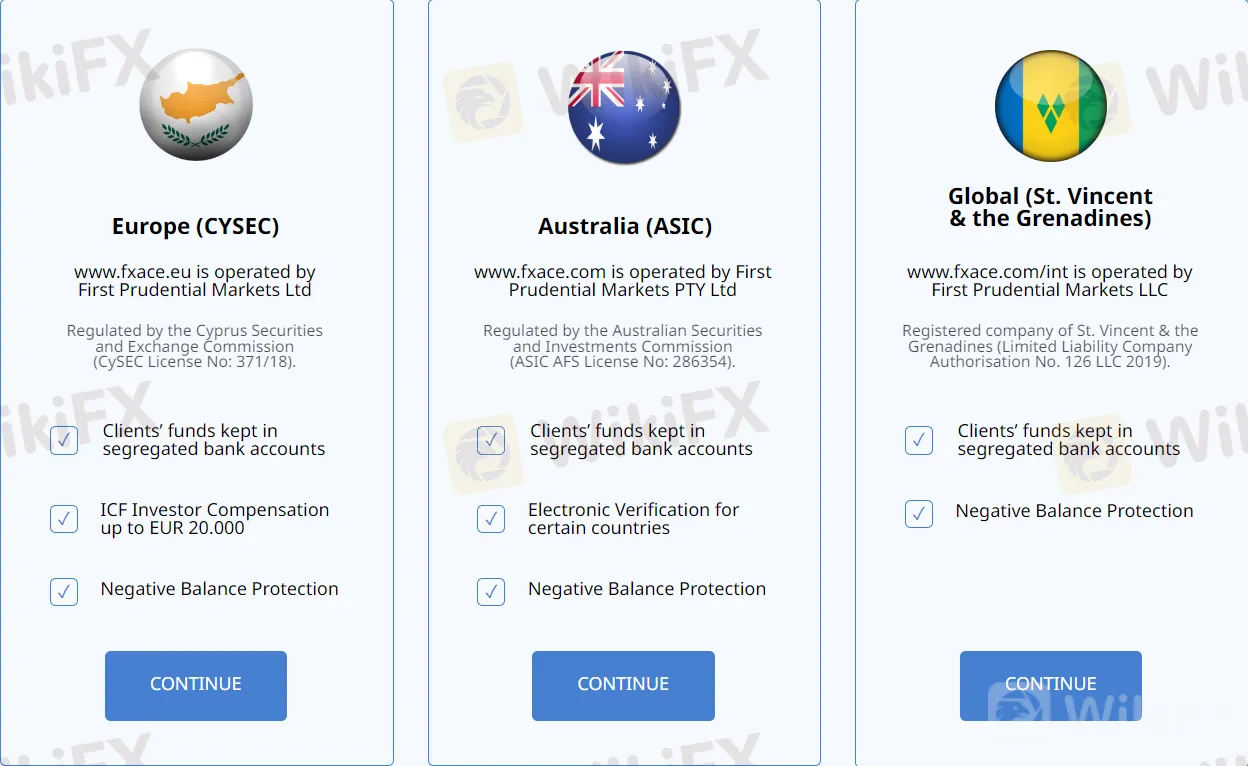

Checking the “Group” part reveals an entirely different story: ACE FX is administered by First Prudential Markets Ltd, a corporation with licenses in Cyprus, Australia, and St. Vincent and the Grenadines.

This cannot be accurate since First Prudential Markets owns FPMarkets, one of the world's most well-known brokers. This broker is unrelated to the ACE FXs website. This is shown by the following list of permitted domains in the FPMarkets registration information:

A third version of the Client Agreement, which is only accessible via the registration form, states that ACE FX is headquartered in the Republic of Vanuatu. This is an offshore zone with lax broker rules. However, this statement is also false: ACE FX is not registered with the Vanuatu Financial Services Commission.

When selecting a broker through which to invest in the financial markets, you should ensure not only that all of the information necessary by law is accessible, but also that it is accurate. Always ensure that the firm is listed on the appropriate regulator's records and that the domain utilized is one of those legally allowed for the specific broker.

Depending on where you live, it is best to select a company that is regulated by an institution such as the Commodity Futures Trading Commission (CFTC) in the United States, the Australian Securities and Exchanges Commission (ASIC), the United Kingdom's Financial Conduct Authority (FCA), or an EU regulator such as the Cyprus Securities and Exchange Commission (CySEC).

Clients of these brokers benefit from safeguards such as negative balance protection and money segregation from the broker's funds. Brokers must also engage in guarantee programs in the EU and the UK, which protect a portion of the trader's investment if the broker goes bankrupt. These assurances may be worth up to 20 000 EUR in the EU and 85 000 GBP in the United Kingdom. However, the possibility of such bankruptcy is limited since regulators impose large net capital requirements on corporations - EUR 730 000 in the UK and Cyprus, AUD 1000 000 in Australia, and at least 20 million USD in the United States.

Have you ever encountered such illegal activities from your broker? Here are the procedures for reporting the incident to the WikiFX Right Protection Center.

Step 1: If you haven't already, download the app from the App Store or Google Play. If it is already installed, go to step 2.

Step 2: Launch the WikiFX application.

Step 3: On the navigation menu, tap the expsoure.

Step 4: After taping the exposure on the nav menu, press the exposure button at the bottom of the screen.

Step 5: After pressing the expose button, a little screen with the case's categories will show. Choose the type of case you want to report.

Step 6: After choosing the appropriate category, look for and touch on the participating broker.

Step 7: After choosing the involved broker, the screen will display a report form. Add a title, a detailed explanation of the occurrence, and, most importantly, submit any proof.

Step 8: Once you've finished filling out the form, click the Release button to submit the report. Someone from customer care will call you shortly to ask follow-up questions about the event.

You may also contact WikiFX Customer Support. However, we always urge traders to publish the occurrence on the expose page so that others are aware of it and for future reference as the matter progresses toward resolution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Oil Prices Soar for 5 Days: How Long Will It Last?

Last week, the global oil market saw a strong performance, with Brent crude and WTI crude prices rising by 2.4% and around 5% respectively. Oil prices have now posted five consecutive days of gains. But how long can this rally last?

Two Malaysians Sentenced for Running S$23M Pyramid Scheme in Singapore

Two Malaysian men have been sentenced in Singapore for orchestrating a S$23 million multi-level marketing (MLM) scheme that defrauded approximately 4,500 investors, including over 2,400 in Singapore.

WikiFX Review: Can EBC make your money safe?

EBC is a UK-registered firm. In today’s article, WikiFX has comprehensively reviewed this broker to help you better understand the truth.

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

Exnova Forex scam exposed! Victim report blocked account and stolen funds from this unregulated broker. Learn how they operate and why you should stay far away.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Ghana Trader Jailed for $300K Forex and Crypto Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

XRP Price Prediction for 2025: Will It Hit $4.30 or More?

Exnova Scam Alert: Account Blocked, Funds Stolen, and Zero Accountability

T3 Financial Crime Unit Freezes $100M in USDT

BlackRock Bitcoin ETF Outflows Hit $332M in Single Day

Terra Founder Do Kwon Denies Fraud Allegations in U.S. Court

Dr. Sandip Ghosh, Ex-RG Kar Principal, Involved in Multi-Crore Scam

Currency Calculator