简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CRUDE OIL PRICE TALKING POINTS

Abstract:The price of oil trades to a fresh weekly high ($115.40) amid an unexpected decline in US inventories, and crude may continue to retrace the decline from the yearly high ($130.50) if the Organization of Petroleum Exporting Countries (OPEC) stick to the current production schedule at the next Ministerial Meeting on March 31.

Crude Oil Price Outlook Hinges on OPEC Meeting

CRUDE OIL PRICE OUTLOOK HINGES ON OPEC MEETING

The price of oil appears to have reversed ahead of the 50-Day SMA ($95.32) as it extends the series of higher highs and lows carried over from last week, and current market conditions may keep crude prices afloat as data prints coming out of the US point to strong demand.

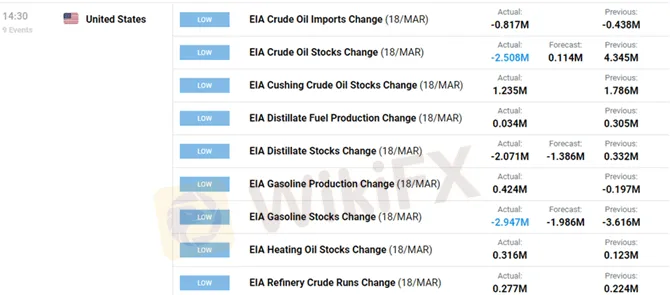

US stockpiles narrowed 2.508M in the week ending March 18 versus forecasts for a 0.114M rise, and the development largely align with the upbeat outlook entailed in OPECs most recent Monthly Oil Market Report (MOMR) as the update insists that “for the time being, world oil demand growth in 2022 remains unchanged at 4.2 mb/d, given the high uncertainty and extreme fluidity of developments in recent weeks.”

Indications of robust demand may encourage OPEC and its allies to retain the current production schedule with the group on track to “adjust upward the monthly overall production by 0.4 mb/d for the month of April 2022,” and the decline from the yearly high ($130.50) may turn out to be a correction in the broader trend as US production remains subdued.

A deeper look at the update from the Energy Information Administration (EIA) show weekly field production holding steady for seven consecutive weeks, with the figure printing at 11,600K in the week ending March 18, and more of the same from OPEC+ may ultimately lead to higher oil prices as the group retains a gradual approach in restoring production to pre-pandemic levels.

With that said, the price of oil may continue to carve a series of higher highs and lows ahead of the OPEC meeting as indications of stronger demand are met with signs of limited supply, and crude may stage another attempt to test the record high ($147.27) if the group shows little interest in responding to the Russia-Ukraine war.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How Did the Dollar Become the "Dominant Currency"?

Since the fourth quarter of last year, the strong trend of the U.S. dollar has intensified, and as we enter 2025, investors face a contradictory situation.

How to Automate Forex and Crypto Trading for Better Profits

Find out how automating Forex and crypto trading is changing the game. Explore the tools, strategies, and steps traders use to save time and maximize profits.

Is Infinox a Safe Broker?

INFINOX, founded in 2009 in London, UK, is a regulated online broker under the UK FCA. It offers diverse trading instruments like forex, stocks, commodities, indices, and futures. Clients can choose between STP and ECN accounts and access educational resources. With 24/7 customer support, INFINOX aims to empower traders with reliable tools and guidance.

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

The idea that astrology could influence success in the stock market may seem improbable, yet many traders find value in examining personality traits linked to their zodiac signs. While it may not replace market analysis, understanding these tendencies might offer insights into trading behaviour.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator