简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RBA Statement: Pushes back on market wagers for an early rate rise

Abstract:The Reserve bank of Australia left its cash rate at a record low of 0.1% on Tuesday and ended its A$275 billion ($194.40 billion) bond-buying campaign as expected.

However, traders were disappointed because the statement has pushed back on market wagers for an early rate rise.

The statement emphasised that ceasing bond purchases did “not imply” a near-term increase in interest rates and the Board was still prepared to be patient.

“As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range,” RBA Governor Philip Lowe said in a brief statement. “While inflation has picked up, it is too early to conclude that it is sustainably within the target band.”

Key points

Rba says it also decided to cease further purchases under the bond purchase program, with the final purchases to take place on 10 February.

RBA says committed to maintaining highly supportive monetary conditions.

RBA says the RBA's central forecast is for gdp growth of around 4¼ per cent over 2022 and 2 per cent over 2023.

RBA says will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

RBA says board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.

RBA says the central forecast is for the unemployment rate to fall to below 4 per cent later in the year and to be around 3¾ per cent at the end of 2023.

RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band

RBA says there are uncertainties about how persistent the pick-up in inflation will be as supply-side problems are resolved

RBA says likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target

RBA says ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates.

RBA says the board will consider the issue of the reinvestment of the proceeds of future bond maturities at its meeting in May.

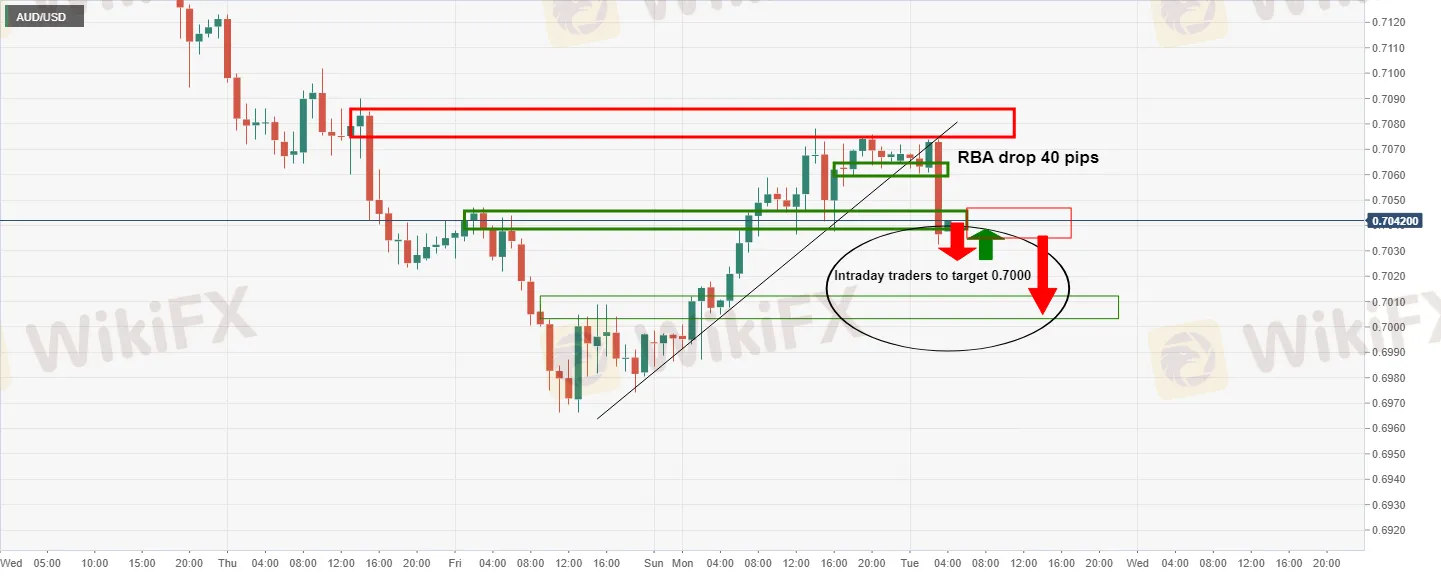

AUD/USD reaction

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator