简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

9 Common Forex Trading Mistakes & How to Avoid?

Abstract:Trading forex is a very competitive market, but only a select few will succeed. This does not mean that these select few never make trading mistakes. Whether for beginners or more experienced traders, it is common to make trading mistakes on the forex market. However, most successful forex traders can be aware of these common mistakes and avoid them, while most newcomers cannot. This article will outline the top nine forex trading mistakes which, once you know, you will be able to avoid making again and they can help you prepare better and minimize your mistakes and, hopefully, boost your returns.

Overview

1. Brief Introduction

2. 9 Common Forex Trading Mistakes & How to Avoid?

Mistake 1: No Trading Plan

Mistake 2: Not Enough Market Research

Mistake 3: No Cutting Losses

Mistake 4: Too Rely on Trading Software

Mistake 5: Emotional Trading

Mistake 6: Risking Too Much

Mistake 7: Not Keeping a Trading Journal

Mistake 8: No Money and Risk Management Rules

Mistake 9: Over Leverage

3. Conclusion

1. Brief Introduction

Trading forex is a very competitive market, but only a select few will succeed. This does not mean that these select few never make trading mistakes. Whether for beginners or more experienced traders, it is common to make trading mistakes on the forex market. However, most successful forex traders can be aware of these common mistakes and avoid them, while most newcomers cannot.

This article will outline the top ten forex trading mistakes which, once you know, you will be able to avoid making again and they can help you prepare better and minimize your mistakes and, hopefully, boost your returns.

2. 9Common Forex Trading Mistakes & How to Avoid?

Mistake 1: No Trading Plan

Trading should always include a trading plan. It is common for beginners to jump into trading without a plan beforehand, while more experienced traders will develop a trading plan and routine that they spend time and energy creating.

Therefore, before you start trading and managing your money, you should create a list of rules to guide you. Generally, a trading plan should contain not only strategies, but also your time commitment and the amount of capital that you are willing to invest, etc.

Mistake 2: NotEnough Market Research

Many new traders fail to conduct the necessary market research because they are lured in by the potential gains. They are so naive to believe they can succeed without any experience or trading education, and someone even fantasizes about making money from day one. As a result, this could lead to a loss of money. The most successful traders, however, read widely and regularly to stay abreast of potentially market-moving events and learn new trading strategies.

Trading is a skill that takes time to master, just like any other skill. Developing a skill requires trial and error, or you can learn from an expert to cut your learning curve. Both are necessary for practice. Make sure you learn to walk before you run! Start small and slowly, learn the basics first.

As you study the market as it should be, you will gain a better understanding of market trends, timing of entry and exit points, and fundamental influences as well. The more time spent studying the market, the better the understanding of the product. There are both large differences and subtle differences between the individual financial markets and instruments on the financial markets. For success in the market of choice, it is necessary to examine these differences in depth.

There are some of the areas in which you will need to do some research: economics (interest rates, economic news, etc.), market fundamentals, money management, and others.

Mistake 3: No Cutting Losses

New traders often make the mistake of averaging down: investing more money in a losing trade in the hope of a turnaround. In most cases, this amounts to throwing good money after bad and can make your losses worse. You should exit the market as soon as possible once it becomes apparent that a trade is going against you. Acknowledging your mistakes and reducing your losses you can are important steps to take when you are wrong.

Especially in day trading and short-term trading strategies, profits are realized through quick market movements. The end of each trading day is the best time to close out active positions, so there's no point in fighting temporary market slumps.

Setting stops allows you to close positions that are moving against you, thus minimizing your risk. Additionally, you can set a profit limit on your position, and it will close automatically once that profit has been achieved.

It is worth noting that the level at which your trade closes may not always match what you specified by the stop. There is no market activity between two prices when the market jumps from one to the other. As a result, slippage occurs. A guaranteed stop, however, eliminates this risk, as it automatically closes a trade once a predetermined level is reached.

Mistake 4: Too Rely on Trading Software

Some trading software can be highly beneficial to traders. For instance, platforms such as MetaTrader4 can automate and customize their trades to meet the specific needs of each trader. Before using software-based systems to open or close a position, it's important to understand their advantages and disadvantages.

Algorithmic trading has the primary benefit of executing transactions much faster than manual trading and executing a plan exactly as coded. It's important to keep in mind, however, that algorithm-based systems lack the advantage of human judgment since they are only as reactive as they have been programmed to be. Market flash crashes have been associated with these systems in the past, due to the rapid sale of shares and other assets in a temporarily declining market.

Whenever you run an automatic trading system on live markets, you should backtest it thoroughly and closely monitor it so you are prepared in case anything goes wrong.

Mistake 5: Emotional Trading

We must overcome our natural tendencies when trading and minimize the impact of emotions on our decisions. Trading based on emotions often leads to irrational and unsuccessful decisions. Traders can be influenced by emotions, such as excitement after a good day or despair after a bad day, causing them to deviate from their plans.

Running losses can cloud judgment and decision-making just as much as the euphoria that comes from a successful trade. Traders may rush into another position with their newly acquired capital without conducting the proper analysis first after a win. It could potentially wipe out their recent gains and result in losses.

When traders suffer losses or do not achieve as good a profit as expected, they might open positions without any analysis to support them. Traders may unnecessarily add to a running loss in hopes that it will increase over time, but this is unlikely to result in a more favourable market movement.

Be as rational as possible and always ask yourself before entering the market: “Does this trade fit with my trading strategy and trading plan?” or “What is the influence of my emotions on my decision-making?”

Mistake 6:Risking Too Much

You would be surprised how many traders make this trading mistake, even though it may seem obvious. The prospect of that big win seduces many traders into taking large positions in hopes of facilitating that win. Investing in the wrong market can be among your biggest and most costly mistakes.

Whatever your confidence in a position, the markets can be unpredictable and there is always a risk of them turning against you. It can drastically damage your future chances for success if you lose a large part of your trading capital. It can also be difficult to recover psychologically from such a trauma.

Make sure you always keep an eye on your position size and do not trade with too much of your total trading account balance at one time.

Mistake 7:Not Keeping a Trading Journal

Many beginning traders commit this less obvious mistake, but it is an essential part of growing as a trader.

Keeping records of all your trades, both good and bad, is a good idea. The time and reason you entered or exited a trade, the instruments you traded with, the outcome of the trade, and your thoughts and reflections are all things that should be recorded.

Making an in-depth trading journal will enable you to learn from both your mistakes and your successes, helping you develop your trading skills and fine-tune your trading strategy, and make better future decisions.

Mistake 8: NoMoney and Risk Management Rules

The most common mistake beginner Forex traders make is to forget about stop-loss orders, which direct your broker to close your position after a certain loss has been reached.

Unless you use stop-loss orders, your positions can fluctuate freely based on the market's price movements, so you have an open-ended risk. Due to this, you are more susceptible to exaggerated losses when things don't work out for you, since you don't limit your losing positions to a certain level, leaving you exposed to large swings.

For your winning trades to exceed your losing trades, your trading plan should include money management and risk management rules. You should not just use stop-loss orders to limit your losses when following money management rules; there are other factors to consider.

The following are some tips for managing your money and risk:

When making a single trade, always use a stop-loss order and a take-profit order to let you know how much you can lose and how much you can gain.

Put a weekly limit on your losses, and immediately stop trading if the limit is reached.

If you're an intraday trader, follow a risk/reward ratio of at least 1:2. If you're a swing or position trader, follow a risk/reward ratio of at least 1:3.

Ensure that you are properly sizing your positions - you should risk no more than 1% of your trading capital per trade.

Once you begin making money, don't change your risk level.

When the market is going against you, don't average up/down.

Mistake 9: Over Leverage

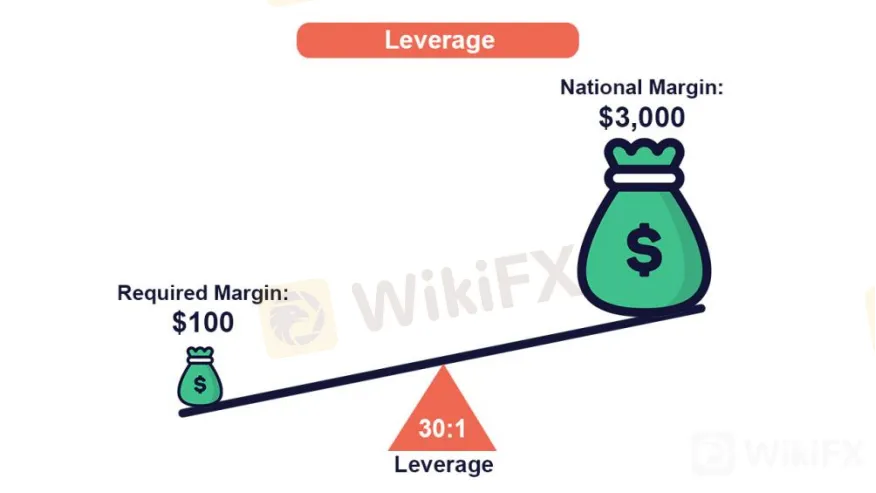

An investment position is opened with leverage, which is essentially a loan from a provider. Margin allows traders to gain much greater exposure to the market through a deposit. You will only benefit if you have a consistently profitable strategy with a positive expectation.

The possibility of enhanced loss exists even though less personal capital is required for each trade. Managing leverage is crucial for maximizing gains while minimizing losses. While leverage can increase gains, it can also amplify losses.

Leverage levels of 1000:1 are common with many brokers, which are unnecessarily high and increase the risk for novice traders as well as experienced traders. Leverage will be capped by regulated brokers at appropriate levels according to guidance provided by respected financial authorities.

The level of your experience, objectives, and risk appetite should all be carefully considered before deciding whether to trade leverage.

3. Conclusion

Trading is indeed a risky activity, but there are things you can do to minimize the risk. Trading more structured and positively towards your trading goals can be made possible by overcoming these forex trading mistakes.

There is no denying that trading mistakes are a natural part of learning, and even the most successful traders make them occasionally. Do not panic if you make a mistake or feel discouraged when you do. The most significant is that you need to learn from your mistakes to avoid making the same mistakes again in the future.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Is PU Prime a decent broker?

In today’s article, we have made a comprehensive review of a broker named PU Prime. We wonder if PU Prime is a scam or a reliable broker.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

Investment Scams in Malaysia: Telegram Tops Scammers’ List

In the first 11 months of 2024, Malaysia recorded 5,685 investment scams, with Telegram emerging as the most commonly used platform for fraudulent activities.

What Are The Common Types of Unregulated Forex Brokers?

Protect your investments from unregulated forex brokers with these tips. Learn about red flags, scams, and how the WikiFX app ensures safe trading experiences worldwide.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Currency Calculator