简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Deal with FOMO to Become a Better Trader

Abstract:Dealing with the fear of missing out – or FOMO – is a highly valuable skill for traders. Not only can FOMO have a negative emotional impact, it can cloud judgment and overshadow logic, which is problematic when making trading decisions.

So what is FOMO in trading? Its the fear traders get when they think they might be missing out on big opportunities, or that other traders are more successful. Traders who understand FOMO, where it comes from and how they react to it are in a strong position to tackle it at its root cause: the innermost workings of their own mind.

This article will help you get to grips with your FOMO, offering solutions to stop it in its tracks – or even to prevent it from arising in the first place.

WHERE DOES FOMO IN TRADING COME FROM?

FOMO in trading has deep-seated emotional roots and it stems from our interconnected daily lives. The modern trader lives in a world where social media is commonplace and they are bombarded with stories of others succeeding.

FOMO can stem from various feelings and emotions that occur during trading, including fear, greed, jealousy and impatience. The fast-paced nature of trading means many situations can drive these emotions. From newsworthy events, to sudden market movements, to something as simple as a conversation with another trader, theres the potential for FOMO.

Explore the roots of FOMO in trading and learn what characterizes a FOMO trader.

STUCK IN A FOMO RUT? HOW TO DEAL WITH FOMO IN TRADING

Putting a stop to your FOMO isn‘t a quick fix, so don’t feel disheartened. It‘s a case of adjusting thought processes – and that isn’t something which happens straight away. The feeling of missing out on a great opportunity can be pervasive.

It might help to remember that it happens to everyone; even the most experienced traders experience The Fear. Here are five top ways to deal with FOMO and become a better trader:

1. Accept the FOMO

The first step to overcoming FOMO is accepting it. This can provide a great deal of relief – the idea that everyone is having a better time, and is more successful, can be lonely and isolating.

Warning signs

Traders having thoughts like this might need to accept their FOMO:

“FOMO? What FOMO? Im in full control of my trading.”

A refusal to accept FOMO means a trader wont change their habits, staying stuck in an unfulfilling cycle of reliance on others.

How to accept FOMO

Remember that FOMO affects traders all the time. It might help to share experiences with others, in a group learning environment like a webinar. Our DailyFX analyst, Paul Robinson regularly hosts webinars addressing psychology in trading and issues such as FOMO.

2. Work on your trading psychology

FOMO is intrinsically linked to psychology; the emotions of trading can take over and make traders question their own decisions.

Warning signs

Thoughts like this could indicate the focus is the here and now, not the bigger picture:

“I can‘t believe I missed that opportunity! Chances like that don’t come around often. I bet other traders took it... their trades will be in the money now.”

Trading based on emotions can be risky, and can lead to cyclical behavior – entering trades, panicking, selling, feeling regret, and doing the same thing again…

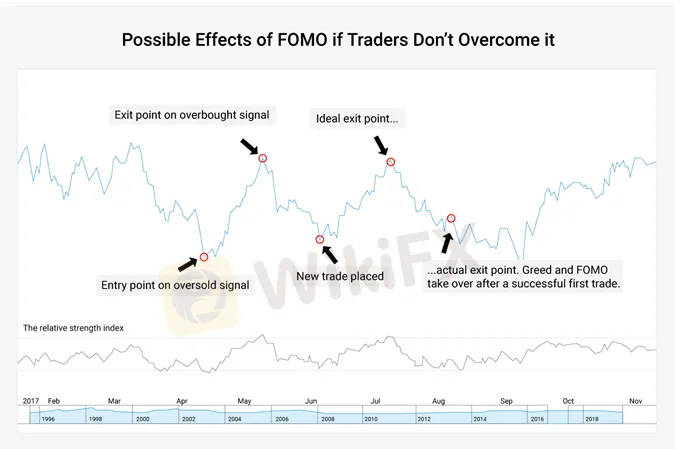

This chart illustrates what can happen if traders get carried away by FOMO. It uses the Relative Strength Index as an indicator, showing when the Japanese Yen has been overbought or oversold. The second set of arrows illustrates a situation where the trader has become overconfident, and is worried about missing out on another opportunity. In their excitement, greed and fear of missing out take over – the trader ignores signals to sell in the hope of getting a bigger win, and ends up making a loss.

How to improve trading psychology

Learning to improve trading psychology starts with an analysis of strengths and weaknesses. Why not get some ideas on trading psychology from the DailyFX Podcast? This will help you overcome FOMO and improve your psychology.

3. Control your social media activity

Social media can be helpful to traders, but it can also be detrimental – when it looks like everyone else is winning trades, its easy to become disillusioned and demotivated.

Warning signs

You might need to consider your relationship with social media if you regularly have thoughts like this:

“I‘ll just check Twitter to get some ideas… but it’s full of people winning trades. Why cant I be more like them?!”

Using social media can knock your confidence if it feels like others know something you dont. It can create a feeling of FOMO rather than proving constructive.

How to control your social media activity

There‘s no need to cut yourself off from the world, but try to use social media in a way that’s helpful for you. Take a look at the #FOMOintrading hashtag to see if you can relate to anyone elses experiences, and follow @wikiFX and our analysts to get hints, tips and ideas for trades.

4. Keep a trading journal

A trading journal will help you log your activity and reflect on it. Its an excellent self-reflection tool, allowing you to spot the habits that are helpful and put a stop to those that might lead to FOMO trading.

Warning signs

You might need to make better use of your trading journal if youre having thoughts like this:

“This feels like a good opportunity. I think Ill go for it. The markets seem to be working in my favor.”

These thoughts suggest you need to spend some time evaluating your trading and establishing what works for you. A trading journal will help.

How to keep a trading journal

Everyones trading journal will be different – yours will be personal to you, and based on your trading goals. Lean how to create a trading journal and use it to its full potential, putting you in a better position to trade with confidence, not fear.

5. Manage your risk

Managing risk carefully is an important step in moving away from FOMO – and if you are tempted into trades through the fear, good risk management will be your backup to ensure losses dont spiral out of control.

Warning signs

Your risk management strategy will come into play if youre having thoughts like this:

“Everyone else is trading this market, it can‘t be that risky… I don’t want to miss out.”

FOMO can make a trade seem more appealing but it doesn‘t substitute a strategy. It’s important that all outcomes are considered so you can manage risk.

How to manage risk

Good risk management sets a precedent for good trading. Learn about the importance of risk management, how it can help control emotions when trading, and why its essential for you.

HOW TO STOP FOMO BEFORE IT HAPPENS

A good approach to deal with FOMO is to trade in a way that prevents it from occurring in the first place. Here are some ideas and actionable tips to help you focus on your trading goals and activities, rather than worrying about what others are doing:

Establish a routine. Trading can be an isolating activity, which is one of the reasons FOMO can kick in. Having a routine really helps. This gives you time to analyze the markets, plan trades and make the decisions that are right for you – without the distractions of others. Once you find a routine that works, its much easier to focus. Find out how successful traders and analysts manage their routines and balance their time on the markets.

Look to the future. Don‘t dwell on the past. The mind will naturally focus on the negatives but it’s possible to teach it not to. Losing some money might seem like a big deal, especially at first, but the most confident and strategic traders know this is all part of the bigger picture. There will always be another opportunity and once this becomes part of the trading psyche, its much easier to avoid FOMO. A practical way to keep up the forward momentum is to use our market sentiment tool, which will help you to make more accurate predictions and get a better idea of whether signals are bullish or bearish.

Create a trading plan. There are no buts: you need a trading plan. Trading outside of a plan could mean risking too much capital or entering trades at the wrong time. Its easy to think a situation is unique, but a trading plan should cover all eventualities. If a trading plan is watertight, you will have the tools they need to make money long term. Learn how to create a trading plan in just seven steps. This will help you establish objective trading strategies and beat FOMO.

Enjoy trading. When you are happy and content in your own activities you‘re less likely to feel the FOMO. An important factor in this is feeling that you’ve really mastered your trading. We have educational resources available for traders of all levels, helping you get to grips with the basics or find more advanced strategies. You can also learn more about creating your own success in our guide to the Traits of a Successful Trader.

Embrace the JOMO!

JOMO stands for the joy of missing out. It pays to take a step back, collect your thoughts, and simply enjoy your own space and routine. Theres a lot to be said for JOMO, and adjusting thought patterns to eliminate FOMO is a solid psychological strategy to take.

Read our guide to turning FOMO into JOMO.

A TRADERS TOOLKIT FOR DEALING WITH FOMOTo summarize, here are the essential tools required to deal with FOMO and become a better trader.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator