简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Changing a new name! ALTMAN FINANCE is running a scam again!

Abstract:To prevent more innocent investors from being cheated by ALTMAN FINANCE and losing their hard-earned money, the WikiFX team decided to dig deeper into this shady platform!

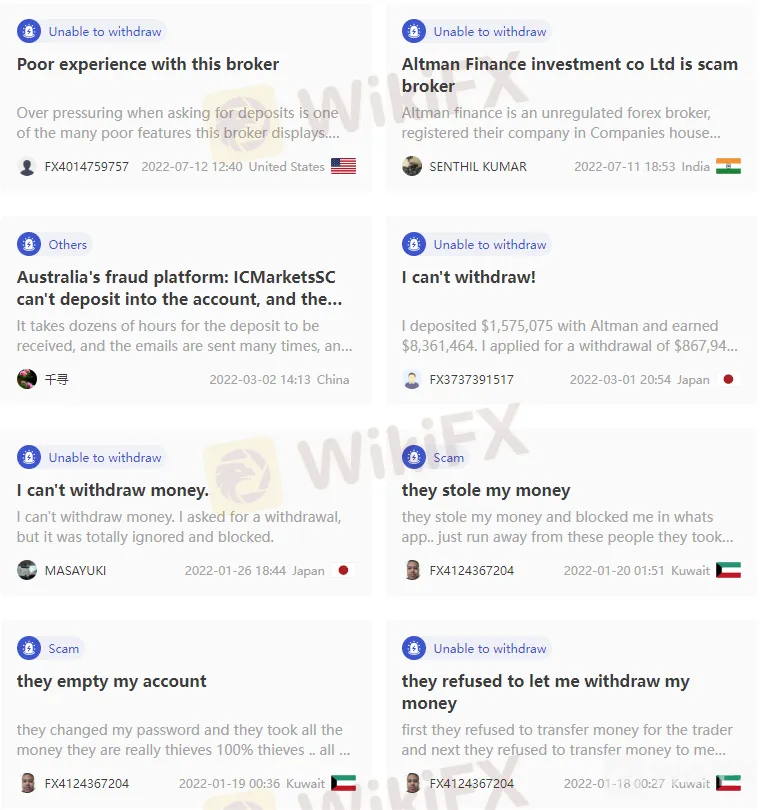

In the past 3 months, the WikiFX exposure channel has received a number of complaints about the forex broker ALTMAN FINANCE. The complainants were mainly from the U.S., India, Japan and other regions, and the content is mostly about the inability to withdraw funds.

To prevent more innocent investors from being cheated by ALTMAN FINANCE and losing their hard-earned money, the WikiFX team decided to dig deeper into this shady platform!

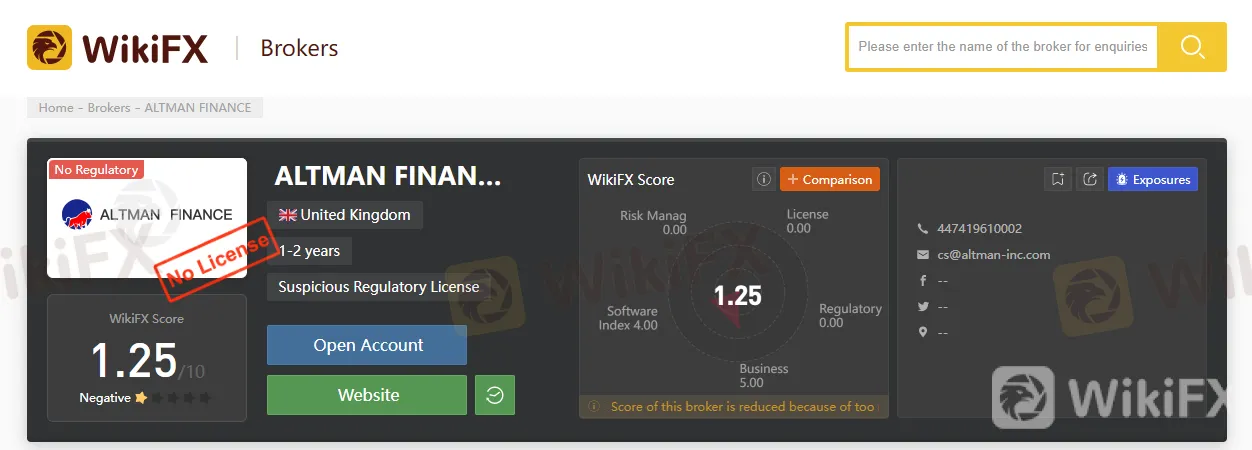

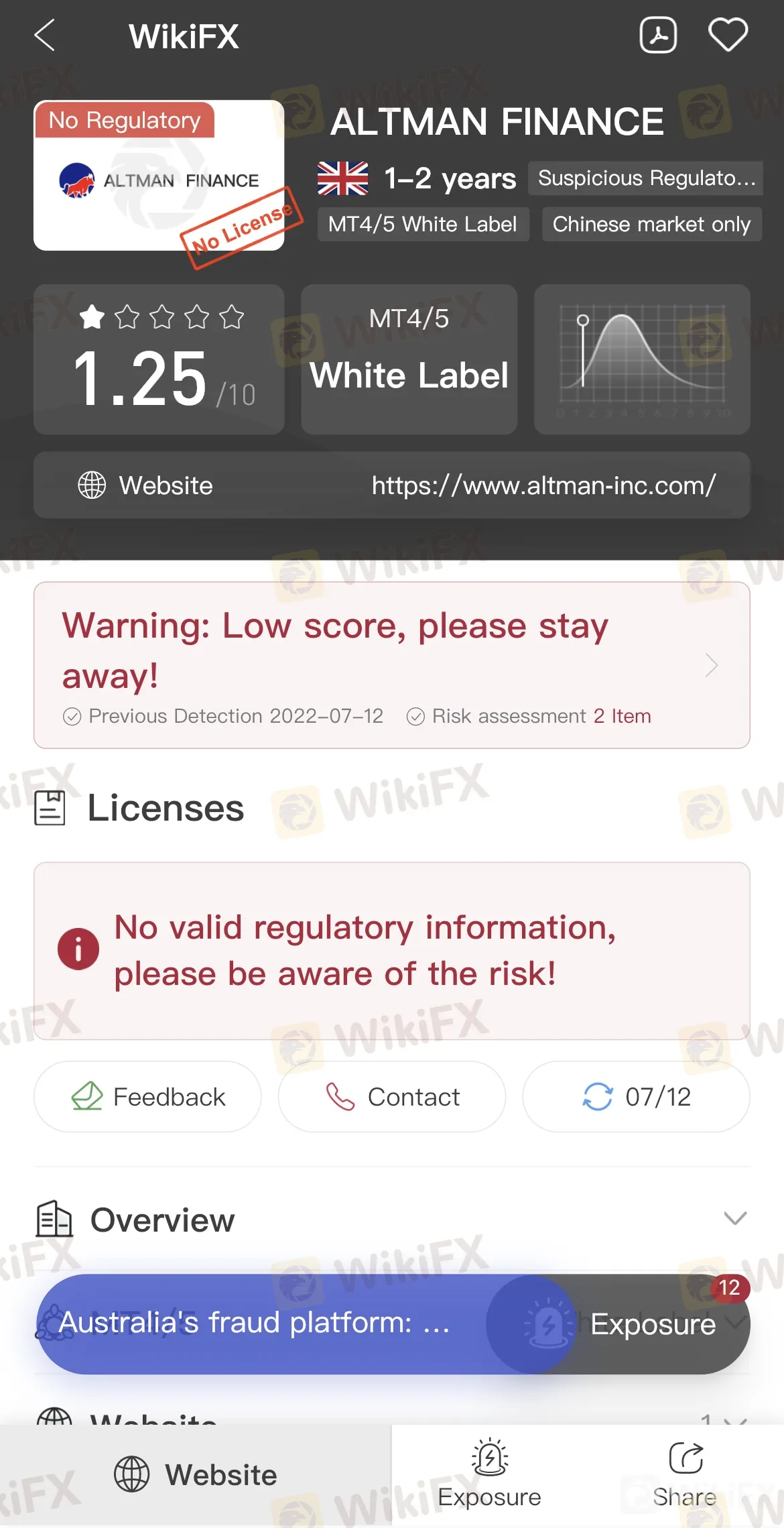

By checking WikiFX App, you can see that ALTMAN FINANCE is only scored 1.25/10. At the same time, the broker shows no regulation for the time being. In other words, ALTMAN FINANCE is very risky!!!

The Shady Side of ALTMAN FINANCE

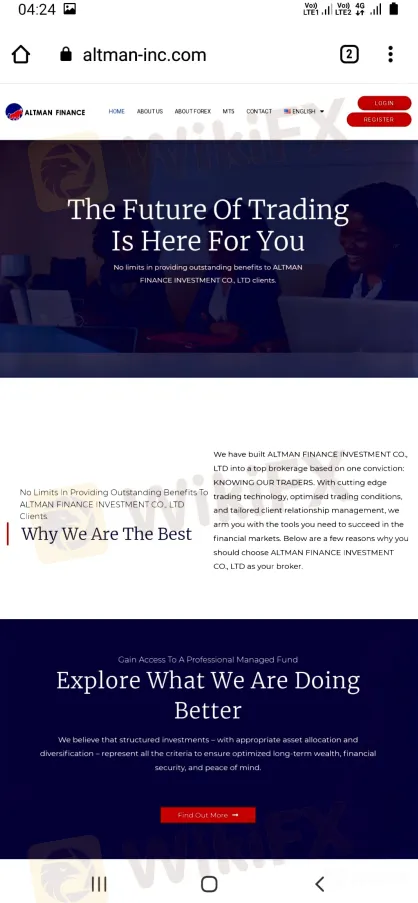

As of now, the website of ALTMAN FINANCE (https://www.altman-inc.com/) is not available. There is no doubt that this shady platform has run away after defrauding the investors' money.

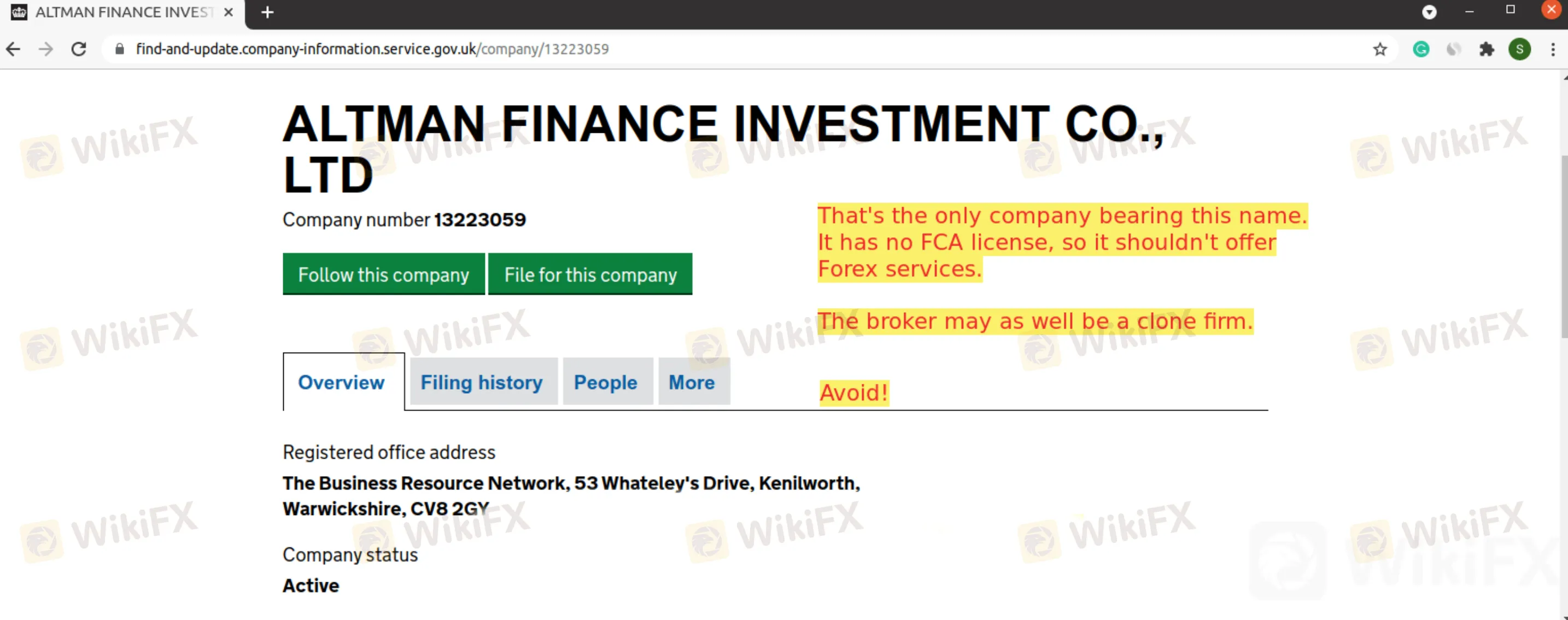

Based on the information online, we found that this shady broker claims to registered in the United Kingdom. However, we checked the official website of the local regulator FCA but could not find any information about the company. In other words, ALTMAN FINANCE is not a legit broker.

The Complaint from A Victim

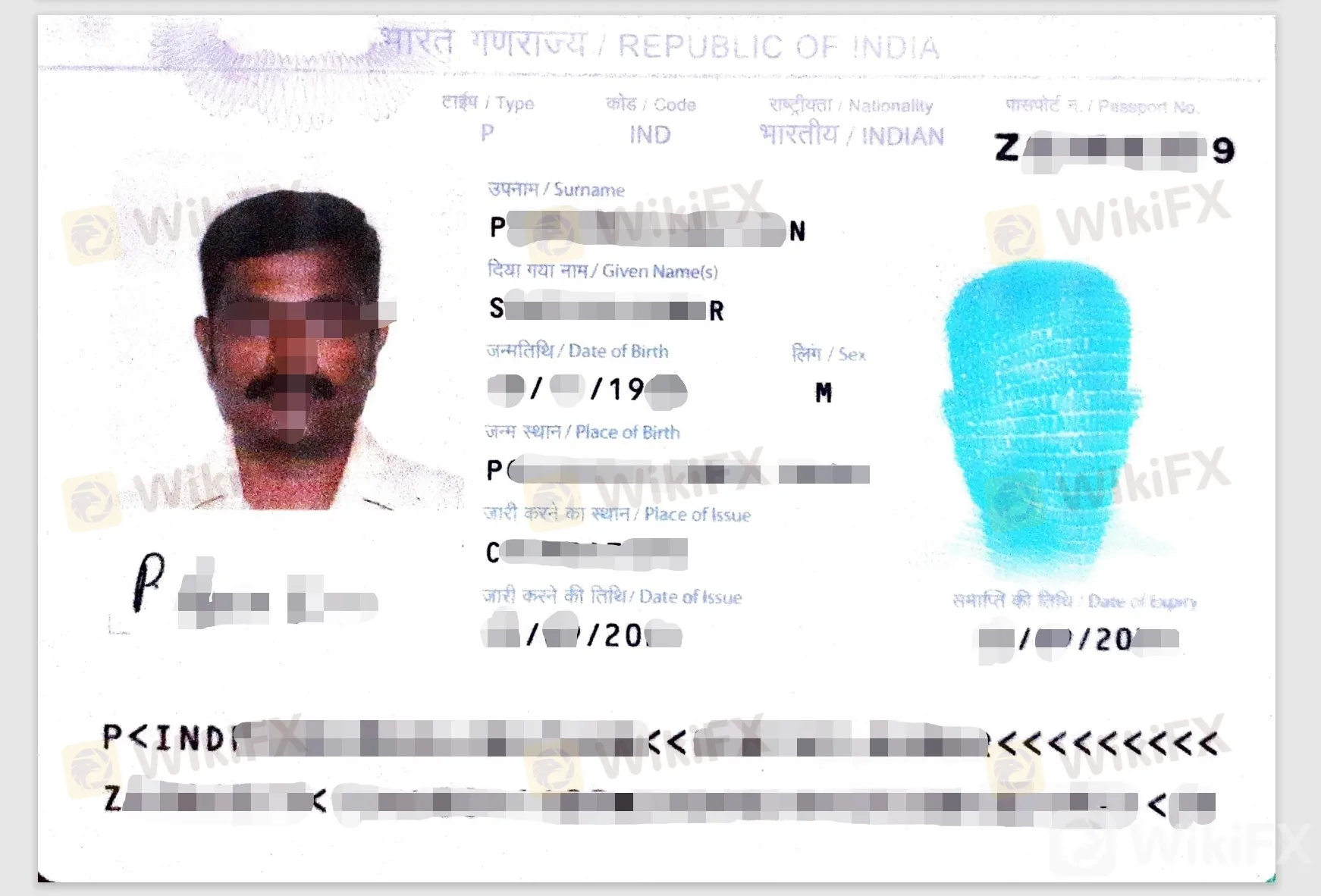

Recently, WikiFX receives a complaint from Mr. KUMAR, an Indian trader who invested in ALTMAN FINANCE. This trader told WikiFX that ALTMAN FINANCE refuses to let him withdraw. This is real-name reporting. Here's the victim's passport.

According to Mr. KUMAR's description, ALTMAN FINANCE first contacted him via Facebook, then shared the CMHK Hong Kong prepaid number +85269387396, and continued to keep in touch via Whatsapp and Line. It is clear and easy to see that the purpose of it is to attract Mr. KUMAR into the game. The following is the information provided by Mr. KUMAR regarding the contact person.

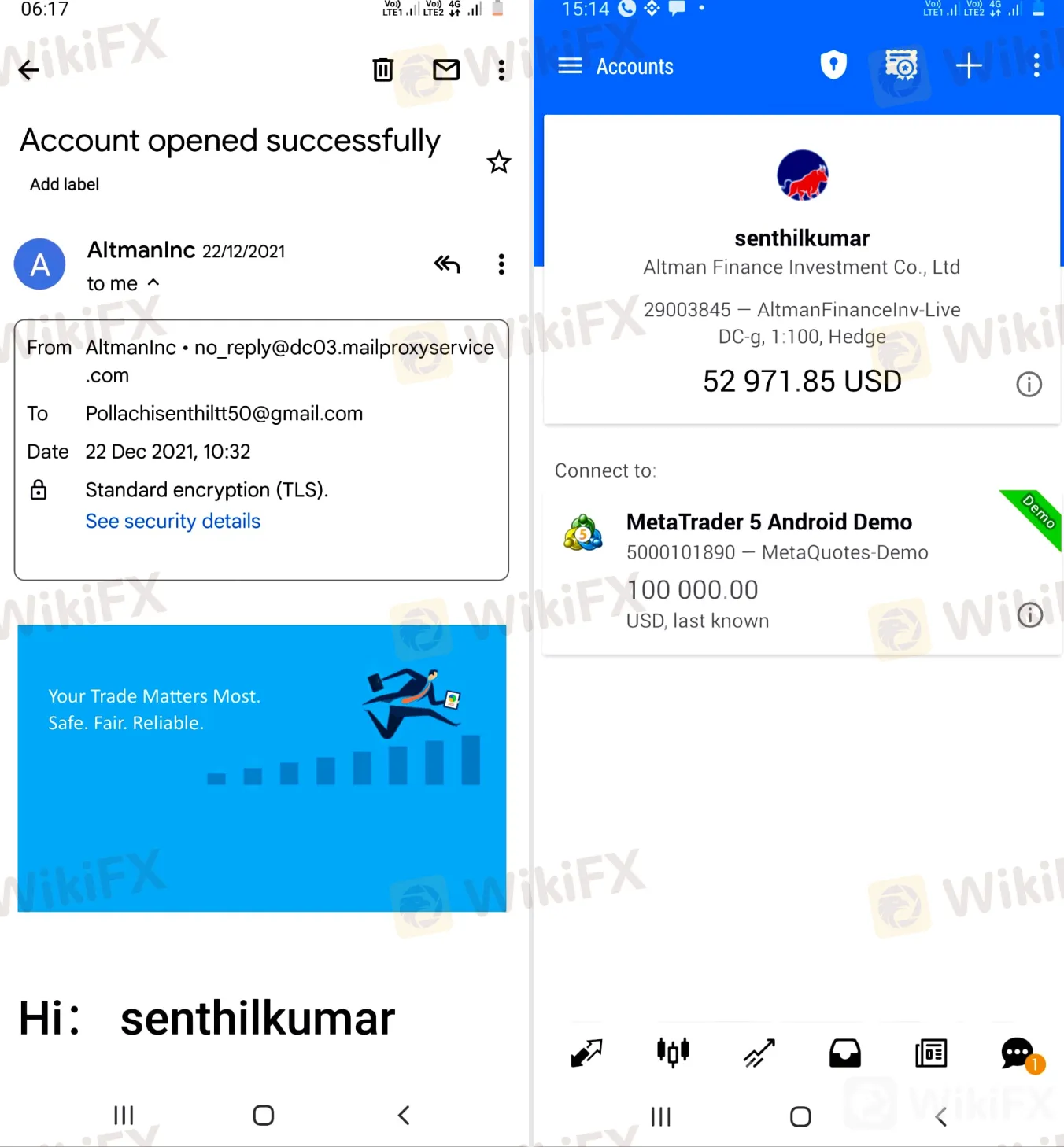

With constant recommendations from customer service, Mr. KUMAR unsurprisingly managed to open an account with ALTMAN FINANCE and trade on MetaTrader 5 offered by the broker.

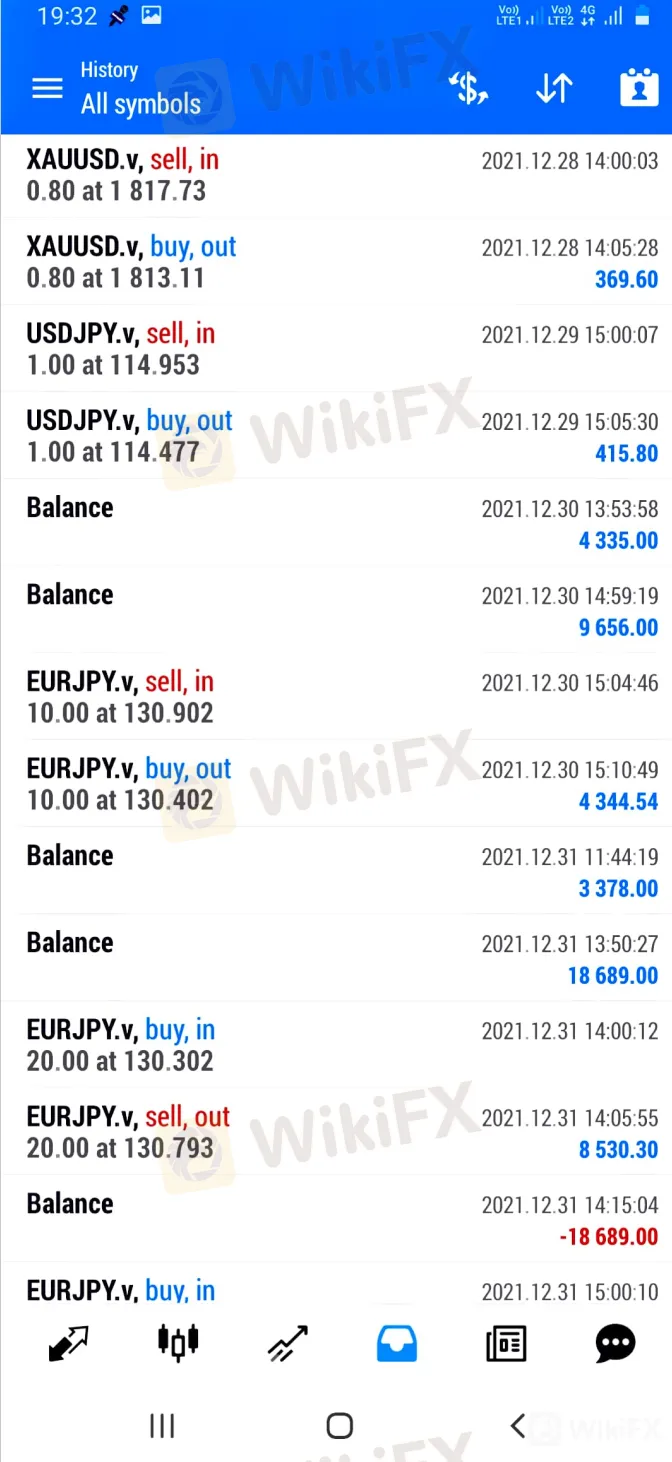

Mr. KUMAR said that he believed that ALTMAN FINANCE controlled the MT5 platform, but in fact did not make any trades. In addition, the broker constructed false profits to keep him invested.

In the end, when Mr. KUMAR reflected and tried to withdraw from ALTMAN FINANCE, he was unable to withdraw his funds. And now the broker has run away!

WikiFX's Latest Findings

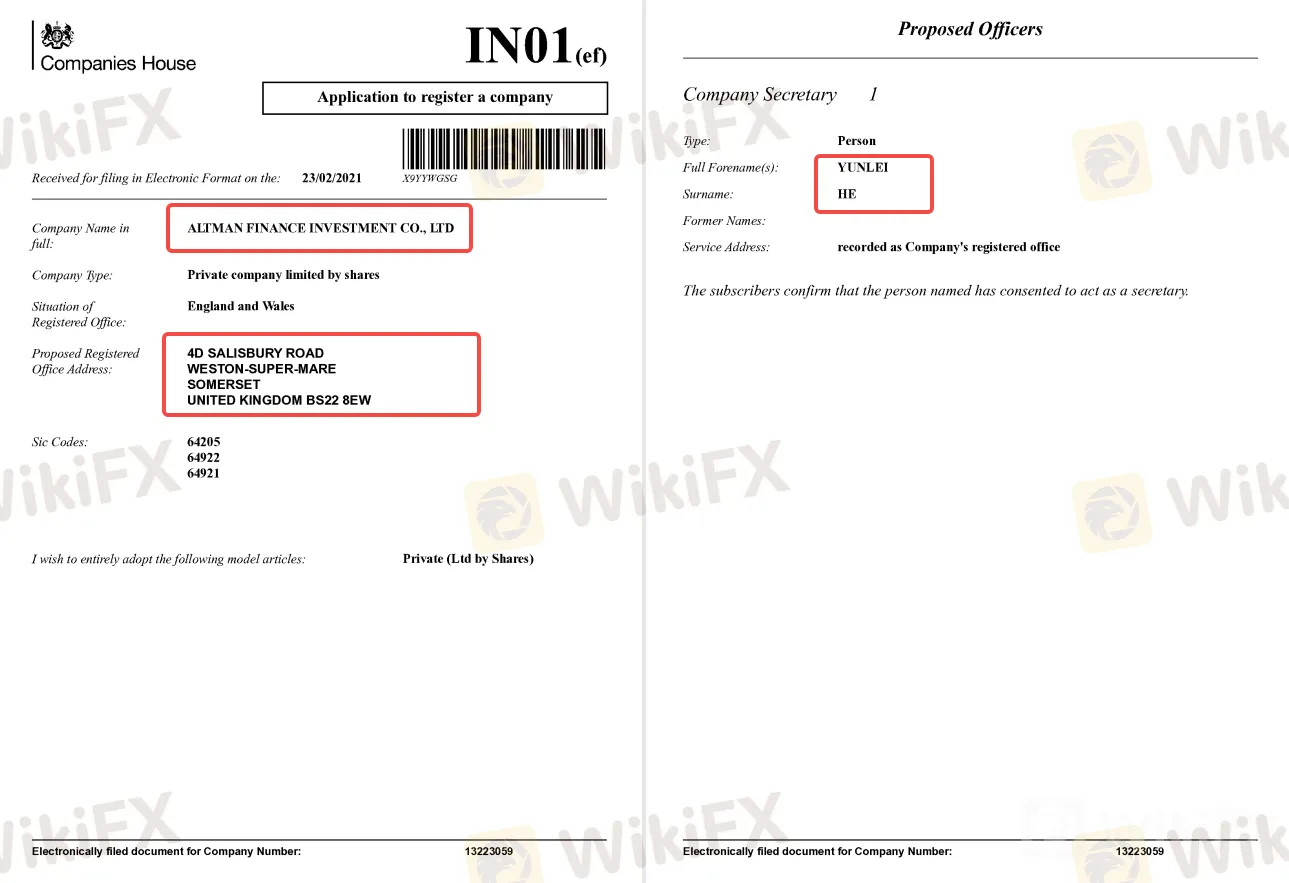

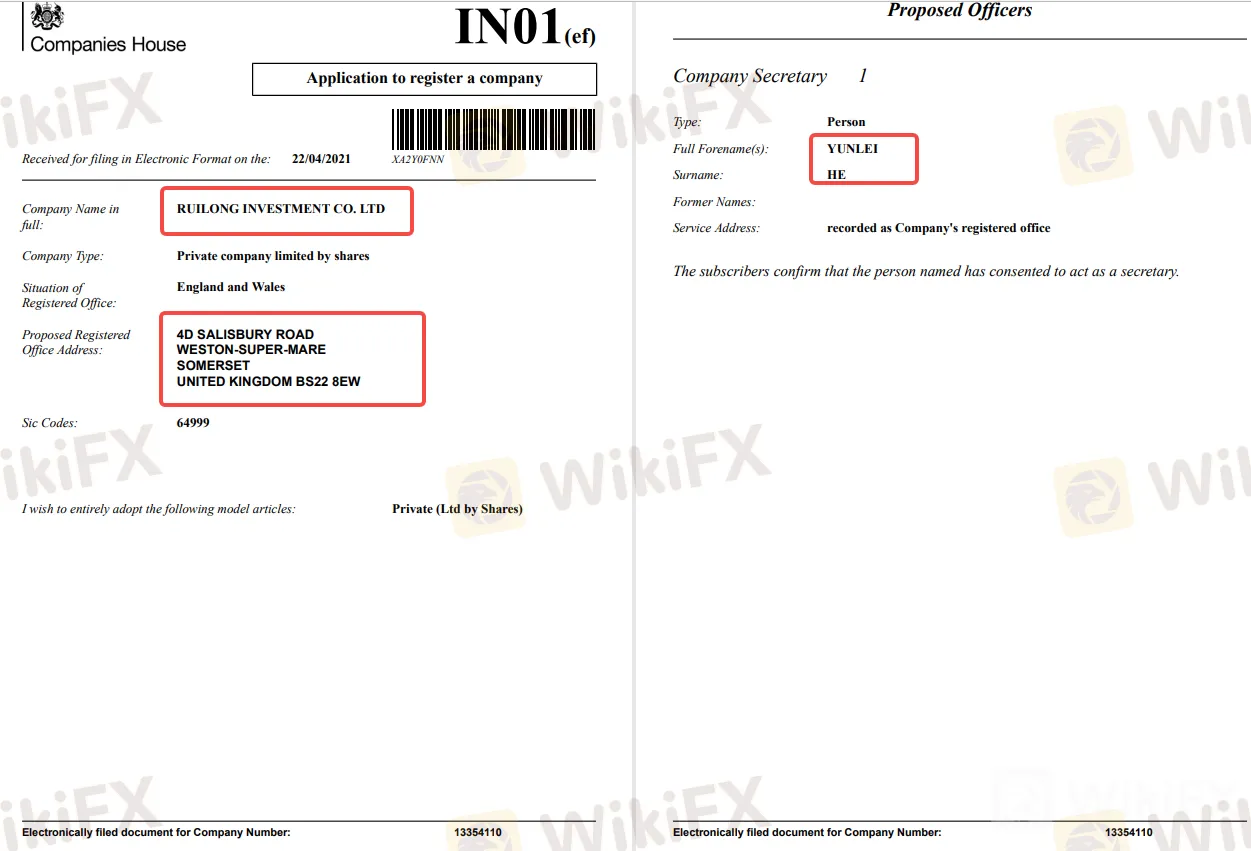

1. On the UK public sector information website gov.uk, we found a company registered at the same address as ALTMAN FINANCE. Not only that, they're registered to the same person named YUNLEI HE. The evidence is as follows:

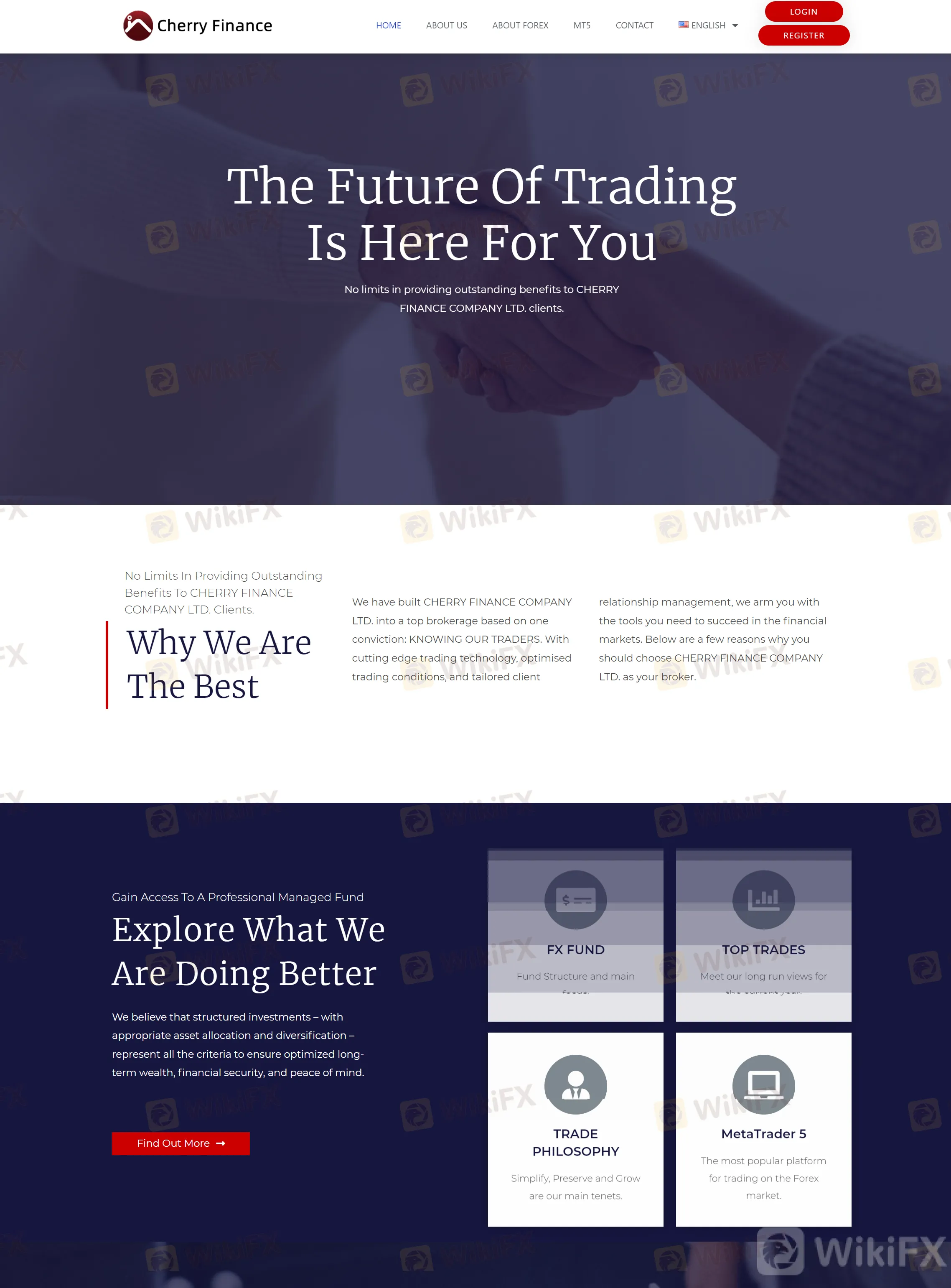

2. WikiFX also found a company called CHERRY FINANCE COMPANY LTD. that is highly similar to ALTMAN FINANCE, especially their official website. Although ALTMAN FINANCE's website is now unavailable, the victim previously saved a screenshot of its homepage and provided it to us. Here is a comparison of the two and you can clearly see they are almost identical!

3. Therefore, we have reason to suspect that ALTMAN FINANCE is trying to commit fraud under a new name - RUILONG INVESTMENT and CHERRY FINANCE! Investors are also advised to be alert if the latter makes contact with them!

Conclusion

We believe that ALTMAN FINANCE is getting involving in a scam. Protecting the legitimate rights and interests of forex traders are always the primary concern of WikiFX. The reason why WikiFX exposed this case to the public is to remind all traders of the potential risks. We are After all, what happened to Mr. KUMAR could happen to any of us. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help him resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

As a reminder, please turn to WikiFX when encountering unknown forex platforms. More caution, more safety!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator