简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Reversals in Forex How to Recognize and Trade

Abstract:This class will teach you how to identify forex reversals and trade them effectively. We will concentrate on reversals that occur in longer periods. The strategies we offer for identifying and trading reversals are tried and true.

This class will teach you how to identify forex reversals and trade them effectively. We will concentrate on reversals that occur in longer periods. The strategies we offer for identifying and trading reversals are tried and true. Traders will improve their capacity to benefit from reversals. In terms of trading reversals, it's essential since, by definition, a reversal is a fresh movement on an H4, H1, or larger time frame, which means that you're trading at the beginning of a move, which you can often ride for 1-3 days or more.

Forex Time Frames to Use for Reversals

Forex traders understand that the bigger time frames contain the most pips, so why play with reversals on the smaller time frames? The strategies in this lesson may be used to reversals as low as the H1 time frame while still maintaining a decent money management ratio. By looking at the higher time frames, you can always determine when the trend is reversing and moving in the opposite direction of the main trend.

There Are Several Types Of Forex Reversals

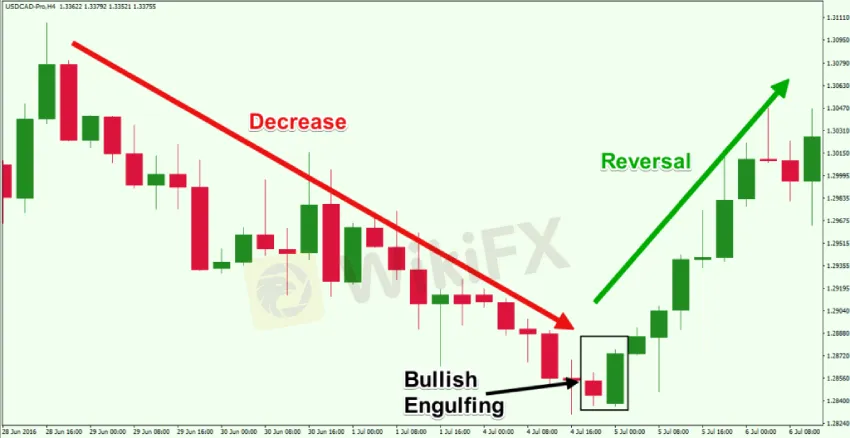

There are several kinds of forex reversals. The first kind occurs when a pair falls, then pauses at support and continues sideways for an extended length of time before reversing back up. A V-shaped reversal is the second form of a reversal. In either case, the pair falls and generates a “V” shaped reversal or pivot off of support.

Assume the currency pair in question is the GBP/USD. You should consider a reversal is likely if the GBP/USD cycles down for a lengthy time and then begins to consolidate and move sideways (left sketch). You might use an audio price alert to keep an eye out for a reversal or breakthrough to the upside. Setting this up on a trading platform is a cinch. If you set up an audio price alert at the red line, this pair may be reversible. As a forex reversal indicator, audible price notifications might be employed.

Then you may observe whether The Forex Heatmap® confirms a purchase with GBP strength, USD weakness, or both. The heatmap is based on parallel and inverse analysis and is a powerful tool for trading forex reversals. It is one of the greatest trend reversal indicators currently available, if not the best.

V-shaped reversals (seen above on the right) need a little more expertise to trade, but it is possible. Tools like The Forex Heatmap®, together with observing the economic calendar for significant drivers and knowing that the market on the GBP or USD pairings is not moving, make it feasible. A V-shape pattern in GBP/USD, for example, is most likely to occur during the main trading session following a GBP or USD economic data driver, and these data drivers occur at scheduled periods in advance. This makes it simpler since you may be in front of the computer when the economic news is scheduled. The heatmap will also show you whether the GBP is gaining in preparation for a reversal.

V-shaped reversals on the H1 and H4 time frames are rather typical in non-trending markets. Begin by sifting through the charts daily, focusing on the largest time range first. V-shaped forex reversals may be expected on the H1 and H4 time frames every few days if there are no longer any trends in the larger time frames. If GBP/USD pairings are bouncing about every few days without forming a longer-term trend, it is reasonable to assume they will continue with V-shaped reversals until at least one of these groups of pairs develops a longer-term trend. Analyzing trends over many time frames makes finding V-shaped reversals much simpler; as you get more expertise reading the charts, they will become more visible. The GBP/NZD V-Shaped Reversal example is shown below.

The third kind of forex reversal occurs when a pair smoothly oscillates or cycles between support and resistance over a broader period. These are quite simple to identify and trade; see the example below. Any time there is a sequence of reversals in the currency market, it may be oscillating rather than moving. If this is the case, trade it both ways. Every week, we look for trading opportunities on pairs that are smoothly cycling and oscillating. As the forex reversals expand over a few days, you can see how the smaller time frames feed the larger time frames on oscillating pairs, which are a wonderful teaching tool.

There have been two reverses in the GBP/JPY, and a third is going to occur off of support on the D1 time frame, as seen in the chart above. Because over 800 pips are conceivable, traders should take this carefully. We recommend splitting the GBP into two different currencies and examining them to see what is causing the reversal. Line up all of the GBP and JPY pairings to discover what is causing the GBP/JPY to rise again. Is the pound strengthening? Is the Japanese yen weakening? This is known as parallel and inverse analysis, and it is quite strong.

A reasonably smooth oscillating market oscillates on numerous pairings, making it easier to identify them. When one pair oscillates in smooth cycles, other pairings in the same currency are frequently oscillating as well. As an example, if the H4 time frame shows that the USD/CHF and the EUR/USD are both oscillating between support and resistance, then you may conclude that it is the USD that is driving these moves. An excellent forex reversals method is to watch the market for oscillations. Larger time frame smooth oscillations are great forex trend reversal patterns.

Reversals may occur in a market that is strongly moving. A trader should consider a reversal if a currency pair falls in the dominant trend for many days before pausing and moving sideways. Look for the return of momentum if you missed out on the massive plunge.

Reversals on H4 time frames will always revert to their original direction if you trade against the major trend in the MN period. The CAD/CHF pair, for example, has dropped 400 pips but is now stalled at a support level. Setting a price alert and monitoring the forex heatmap for a reversal is a good way to spot a 100 pip shift. A fantastic chart setup for a reversal.

Forex Reversal Procedures

Only trade reversals on lengthier time frames (H1 minimum), and keep your risk-reward ratio in check.

Look for a reversal when a pair has moved in the same direction for many days but is now sideways. Don't be concerned about missing a lengthy move; instead, look for the reversal!!

Keep an eye on the news calendar and pairings within the same currency group for news calendar reversals.

Monitor for forex reversals by using audio price alerts and The Forex Heatmap.

Know the market circumstances, trending vs non-trending, and use MTFA to ensure you are aware of this fact if you trade a reversal against the primary trend.

More Educational Forex articles may be found at https://www.wikifx.com/en/education/education.html.

WikiFX app can be downloaded for free on App Store ang Google Play Store

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

Are you ready to take your trading expertise to the next level? WikiFX is excited to announce an extraordinary India Trading Competition designed to connect passionate forex traders, enhance user engagement, and reward trading excellence!

WikiEXPO Dubai on-site videos are here!

Let’s experience the excitement through the video!

WikiEXPO Dubai on-site videos are here!

WikiEXPO Dubai on-site videos are here!

WikiEXPO Dubai 2024

Come and experience it with us!

WikiFX Broker

Latest News

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Robinhood Launches Ethereum Staking with 100% Rewards Match

Kraken Closes NFT Marketplace Amid New Product Focus

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Broker Review: Is FOREX.com a solid Broker?

Tether to Discontinue EURt Stablecoin Amid Regulatory Shifts in Europe

Adani’s Bribery Scandal! SEC Charges, Major Fallout & Adani’s Stand

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

Currency Calculator