简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bitcoin Rises Again as Altcoins Outperform

Abstract:Bitcoin is recovering from a weekend dip as traders anticipate the third U.S. futures-focused bitcoin exchange-traded fund (ETF) listing.

Bitcoin is recovering from a weekend dip as traders anticipate the third U.S. futures-focused bitcoin exchange-traded fund (ETF) listing. The VanEck Bitcoin Futures ETF is expected to launch on Tuesday and will trade under the ticker symbol XBTF. Analysts continue to expect further upside in bitcoins price given strong investor sentiment on ETF approvals.

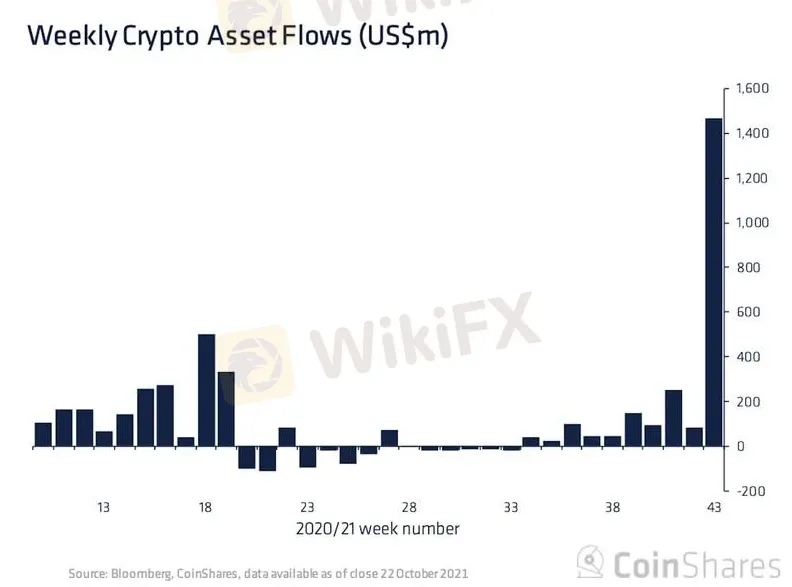

Last week, crypto investment funds saw a record $1.47 billion in inflows as investors positioned themselves ahead of the first U.S. bitcoin-linked ETF launch, by ProShares. Alternative cryptocurrency-focused funds also saw inflows, which coincided with a near 30% rise in Solanas SOL token over the past week.

Analysts are also monitoring the recent rotation to alternative coins (altcoins), which are starting to outperform bitcoin. “The crypto market is turning from being dominated by short-term traders who want to ride the speculative trends to longer-term investors who value the technical capabilities of the different blockchains, challenging bitcoins market dominance,” Anders Nysteen, quantitative analyst at Saxo Bank, wrote in a research report.

Latest prices

Bitcoin (BTC): $62,813.67, +3.3%

Ether (ETH): $4,191.45, +3.53%

S&P 500: $4,566.48, +0.47%

Gold: $1,806.85, +0.69%

10-year Treasury yield closed at 1.64%

Record $1.5 billion crypto fund inflows

Investors pumped a record $1.47 billion in new money into digital asset investment products last week, fueled by a rally in cryptocurrencies and the launch of the ProShares bitcoin futures exchange-traded fund, according to a CoinShares report Monday.

Bitcoin-focused funds dominated last week‘s inflows, at 99%. During the prior week, inflows into bitcoin-focused funds were at $70 million, CoinDesk’s Lyllah Ledesma reported.

Bitcoin dominance declines

The bitcoin dominance ratio, or the measure of bitcoins market capitalization relative to the total crypto market, declined last week to 45%. The decline in the dominance ratio was due to the recent outperformance of several altcoins such as ETH and SOL.

Some traders are starting to rotate into altcoins, which suggests a greater appetite for risk. “Overall, we are structurally long BTC, ETH and most layer 1s such as ALGO and SOL,” crypto trading firm QCP Capital wrote in a Telegram chat.

But is the rotation to altcoins sustainable?

The chart below shows the bitcoin dominance ratio, which increased from a recent low of 40% in mid-September. A similar situation occurred in 2018 before the start of a crypto bear market. At that time, the bitcoin dominance ratio rose as investors reduced their exposure to altcoins and sought relative safety in bitcoin.

Currently, the bitcoin dominance ratio is declining from a high of 48% in July, which was when crypto prices stabilized from a correction earlier this year. Similar to February-March 2018, traders are returning to buy the dip in altcoins that have lagged behind a sharp recovery in bitcoin over the past month. For now, some analysts expect altcoins to take the lead, because cryptocurrencies typically produce positive returns during the fourth quarter.

Altcoin roundup

Shiba Inu hits record high: Shiba Inu (SHIB) tapped lifetime highs on Sunday, trading at $0.0000455 at 11:20 UTC, topping the previous record reached on May 10, CoinDesk‘s Omkar Godbole reported. Prices for the meme token have risen by nearly 50% in the past 24 hours, with a month-to-date gain of almost 500%. SHIB’s latest rise comes amid rumors that Robinhood may soon list the cryptocurrency on its platform.

Solana also hit a new record high: Prices for Solana‘s SOL tokens hit a record high on early Monday as a majority of tokens representing layer 1 blockchains followed bitcoin, CoinDesk’s Muyao Shen reported. The token, which is backed by FTX crypto exchange founder Sam Bankman-Fried, traded at $218.9 on Monday. According to decentralized finance data provider Defi Llama, the total value locked in Solana reached an all-time high of approximately $13.91 billion.

Ether hit all-time high last week while seeing continued outflows: Ether (ETH), the native cryptocurrency of the Ethereum blockchain, hit a record high on Oct. 21 at $4,361, CoinDesk‘s Lyllah Ledesma reported. However, despite the price increase, funds focused on the world’s second-largest cryptocurrency by market capitalization saw outflows for a third consecutive week, totaling $1.4 million last week. Other altcoins, including SOL, Cardanos ADA currency and Binance coin (BNB), all saw inflows.

Stay tuned on WikiFX for more updates! Now you can review more than 30,000 Forex & CFDs brokers with just one click, quickly and easily!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bitcoin and Ethereum See Strong Recovery

BTC crossed $57,000 while Ethereum jumped by more than 7%.

Crypto startup MoonPay raises $555M to hit $3.4B valuation

Launched in 2019, MoonPay says it has processed more than $2 billion in transactions and hit 7 million users so far.

Bitcoin Price Prediction

Can Bitcoin reach $100,000?

Is Bitcoin’s bull run really over?

The constant volatility of the Bitcoin market has forced analysts to repeatedly change their lens from bearish to bullish and vice versa.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator