简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Hit 14-Year High on New Russia Sanctions Risk

Abstract:Crude oil prices roared higher at the weekly trading open as the deepening crisis in Ukraine stoked speculation about another round of still-harsher Western sanctions against Russia. As the fighting spreads to engulf more of the civilian population, headlines foreshadowing a Western ban of Russian energy exports have emerged.

CRUDE OIL OUTLOOK:

Crude oil prices hit a new 14-year high as fighting in Ukraine broadened

Markets eye harsher Western sanctions as Russia races to gain leverage

Risk appetite evaporates across markets, ceasefire talks to resume today

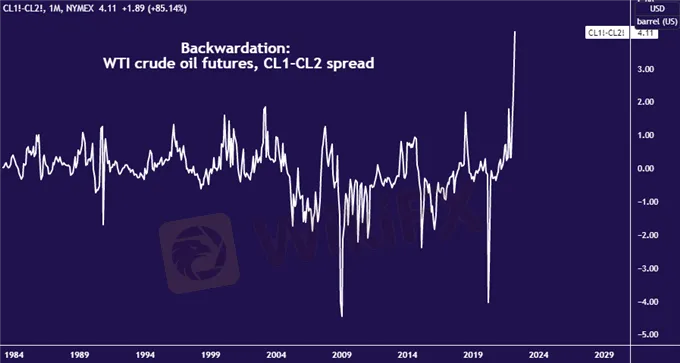

Dramatic backwardation now shows demand for the soonest-possible crude deliveries outstripping those due just a month later by the largest gap on record since at least 1984. That speaks to acute concerns about supply disruption. Russia is the second-largest global oil producer, accounting for over 13 percent of output.

WTI crude oil CL1-CL2 futures spread chart created using TradingView

Risk appetite soured across financial markets against this backdrop. Australias ASX 200 stock market benchmark fell at the open and futures tracking key equity averages in Japan and Hong Kong indicate steep losses when those bourses come online. Bellwether S&P 500 futures – a global sentiment proxy – are down over 1.3 percent.

The Swedish Krona, Euro and Swiss Franc saw outsized losses in the G10 FX space, seemingly reflecting their proximity to the crisis. The oil-sensitive Norwegian Krone held up a bit better. The Australian and New Zealand Dollars rose with broader commodity prices as the turmoil warns of shortages. Gold hit an 18-month high.

RUSSIA, UKRAINE TO RESUME TALKS AS MOSCOW LOOKS FOR LEVERAGE

Moscow‘s decision to broaden the assault in recent days – even braving a risky and globally-condemned shootout amid the capture of Ukraine’s largest nuclear power plant – may mark a final push to gain leverage after series of early setbacks and miscalculations. This is as biting sanctions speed up the clock to ceasefire negotiations.

As noted earlier, the terms of mutually acceptable disengagement may see Russia to pull back to its pre-war borders in exchange for Ukraine and Western powers agreeing to discuss the status of breakaway Luhansk and Donetsk regions in eastern Ukraine “later”, at least for now. Talks are due to resume today.

RUDE OIL TECHNICAL ANALYSIS

WTI crude oil prices gapped sharply higher after closing above long-standing resistance in the 107.68-114.83 area last week. The 78.6% Fibonacci extension at 121.65 is now being tested. Securing a firm foothold above this threshold may set the stage to challenge the 100% level at 137.77 next.

Reversing back below 114.83 may cool upward momentum to some extent but overtaking 107.68 on the downside seems like a prerequisite for substantive downside follow-through.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai on-site videos are here!

Let’s experience the excitement through the video!

WikiEXPO Dubai on-site videos are here!

WikiEXPO Dubai on-site videos are here!

WikiEXPO Dubai 2024

Come and experience it with us!

The WikiEXPO2024 Dubai After Party came to a successful end

Last night in Dubai, there was a financial party with big shots gathering and stars shining brightly.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator