简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Does Your Homework For You

Abstract:The anatomy of a Forex broker is another knowledge of its own, in addition to practical trading. Before a trader could dive into the currency markets, he needs to first find a credible broker with whom he deposits his capital.

This topic of “brokers” is a big one to cover. The majority of market participants have a love-hate relationship with their brokers. From the “love” perspective, a Forex broker provides the prerequisite entry ticket into the playing field. On the flip side of the coin, people generally believe that brokers are designed to capitulate their trading accounts and even scam their money.

The right broker should be credible, regulated, provide services and products that suit ones needs, and offer timely support to their clients. However, due to the fact there are thousands of brokers out there, how can one conveniently compare them without much hassle?

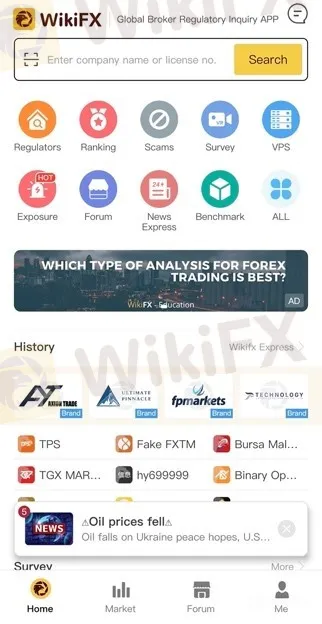

Here at WikiFX, we provide solutions to all your concerns related to broker companies. We prioritize our users convenience and trust, so we aim to provide the most transparent information under a single platform for all.

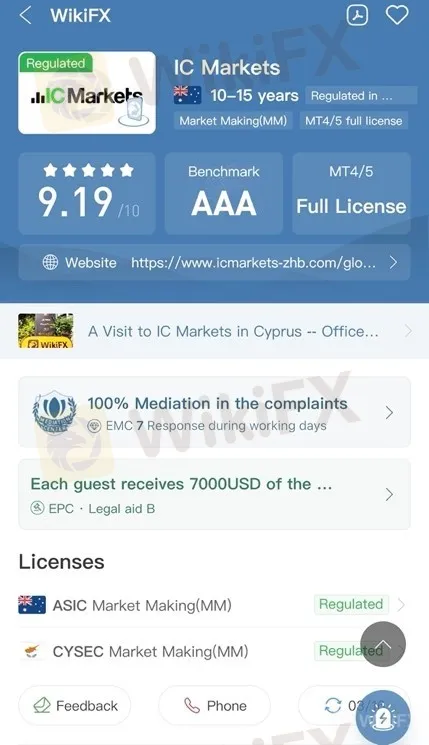

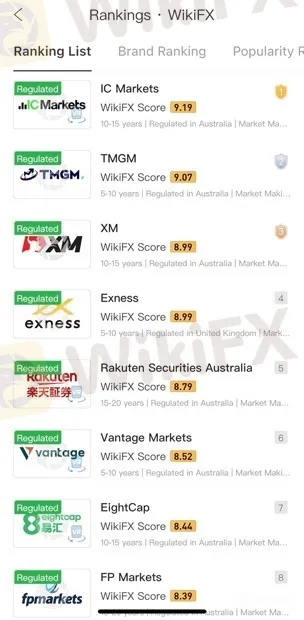

We perform thorough background checks on brokers by evaluating their basic information provided, such as the currencies, commodities, and indices that are available for trading, levels of leverage offered, and most importantly their licenses. We go to the extent of carrying out site visits to their premises to examine the legitimacy of their businesses.

We then compare, rate, and rank the respective brokers on our website and app to make the survey work easy for our users. Furthermore, we also provide forums to collect honest reviews from users globally regarding their personal experiences with their respective brokers.

We know that it is always overwhelming and frustrating having to do all this research because trading the financial and currency markets itself is stressful. However, it is never too late for a trader to find out the truth behind his broker and take preventative measures. After all, protecting your capital is the most important step in trading and investment.

All you need to do is just go through the WikiFX website and app with a few clicks and that will save you a lot of time, (potentially) money, and worries in the long run.

The WikiFX team has your back on this!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator