简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Markets Week Ahead

Abstract:Dow Jones, US Dollar, Yen, Crude Oil, Bitcoin Nears Record High, China GDP

Global market sentiment remained rosy this past week. On Wall Street, the Dow Jones, S&P 500 and Nasdaq Composite climbed about 1.5%, 1.7% and 2.1% respectively. European equities also shined, with the FTSE 100 and DAX closing 2.69% and 1.95% respectively. In Asia, the Hang Seng outperformed, rising 5.69%. Japans Nikkei 225 increased 3.64%.

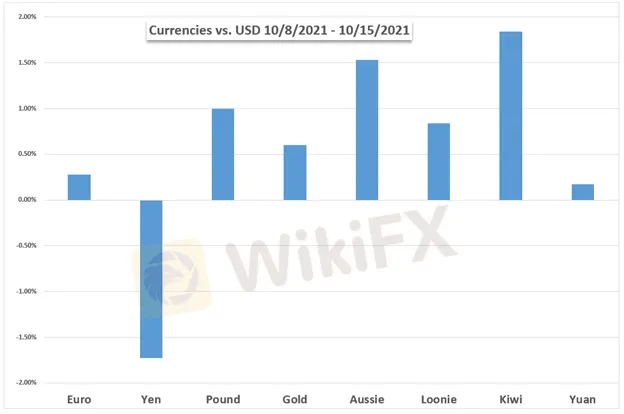

With the cheery mood, haven-linked currencies underperformed. These included the US Dollar and Japanese Yen. Rising Treasury yields meant that USD/JPY touched its highest since late 2018. The sentiment-linked Australian and New Zealand Dollars shined. Taking a look at commodities, crude oil prices continued gaining, with WTI prices touching the highest since October 2014.

The surge in oil continues to reflect a global supply crunch. China has resorted to releasing Australian coal from storage after an unofficial ban on imports amid geopolitical tensions. Meanwhile, solid corporate earnings thus far have likely been bolstering sentiment. The US announced it will open international travel for vaccinated people on November 8th.

Front-end bond yields are on the rise, especially in the United States. FOMC minutes and CPI data this past week highlighted rising shelter costs, which could remain sticky amid supply shortages with elevated construction and labor costs. Data on this front will cross the wires this week. Rising returns on safer bond yields may continue slowly undermining riskier assets like stocks.

The week starts off with New Zealand CPI data and Chinese third-quarter GDP. Given that the RBNZ is probably the most hawkish developed central bank, NZD/USD could see some volatility. Being the worlds second-largest economy, a slowdown in China risks reverberating outwards, especially following issues in its real estate market. Bitcoin nears its record high after the SEC paved a path for futures trading of the cryptocurrency. What else is in store for markets ahead?

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD

FUNDAMENTAL FORECASTS:

Euro (EUR) Price Forecast: More Falls Ahead for EUR/GBP, EUR/AUD, EUR/CAD

Relative stability in EUR/USD has masked weakness in the Euro against most other major currencies, and that weakness can be expected to persist in the week ahead and likely for longer.

Australian Dollar Outlook: AUD/USD Back on the Offensive as Covid Restrictions Ease

The Australian Dollar is seemingly back on the offensive as lockdowns ease in Sydney and Melbourne. Improving sentiment may allow AUD/USD to capitalize on rising equities and commodity prices.

Bitcoin (BTC/USD) Surges Back to Multi-Month Highs on Renewed ETF Chatter

Bitcoin broke above $60k earlier in the session to a fresh multi-month high on the renewed expectation that the SEC will approve a futures-based Bitcoin ETF very soon.

US Dollar Outlook: USD Upside Stalling, Risk of Larger Setback

US Dollar losing its appear demand picks up for major counterparts. Risk of larger setback as risk appetite stabilises.

Gold Fundamental Forecast: Yield Curve Key to Bullion Prices as Q3 China GDP Nears

Gold prices moved higher last week, but an upbeat US retail sales report underpinned Treasury yields on Friday, which weighed on bullion. Chinese Q3 GDP is in focus for XAU traders.

GBP/USD Rate Rally Susceptible to Slowdown in UK CPI

The update to the UK Consumer Price Index (CPI) may undermine the recent rally in GBP/USD as the report is anticipated to show a slowdown in the core rate of inflation.

S&P 500 & Nasdaq 100 Forecast: Netflix & Tesla Earnings to Set the Tone for the Market

Quarterly earnings from Netflix and Tesla, two big tech companies, will take center stage next week and could set the trading tone for the S&P 500 and the Nasdaq 100.

TECHNICAL FORECASTS:

Japanese Yen Forecasts for the Week Ahead - USD/JPY, GBP/JPY, EUR/JPY

The Japanese Yen continues to be pummeled against most major currencies.

Canadian Dollar (CAD) Technical Forecast: USD/CAD and CAD/JPY Setups

This weekly forecast delves into ‘strong vs weak’ currency analysis as we compare the high-flying CAD to the weaker US dollar and Yen

Gold Price Forecast: Gold Coils at Support- XAU/USD Breakout Imminent

Gold prices are poised for a breakout in the days ahead as XAU/USD contracts into longer-term uptrend support. The levels that matter on the gold weekly technical chart.

Dow Jones, Nasdaq 100, S&P 500 Forecasts for Next Week

Stocks looked poised to rally with risk sentiment generally strong and technical signposts supportive of higher levels.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic Indicators to Watch

Market Review | August 30, 2024

Insights into Today's Markets

Market Review | August 29, 2024

Financial Forecast Today

Market Overview | August 22, 2024

Today's Market News

Market Review | August 21, 2024

WikiFX Broker

Latest News

Trading is an Endless Journey

Japan to Take Action to Stabilize the Yen

Ringgit Remains Flat Amid Holidays, US Debt Concerns Loom

Taurex: Is it Safe to Invest?

Malaysia’s Securities Commission Enforces Ban on Bybit & Its CEO

New Zealand's FMA Warns Against "YouTube Crypto Investment Scam"

Will Inflation Slow Down in the New Year 2025?

The WikiFX 2024 Annual User Report is here! Come and claim your exclusive identity!

SCAM ON SCAM: New Tactic Used by Scammers

Crypto Fraud: MBBS Student Linked to Rs.8 Lakh Scam

Currency Calculator