简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The US NFP is in the spotlight.

Abstract:Predictions for the US non-farm payrolls: Ugly leading indications have traders on edge

Click Here: After you read it, Daily Routine with WikiFx

Find out what the leading indications indicate about this month's NFP data and how you may trade it!

In his press conference on Wednesday, Fed Chairman Jerome Powell stated that the US job market “remains extraordinarily tight” and that “[the Fed] must bring down inflation” to sustain the labor market. In other words, the central bank is happy with its “employment” mandate but worried about its “inflation” component.

In this context, it will be interesting to monitor how employment figures evolve in the next months as financial conditions (read interest rates) change. Thankfully, analysts don't expect that to be a large role in this month's NFP report, with consensus predictions of 400K net new jobs and a 0.4% increase in average hourly earnings:

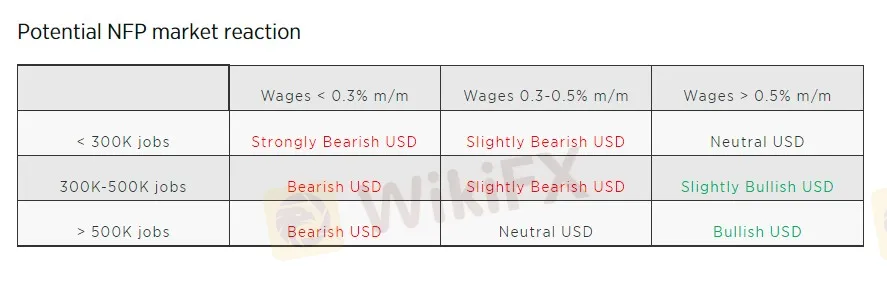

The market reaction to this month's jobs data may be less than last month's, but it's still worth watching how the report comes in relative to market expectations.

Are these hopes valid? Onward to Friday's vital jobs report!

NFP outlook

To forecast each month's NFP data, we use four historically accurate leading indicators:

The ISM Services PMI Employment component fell to 49.5 from 54.0 previous month, indicating a substantial decline in service sector employment.

The ISM Manufacturing PMI Employment component fell to 50.9 from last month's 56.3.

247K net new jobs were reported by ADP, considerably below projections and well below last month's revised 479K.

Finally, the 4-week moving average of initial unemployment claims jumped to 188K from 178K last month.

Remember that the US labor market is still recovering from the unprecedented disruption caused by the COVID outbreak. But analyzing the data and our internal models, the leading indicators point to this month's NFP report showing somewhat below-expected employment growth of 300-400K, albeit with a larger spectrum of uncertainty than previously given the present global context.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to forecast (including ours). These are always closely followed by the average hourly wage, which rose by 0.4 percent m/m in the latest NFP data.

The US dollar index rose to near 20-year highs above 103.00 last month, but Fed Chairman Powell's more cautious-than-expected comments have halted the advance so far this week. Macroeconomically, a strong NFP data may be required to boost the greenback to fresh highs.

For potential trade setups, consider buying USD/JPY after a solid NFP data. After a week of controlled declines (potential bullish flag formation), the medium-term momentum remains bullish.

A weaker jobs data may give a buy opportunity in AUD/USD. With the Aussie forming a “higher low” in the mid-0.7000s, the pair could continue its gains into 0.7300 if traders elect to take profits on the (US) dollar ahead of the weekend.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator