简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

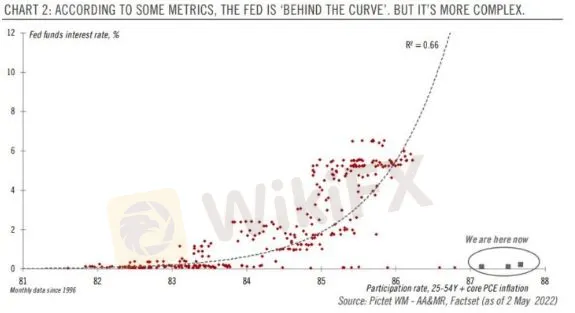

Should you buy or sell the US dollar ahead of a historic rate hike?

Abstract:In a few hours from now, the Federal Reserve of the United States is forecast to hike the funds rate by 50 basis points. It would be the first time since 2000 that the Fed will hike by more than 25 basis points.

The worlds reserve currency rallied in 2022, reaching levels that many think of being overbought. At this point, the money markets have priced in 325 basis points of hikes in this cycle, which is above average compared to the past four cycles.

For instance, during the 2015-2018 cycle, the Fed hiked 225 bp. Also, during the 1999-2000 cycle, the Fed raised the interest rate by 175 basis points.

Only this time is different, for the simple reason that inflation is much higher than during past hiking cycles. Therefore, traders should keep an open mind about what the Fed wants and is willing to do.

Will the Fed target the US business cycle?

With inflation running above 8%, it is hard to believe that the Fed will not use everything in its powers today and in the upcoming meetings. As such, it will likely tighten sharper than most expect.

Also, it will likely deliver a very hawkish rethoric about future rate hikes. All these favor a much stronger US dolllar.

Furthermore, quantitative tightening, or the Fed selling the bonds it holds on the balance sheet, will further contribute to the greenbacks strength.

But then again, this should already be priced in.

What is not priced in is the possibility of the Fed targeting the business cycle. Sharp tightening of monetary policy may lead the US economy to shrink drastically over the summer.

More precisely, the housing market is in focus, when interest rates rise.

Therefore, another quarter of slow or negative economic growth would make the Fed pause int tightening after summer. That is especially true if inflation starts coming down as well.

For now, dollar bulls are comfortable. Rate hikes and hawkish rhetoric should help the dollar, but those looking for investing for the medium and long term, may have a different opinion about todays outcome.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator