简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

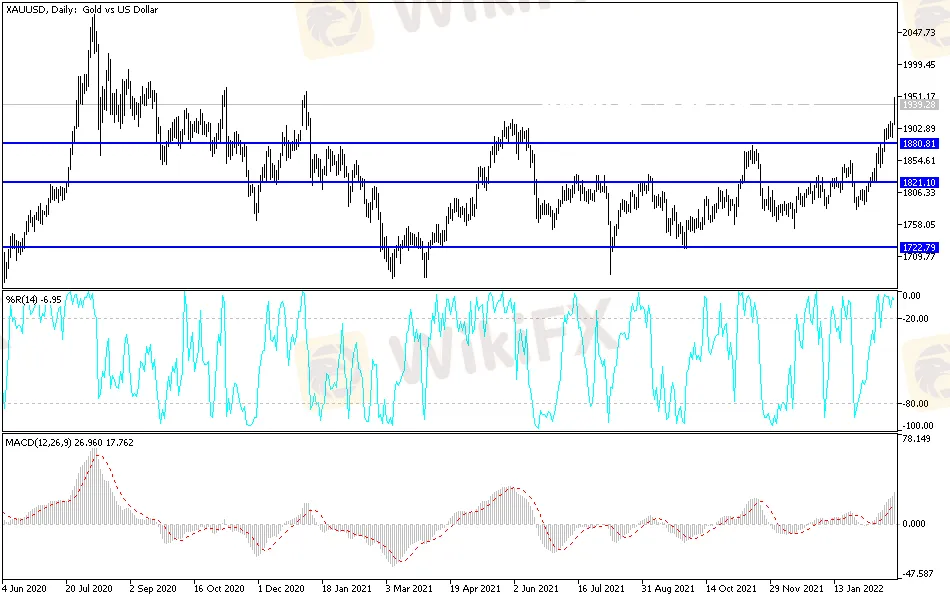

Gold Technical Analysis: Looking Past $2000

Abstract:All that we expected for the price of gold since approaching the psychological peak of 1900 dollars was achieved, as the price of gold moved today towards the resistance level of $1950. With Putin bent on invading Ukraine in stages and Russia's latest military measures, the price of gold fell $1,888 as investors evaluated the limited Western sanctions against Russia after it recognized the self-proclaimed separatist republics in eastern Ukraine.

All that we expected for the price of gold since approaching the psychological peak of 1900 dollars was achieved, as the price of gold moved today towards the resistance level of $1950. With Putin bent on invading Ukraine in stages and Russia's latest military measures, the price of gold fell $1,888 as investors evaluated the limited Western sanctions against Russia after it recognized the self-proclaimed separatist republics in eastern Ukraine.

Initial US sanctions targeted two Russian banks and three members of the Russian elite with close ties to the Kremlin, avoiding sweeping sanctions that would cut off the country's financial transactions from the global economy. European shares and US futures rose on Wednesday, in a sign that markets are expecting a sharper package.

For his part, Russian President Vladimir Putin said the crisis could be avoided if Ukraine accepted the demands, which include recognition of Russian sovereignty over Crimea and abandoning its bid to join NATO. Moscow has denied plans to invade Ukraine and Putin has said he has no plans to send troops - which he called “peacekeepers” - to the breakaway regions of eastern Ukraine.

Bullion is still trading near the highest level since June after recovering on the back of geopolitical tensions. It has attracted renewed interest from ETFs and Comex-traded hedge fund investors, who spent much of 2021 on the sidelines.

This is despite expectations that the Federal Reserve will start raising US interest rates in March to try to control the hottest inflation in decades. And tighter monetary policy should put pressure on gold - which carries no interest - even though the swap markets are already pricing it higher.

Commenting on the performance of the gold market. “Gold pricing indicates that financial markets and/or the real economy will roll once they start walking or the Fed will prove unwilling/unable to rein in high inflation,” analysts at Macquarie Group Ltd including Marcus Garvey wrote in a note. and “we struggle to believe that geopolitics alone explains how outperform it has been.”

Today, the price of oil and gold jumped after the TASS news agency reported that Russian President Vladimir Putin decided to conduct a special operation to “protect” the Donbass region. Accordingly, the price of Brent crude advanced 2.6% to $ 99.36 a barrel, while gold reached its highest level in more than a year with increased demand for safe haven assets.

According to the technical analysis of gold: With today's gains and the gold price reaching the resistance level of $1950, there has been talk about the historical psychological peak of $2000 again, and even went beyond that in the event of a Russian war with Ukraine. Everything is hinging on this crisis, and accordingly, the declines will remain an opportunity for gold investors to buy. The closest support levels for gold are currently $1920 and $1885.

Gold will be affected today by the level of the US dollar and the extent of risk appetite, as well as the reaction to developments in Europe and the announcement of the results of US economic data, GDP growth, jobless claims and US new home sales.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

Italian Regulator Warns Against 5 Websites

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

Currency Calculator