简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

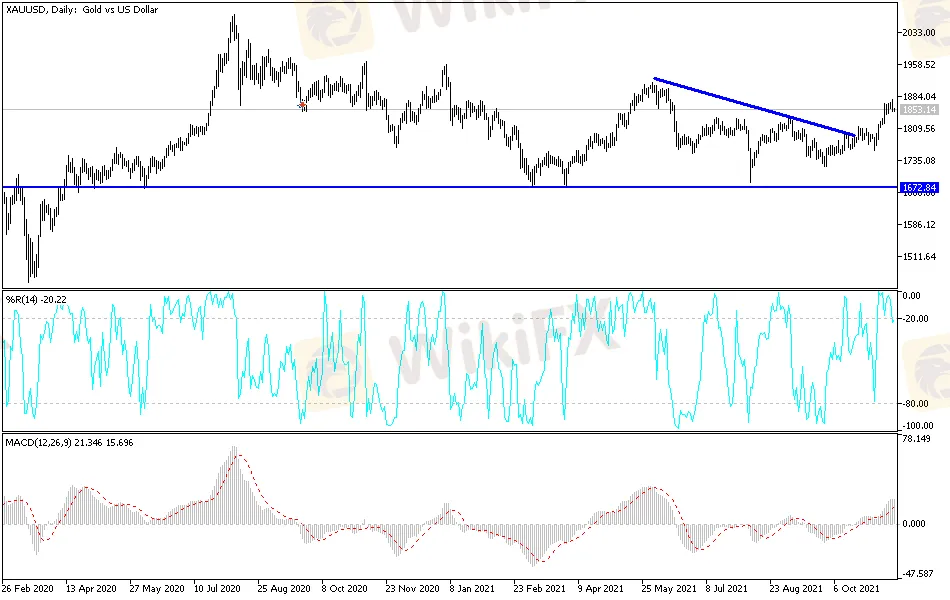

Gold Technical Analysis: Starting to Sell Off

Abstract:It had been previously predicted that the resistance levels of $1878 and $1900 may lead the technical indicators towards strong overbought levels, which may lead to profit-taking. Indeed, gold declined from the resistance level of $1878 yesterday, its highest in five months, before it reached the $1849 support and settled around the $1857 level as of this writing. What helped the sell-off was the strength of the US dollar, after the US retail sales numbers were stronger than all expectations, which were in favor of the approaching date of raising US interest rates.

It had been previously predicted that the resistance levels of $1878 and $1900 may lead the technical indicators towards strong overbought levels, which may lead to profit-taking. Indeed, gold declined from the resistance level of $1878 yesterday, its highest in five months, before it reached the $1849 support and settled around the $1857 level as of this writing. What helped the sell-off was the strength of the US dollar, after the US retail sales numbers were stronger than all expectations, which were in favor of the approaching date of raising US interest rates.

On the economic side, according to a report by the Commerce Department, US retail sales rose 1.7% in October after rising by an upwardly revised 0.8% in September. Economists had expected US retail sales to jump 1.4%, compared to a 0.7% increase originally recorded for the previous month.

However, analysts noted that the strong growth in retail sales during the month was largely due to inflation, as retail sales were reported in nominal dollars.

Elsewhere, the Federal Reserve released a report showing that US industrial production rebounded more than expected in October. The report showed industrial production rising 1.6% in October after declining 1.3% in September. Economists had expected industrial production to increase 0.7%.

A separate report from the National Association of Home Builders (NAHB) showed an unexpected improvement in the confidence of homebuilders in the US in November. The report showed the NAHB/Wells Fargo Housing Market Index rose for the third consecutive month, rising to a reading of 83 in November from a reading of 80 in October. The increase surprised economists, who expected the index to remain unchanged.

Investors also reacted strongly to Richmond Fed President Thomas Barkin's comments that while the Fed will not hesitate to raise interest rates, the central bank should wait to see if inflation and labor shortages last longer.

Technical Analysis

Despite the recent profit-taking, the general trend of gold is still bullish, which will not change without a break down to the support levels of $1820 and $1800. On the other hand, the bulls' return to the vicinity of the resistance of $1875 will stimulate the trend to move towards the psychological resistance of $1900 again, and as I indicated earlier, the technical indicators may move towards strong overbought levels. I still caution that profit-taking will happen if the tone of all global central banks remains in favor of tightening policy and raising interest rates.

The price of gold will be affected today by risk sentiment, the level of the US dollar and the reaction to the announcement of inflation figures from Britain, the Eurozone, Canada and US housing numbers. And do not forget more statements by US monetary policy officials.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

MTrading’s 2025 "Welcome Bonus" is Here

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator