简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

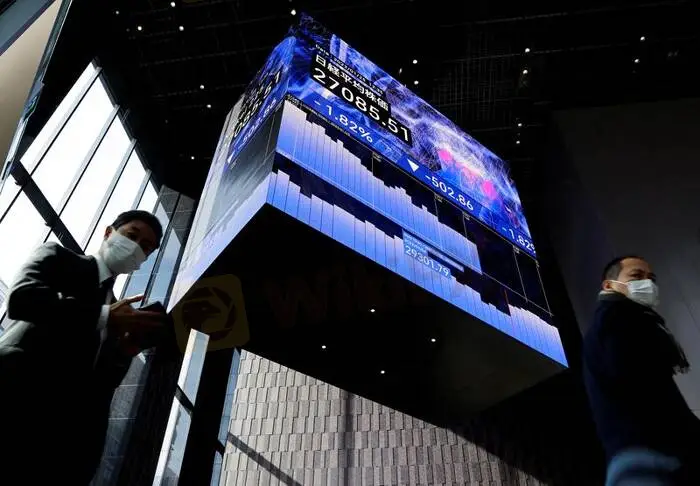

Asian stocks, U.S. futures regain footing after hawkish Fed

Abstract:Asian stocks recovered some of their steep losses from the previous session on Friday after U.S. markets limited further declines from hawkish U.S. Fed comments, supported by a firm economy and strong earnings at Apple Inc.

Asian stocks rebounded of Friday after steep losses in the previous session as strong U.S. economic growth and Apple Inc‘s impressive earnings offset some bearishness generated by the Federal Reserve’s hawkish comments.

U.S. stock futures rose in Asia trade with Nasdaq futures up 0.77% and S&P 500 e-minis up 0.48% after Apple on Thursday reported record sales in the holiday quarter. Apple shares rose over 5% in after-hours trading.

In early European trade, the pan-region Euro Stoxx 50 futures were up 0.14% and FTSE futures were up 0.34%.

MSCIs broadest index of Asia-Pacific shares outside Japan was up 0.4% after sliding 2.26% on Thursday. The index is still down 5.1% so far this month.

Japan‘s Nikkei stock index rose 2.25% on Friday, recovering after a 14-week closing low. Fuji Electric surged 9.68% to become the Nikkei’s biggest percentage gainer, after posting strong earnings late on Thursday. Australian shares were up 2.19%.

“After big sell-off earlier this week amid a hawkish stance by the Fed, we are seeing several markets in Asia recover from some of the heavy losses today,” said Zhang Zihua, chief investment officer at Beijing Yunyi Asset Management.

Elsewhere in Asia, China stocks inched higher on Friday, after state-backed newspapers and fund houses tried to boost sentiment ahead of next weeks Lunar New Year holiday.

Benchmark Shanghai Composite Index gained 0.43% while Shenzhen SE Composite Index advanced 0.97%.

“In China, the market sentiment has also been bolstered by robust profit forecast of battery maker CATL,” Zhang added.

Shares of Shenzhen-listed Contemporary Amperex Technology Co Ltd (CATL), the worlds largest EV battery manufacturer, jumped more than 4% after the company expected its 2021 net profits to rise more than 150% from one year earlier.

Hong Kong‘s Hang Seng index however dropped 0.71%, dragged by the city’s tech index and finance index which retreated 0.71% and 0.94%, respectively.

Overnight, Wall Street retreated after a solid opening, as investors juggled positive economic news with mixed corporate earnings, geopolitical tensions and the prospect of rising U.S. interest rates.

U.S. markets had opened higher after the Commerce Departments advance take on fourth-quarter GDP showed the U.S. economy grew 6.9% in 2021, its fastest pace in nearly four decades.

However, gains were pared with all three major U.S. stock indexes ending lower, as investors processed how strong economic growth might inform the Feds thinking.

In its latest policy update on Wednesday, the Fed indicated it was likely to raise rates in March, as widely expected, and reaffirmed plans to end its pandemic-era bond purchases that month before launching a significant reduction in its asset holdings.

The prospect of faster or larger U.S. interest rate hikes helped push the dollar to its best week in seven months. The dollar rose 0.08% against the yen to 115.43, closing in on its high this year of 116.34 on Jan. 4.

The yield on benchmark 10-year Treasury notes rose to 1.8212% compared with its U.S. close of 1.808% on Thursday. The two-year yield, which rises with traders expectations of higher Fed fund rates, touched 1.1902% compared with a U.S. close of 1.192%.

U.S. crude ticked up 0.52% to $87.06 a barrel. Brent crude rose to $89.7 per barrel.

Rising tension between Russia and Ukraine had pushed oil prices to seven-year highs earlier in the week.

Gold was slightly higher. Spot gold was traded at $1,797.65 per ounce. [GOL/]

(Reporting by Julie Zhu; Editing by Richard Pullin)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator