简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

LIVE MARKETS Lockdown trading

Abstract:Markets have suddenly woken up to COVID-19 risks

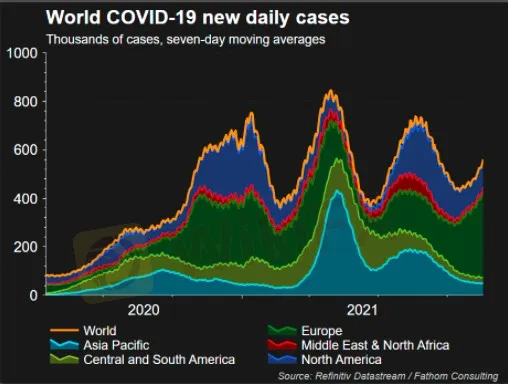

Markets have suddenly woken up to COVID-19 risks, and after Austria imposed 10-days of nationwide restrictions to fight the winter virus wave, investors swiftly shifted to lockdown trading mode.

Oil hit 7-week lows in Asia hours, and equities in Europe look set for a muted start after clocking on Friday their first weekly decline in seven weeks, as bond yields and banking stocks tanked. The euro is also under pressure at 16-month lows.

Concerns are that Germany and other countries could follow suit, forcing million of people to stay at home, hitting tourism-dependent economies and outdoor businesses just before key Christmas holidays and spending.

Little wonder then that Italian and Spanish stocks look particularly vulnerable at this stage, while Big Tech and online economy names are once again in favour, sending Nasdaq futures to new record highs overnight.

Shares in vaccine makers meantime could also benefit. German politicians are debating making COVID-19 vaccinations compulsory, and other countries are also pondering what to do with the unvaccinated.

On the corporate front, eyes are on Telecom Italia after KKR made a $12 billion approach to take the Italian phone group private. Ericsson is also on the watch-list after the equipment maker agreed to buy cloud communications firm Vonage for $6.2 billion.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Wall Street Rally on Soft CPI

The most anticipated economic indicator of the week, the U.S. Consumer Price Index (CPI), was released yesterday, coming in at 2.9%, below the 3% threshold and in line with the Producer Price Index (PPI) data from the previous day. This further sign of easing inflationary pressure in the U.S. has heightened expectations that the Federal Reserve may implement its first rate cut in September.

Wall Street Advances Ahead of CPI

The equity markets continued their upward momentum, driven by the easing of the Japanese Yen's strength. The Yen was pressured by a dovish tone from Japanese authorities, signalling that the Bank of Japan (BoJ) might keep its monetary policy unchanged amid rising global economic uncertainties.

Nasdaq Bullish, Encourage by Upbeat U.S. Job Data

The financial markets reacted positively to the upbeat Initial Jobless Claims data released yesterday, which came in at 233k, lower than market expectations. This eased concerns about a weakening labour market and the heightened recession risks that emerged after last Friday's disappointing NFP report. Wall Street benefited from the improved risk appetite, with the Nasdaq leading gains, surging by over 400 points in the last session.

Japanese Yen Eases on BoJ Dovish Statement

The Japanese Yen eased on Wednesday morning after the BoJ Deputy Governor indicated that the Japanese central bank would not raise interest rates if global markets remained unstable. This statement has calmed the market and unwound concerns about Yen carry trades. Meanwhile, the dollar has regained strength, with the dollar index (DXY) climbing above the $103 mark.

WikiFX Broker

Latest News

ASIC Sues HSBC Australia Over $23M Scam Failures

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

Understanding the Impact of Interest Rate Changes on Forex Markets

FCA Seeks Input to Shape UK Crypto Market Regulations

Broker Review: Is Eightcap Legit?

Currency Calculator