简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Technical Analysis: Bull Control Strong

Abstract:The price of gold gained as investors weighed the impact of sanctions against Russia with Moscow's countermeasures in the wake of the invasion of Ukraine, which boosted demand for safe haven assets. The price of gold rose yesterday to the resistance level of 1950 dollars an ounce, starting from the support 1901 dollars in the same trading session, and it settled around the resistance level of 1940 dollars an ounce at the time of writing the analysis.

The price of gold gained as investors weighed the impact of sanctions against Russia with Moscow's countermeasures in the wake of the invasion of Ukraine, which boosted demand for safe haven assets. The price of gold rose yesterday to the resistance level of 1950 dollars an ounce, starting from the support 1901 dollars in the same trading session, and it settled around the resistance level of 1940 dollars an ounce at the time of writing the analysis

Bullion capped its biggest monthly advance since May as a raft of sanctions against Russia raised concerns about the impact on global growth and inflation. Disruptions in grain, energy and mineral supplies are adding to price pressures, as the Federal Reserve prepares to raise US interest rates.

Russian markets remain under enormous pressure after the United States and its allies moved to block the Russian Central Bank's access to its foreign reserves and isolated some lenders from the SWIFT messaging system for global banking. For his part, Russian President Vladimir Putin revealed his countermeasures by preventing the population from transferring hard currency abroad.

Commenting on the performance of the gold market. “The price of gold is somewhat stuck at the $1,900 level and that may continue until global growth concerns intensify,” said Edward Moya, chief market analyst at Oanda Corp. Gold will regain strength once inflationary pressures threaten growth prospects. And stagflation will be the key word being thrown that should eventually lead to safe haven flows into gold.

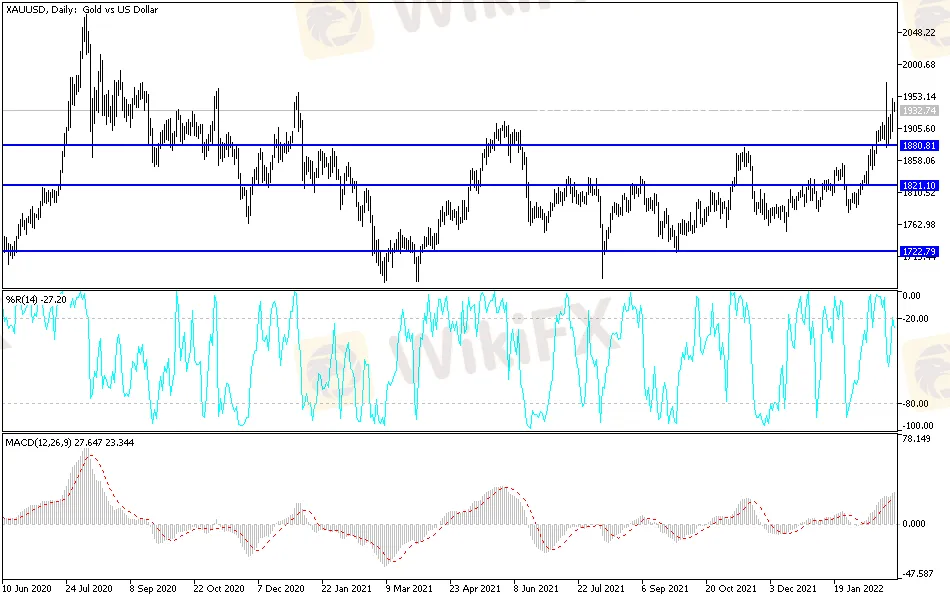

According to gold technical analysis: There is no change in my technical view of the future price of gold, as the general trend will remain bullish. Stability around and above the psychological resistance of 1900 dollars per ounce confirms a stronger control of the bulls on the trend. The continuation of the Russian war and its repercussions on the future of global economic growth and the future of tightening the policies of global central banks will remain strength factors for the gold market. It may be a strong opportunity to move towards stronger peaks and the closest to them currently 1955 and 1980 and the next historical peak of 2000 dollars an ounce.

I still prefer buying gold from every bearish level with the continuation of the current global anxiety, and the closest support levels for gold are currently 1910, 1885 and 1860 dollars, respectively. The price of gold will be affected today by the extent to which investors take risks or not, along with the price of the US dollar, in response to the testimony of Federal Reserve Governor Jerome Powell.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AI-Driven Fraud: Social Media Fraud Reportedly Soars 28%

HKEX to Open Riyadh Office in 2025, Strengthening Ties Between China and the Middle East

Hong Kong Exchange Pioneers Asia's First EU-Compliant Crypto Index

STARTRADER PRIME: Your Trusted Partner in Institutional Liquidity Solutions

J.P. Morgan Leads with Five Awards in Global $7.5 Trillion FX Market

DON’Ts DURING US Election 2024

Trump vs. Harris: Whose policies are Better for US stock investors?

Can Blockchain Technology Protect Your Money from Risk?

MyTrade Founder Guilty of Crypto Manipulation

Hong Kong Court Rules in Favor of Investors in JPEX Case

Currency Calculator