简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

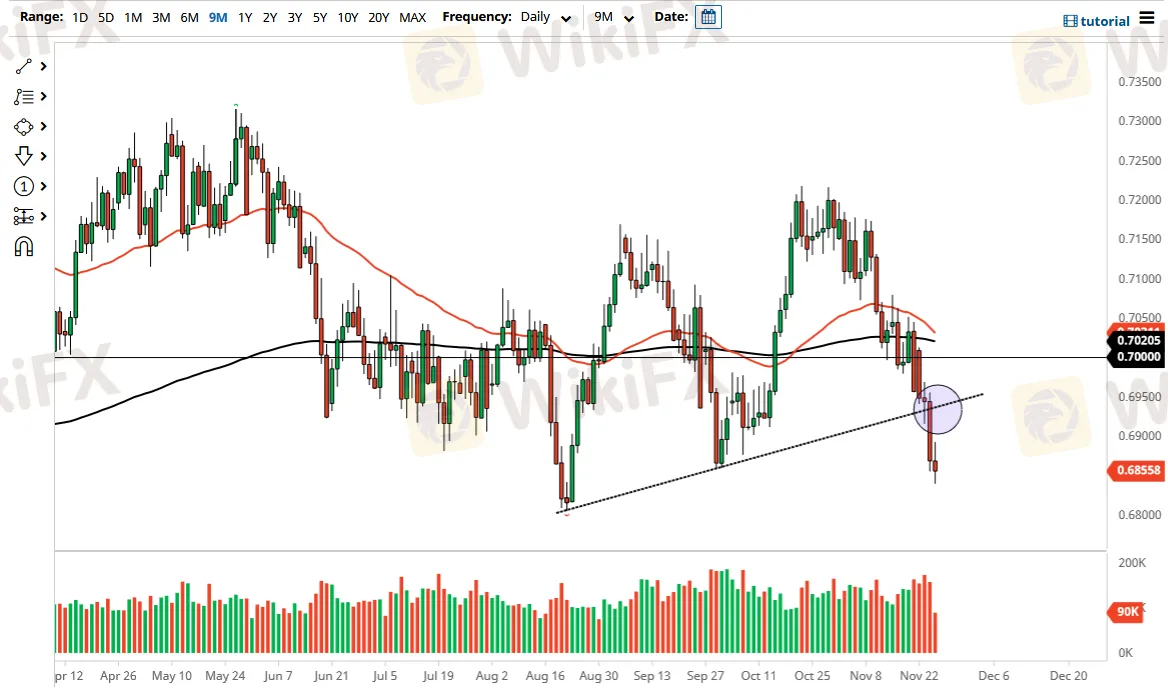

NZD/USD Forecast: Kiwi Makes Fresh New Low Against USD

Abstract:The New Zealand dollar has gone back and forth during the Thursday session, but it should be noted that it was Thanksgiving, meaning that the liquidity coming out of North America would have been almost nonexistent. It is worth noting that the Wednesday candlestick was actually horrible for the New Zealand dollar, and during the day on Thursday we had continued this overall downward pressure, making a “lower low” than what had been made back on September 29. This of course is a very negative sign, and of course it is worth noting that the Wednesday session had featured a major breakdown through an uptrend line.

The New Zealand dollar has gone back and forth during the Thursday session, but it should be noted that it was Thanksgiving, meaning that the liquidity coming out of North America would have been almost nonexistent. It is worth noting that the Wednesday candlestick was actually horrible for the New Zealand dollar, and during the day on Thursday we had continued this overall downward pressure, making a “lower low” than what had been made back on September 29. This of course is a very negative sign, and of course it is worth noting that the Wednesday session had featured a major breakdown through an uptrend line.

At this point, the neutral candlestick does suggest that we could get a little bit of a bounce, but that bounce will probably be sold into, and I certainly would do so at the first signs of exhaustion. After all, the US dollar continues to be the favored currency for traders around the world. Interest rates in America continue to rally, so it does make a certain amount of sense that we would see the Kiwi dollar fall against it. Everything has been falling against the dollar so it makes quite a bit of sense that this market would be no different.

When we get back to work on Friday, I would anticipate somewhere near the 0.6950 level there will be a bit of a “ceiling in the market”, and therefore break above there would be a bit surprising. We are also getting ready to form the so-called “death cross”, when the 50 day EMA starts to break down below the 200 day EMA. Obviously, that is something that attracts a lot of longer-term traders, but it is already negative enough to get me looking for shorting opportunities anyway. Furthermore, the global growth concerns continue to weigh upon commodity currencies in general, especially the ones that are exposed to Asia like the New Zealand dollar and the Australian dollar. Because of this, I think it is only a matter of time before we plunge even lower, perhaps revisiting the 0.68 level, an area that has been important more than once. That area has a lot of historical magnetism built in, so I fully anticipate a revisit to that area over the longer term.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Broker Review: Is FOREX.com a solid Broker?

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Pros & Cons of Automated Forex Trading

Magic Compass Sponsors World Taekwondo Poomsae Championships 2024

Trump tariffs: President-elect is serious but it\s not about trade

Currency Calculator