简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IQ Option-Some Detailed Information about This Broker

Abstract:IQ Option is an online trading platform that allows individuals to trade a variety of financial instruments including stocks, options, cryptocurrencies, forex, and more. The platform was founded in 2013 and has grown to become one of the most popular online trading platforms in the world, with over 48 million registered users across 213 countries and territories. IQ Option is owned and operated by IQ Option Ltd, which is based in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

| IQ Option | Basic Information |

| Founded in | 2013 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:500 |

| Trading Instruments | Forex, Stocks, Cryptocurrencies, Commodities, ETFs |

| Trading Platforms | IQ Option Desktop, IQ Option Mobile App |

| Account Types | Standard, VIP |

| Deposits | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, WebMoney, Boleto |

| Withdrawals | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, WebMoney |

| Customer Support | Email, Phone, Live Chat |

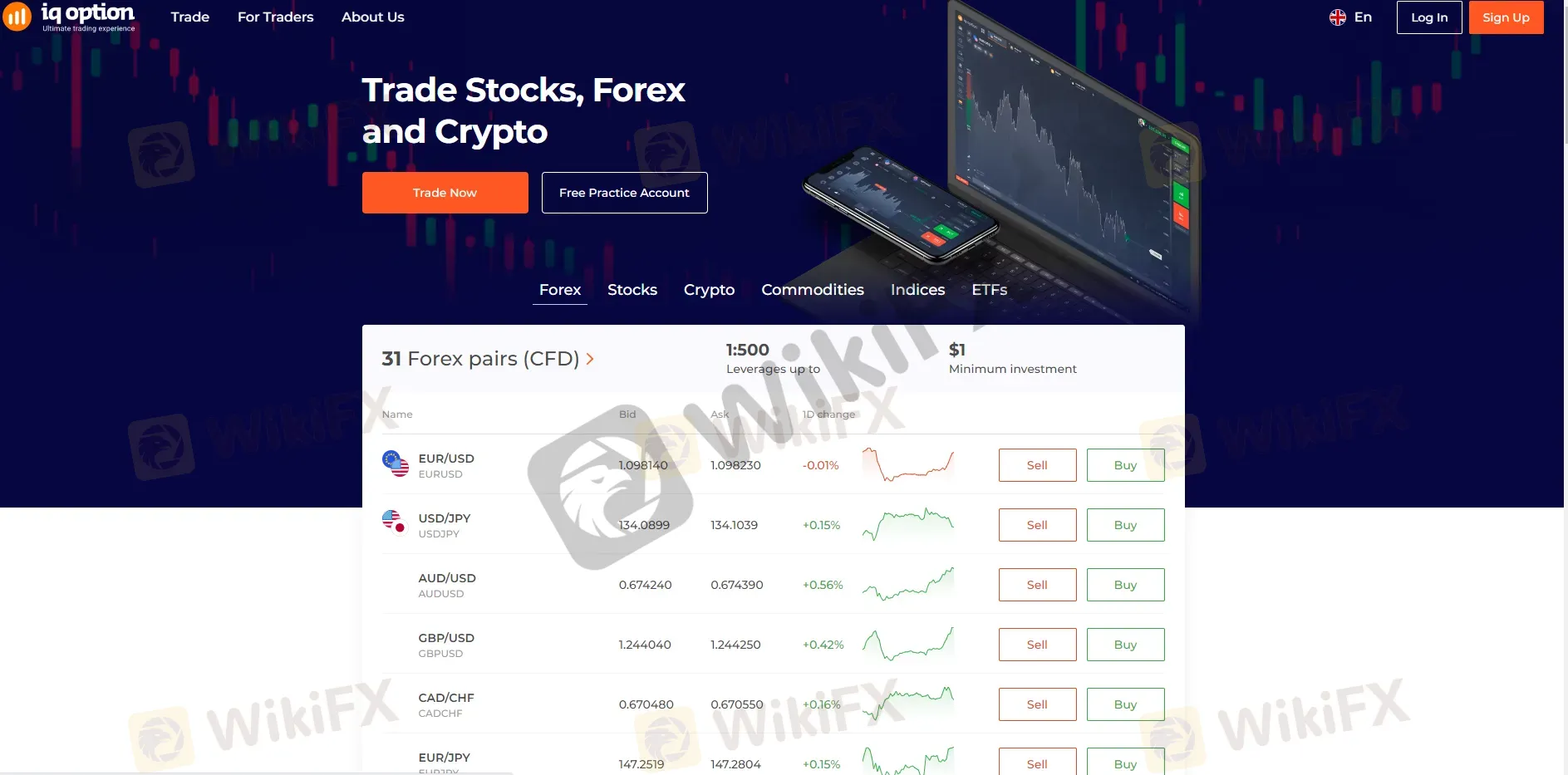

Overview of IQ Option

IQ Option is an online trading platform that allows individuals to trade a variety of financial instruments including stocks, options, cryptocurrencies, forex, and more. The platform was founded in 2013 and has grown to become one of the most popular online trading platforms in the world, with over 48 million registered users across 213 countries and territories. IQ Option is owned and operated by IQ Option Ltd, which is based in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

The platform is known for its user-friendly interface, extensive educational resources, and low entry barriers for new traders. It offers a range of trading tools and features, including customizable charts, technical analysis indicators, and a range of order types, such as stop-loss and take-profit orders. Additionally, IQ Option offers a range of account types, including a free demo account for practice trading, as well as real accounts with different features and benefits.

However, IQ Option has also received some complaints from customers regarding issues such as slow withdrawal processing times and account verification delays. It is important for traders to weigh the pros and cons of using IQ Option and to exercise caution when making financial decisions.

Is IQ Option legit or a scam?

IQ Option is a legitimate online trading platform that has been operating since 2013. It is regulated by the Cyprus Securities and Exchange Commission (CySEC) under the regulatory license number of 247/14. However, it is important to note that there have been some complaints and negative reviews about the platform, particularly regarding withdrawal issues and customer support. It is always recommended to do your own research and due diligence before investing with any broker.

Pros and Cons of IQ Option

While the broker offers a regulated and user-friendly trading platform with low minimum deposits and a free demo account, it may not be suitable for traders who require a larger range of tradeable assets or support for specific payment methods. Additionally, some traders have experienced issues with withdrawal processing times and customer service, which may be a concern for those who prioritize timely and reliable support from their broker.

| Pros | Cons |

| Regulated by CySEC | Limited range of tradeable assets compared to other brokers |

| Intuitive and user-friendly trading platform, suitable for both beginners and advanced traders | No support for MetaTrader 4 or 5, which may be a deal-breaker for some traders |

| Low minimum deposit requirement of $10, making it accessible to all traders | High fees for bank transfers and withdrawals |

| Offers a free demo account with $10,000 in virtual funds for traders to practice and test strategies before trading with real money | Limited customer support options outside of business hours |

| Wide range of educational resources, including video tutorials, articles, and a blog | Some negative reviews and complaints from traders regarding slow withdrawal processing times and customer service |

| Multiple account types to suit different trading styles and preferences | No support for popular payment methods such as PayPal and Skrill |

Market Instruments

IQ Option offers a wide range of market instruments for trading including forex, stocks, cryptocurrencies, commodities, and ETFs. Forex trading includes major currency pairs, minor pairs, and exotic pairs such as USD/CNY, USD/INR, and USD/ZAR. Stocks trading includes a variety of popular companies such as Apple, Facebook, and Amazon. Cryptocurrency trading includes popular digital assets such as Bitcoin, Ethereum, and Litecoin. Commodities trading includes oil, gold, silver, and other metals. ETF trading includes various exchange-traded funds that track different markets such as the S&P 500, the Dow Jones, and the Nasdaq.

| Pros | Cons |

| Wide range of instruments including stocks, forex, commodities, cryptocurrencies, and options | Limited selection of underlying assets |

| Availability of digital options and CFDs | Limited availability of traditional options |

| ETFs available | High rollover fees for overnight positions |

| Advanced charting and technical analysis tools | Limited fundamental analysis tools |

| Accessible trading through web and mobile platforms | No access to futures markets |

| High leverage options up to 1:500 | High risk of loss due to high leverage |

Account Types

IQ Option offers three main account types: the demo account, the standard account, and the VIP account.

Demo Account: This account is free to use and provides access to all the trading features on the platform. It is an excellent option for beginners who want to practice trading strategies without risking any real money.

Standard Account: This account requires a minimum deposit of $10 and offers a range of features including access to all tradable assets, 24/7 customer support, and the ability to participate in trading competitions. The standard account also offers access to training materials and webinars.

VIP Account: The VIP account requires a minimum deposit of $3,000 and offers all the features of the standard account, as well as additional perks such as a personal account manager, monthly trading reports, and exclusive access to certain trading instruments.

Each account type comes with its own benefits and drawbacks, and traders should carefully consider their trading goals and preferences before selecting an account type.

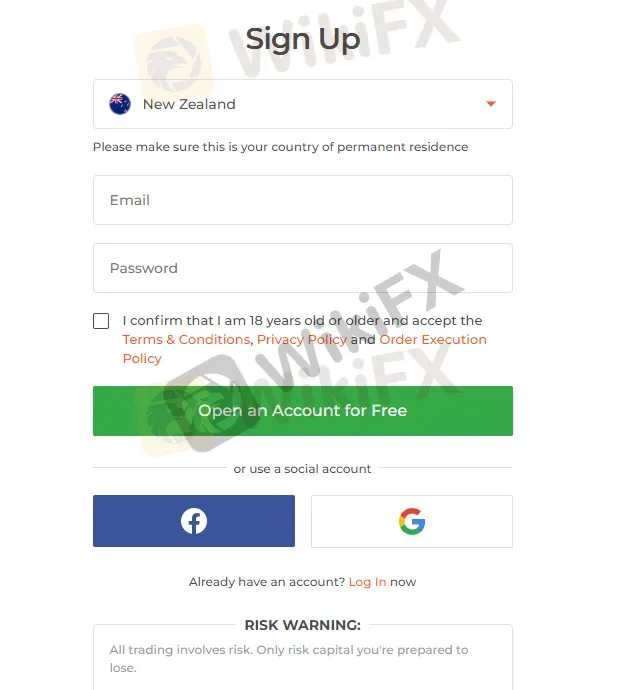

How to open an account?

Opening an account with IQ Option is a breeze. Simply go to their website and click on the “Trade Now” button. You can then choose between a real account, where you can start trading with as little as $10, or a demo account, which is a risk-free way to practice your trading skills.

To sign up for a real account, you'll need to provide some personal information, including your name, email address, and phone number. You'll also need to select your preferred currency and choose a password for your account. Once you've filled in all the required fields, click on the “Register” button and you're good to go.

But before you can start trading, you'll need to verify your identity by submitting some documents, such as a copy of your passport or driver's license, and proof of address. This is a standard procedure for all regulated brokers and is designed to prevent fraud and ensure the safety of your funds. Once your account has been verified, you can make your first deposit and start trading right away.

Leverage

IQ Option offers variable leverage depending on the asset being traded and the account type. The maximum leverage offered by IQ Option is 1:500 for non-regulated clients and 1:30 for regulated clients. The leverage for Forex trading is also subject to regulation in certain regions. It is important to note that while high leverage can increase potential profits, it can also increase the risk of losses, so it is crucial to use it wisely and only if you have a thorough understanding of the risks involved. It is always recommended to start trading with lower leverage and gradually increase it as you gain more experience and confidence.

Spreads & Commissions (Trading Fees)

IQ Option operates on a commission-free trading model, meaning that the broker does not charge any fees for opening or closing trades. Instead, the broker earns its revenue through the spreads, which is the difference between the buy and sell price of a financial instrument.

The spreads on IQ Option vary depending on the type of asset and market conditions, with major currency pairs like EUR/USD typically having low spreads starting from as low as 0.6 pips. However, spreads for other instruments like stocks and commodities tend to be higher.

Non-Trading Fees

In addition to trading fees, IQ Option also charges non-trading fees. Non-trading fees are fees that are not directly related to trading activities. For example, deposit and withdrawal fees, account inactivity fees, and currency conversion fees.

IQ Option does not charge any deposit or withdrawal fees, except for wire transfer withdrawals, which incur a fee of $31. In terms of account inactivity fees, IQ Option charges an inactivity fee of $10 per month after 90 days of inactivity. This fee is relatively high compared to other brokers. Finally, IQ Option may charge currency conversion fees if you deposit or withdraw funds in a different currency from your account's base currency. The fee is usually around 2% to 3% of the total transaction amount.

Trading Platform

IQ Option offers its propritary trading platform, which is available both as a web-based version and a mobile app, making it accessible to traders on-the-go. The platform offers a range of trading tools, such as technical analysis tools, historical quotes, and real-time market news, enabling traders to make informed decisions. It also offers a demo account option, which is beneficial for new traders who want to practice trading without risking any real money. Additionally, the platform is customizable, allowing users to adjust the layout to their preferences and choose from a range of different chart types.

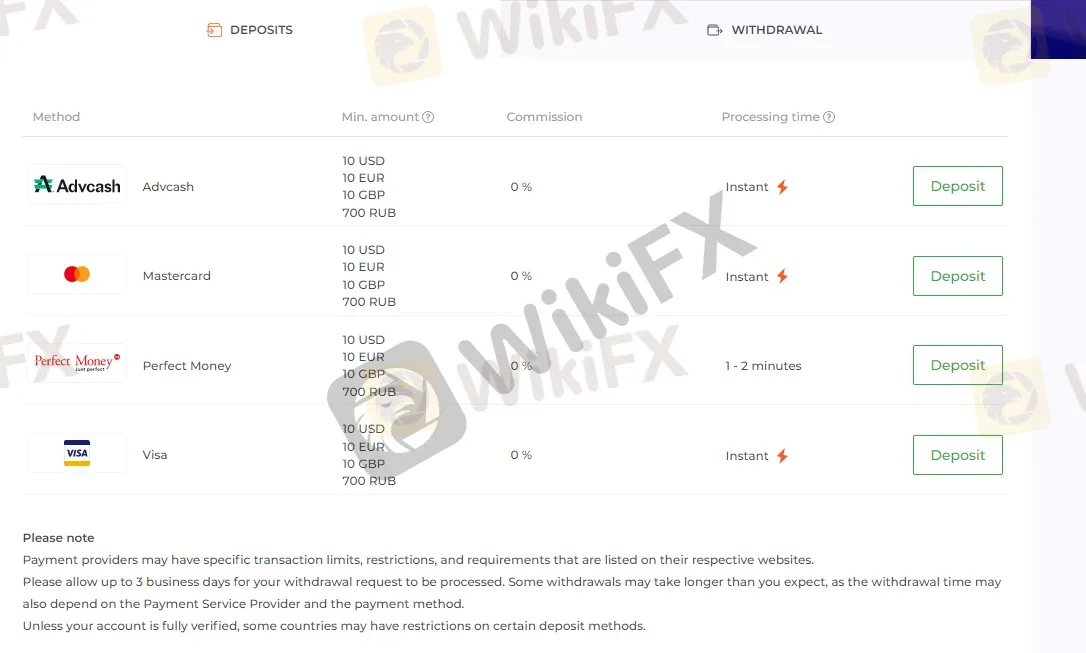

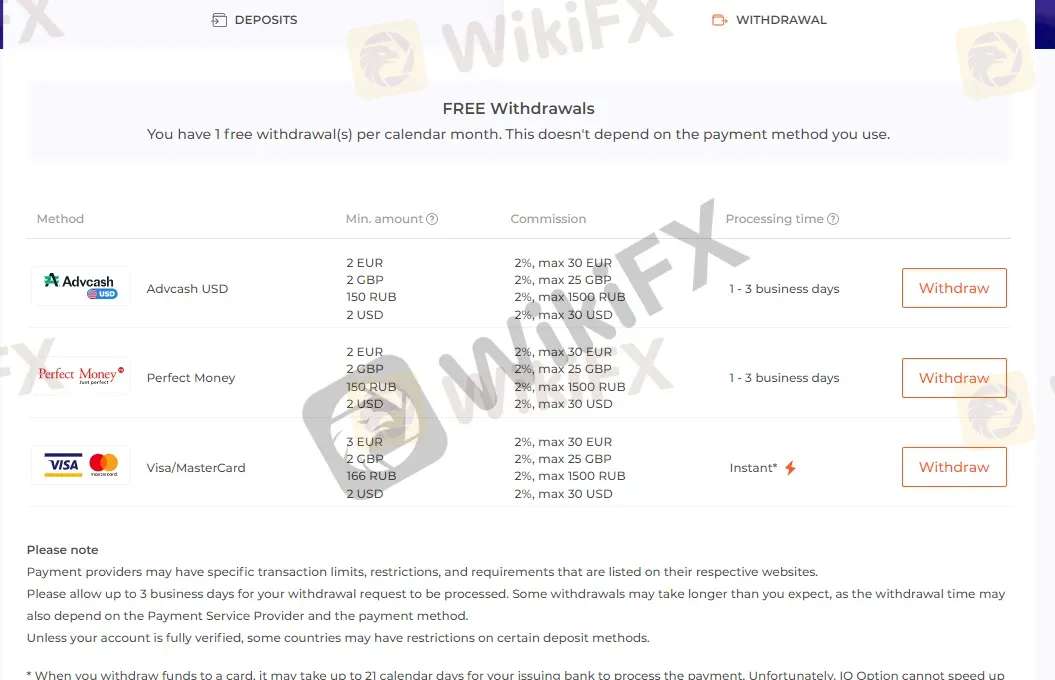

Deposit & Withdrawal

IQ Option offers a variety of deposit and withdrawal methods, including Visa, Mastercard, Perfect Money, and AdvCash. The minimum deposit amount is $10, and there are no deposit fees.

Withdrawals can be made via the same methods used for deposits. IQ Option has a minimum withdrawal amount of 2 EUR/GBP, and a withdrawal fee of 2%, with a maximum fee of 25 GBP, 30 EUR/USD. However, it's worth noting that the withdrawal fee can vary depending on the payment method used.

The processing time for withdrawals may vary depending on the chosen method, with some methods being processed instantly, while others may take up to 3 business days. IQ Option also offers the ability to withdraw funds using cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

| Pros | Cons |

| Multiple deposit options including VISA, Mastercard, and e-wallets like Perfect Money and AdvCash | Limited options for withdrawing funds, with only bank transfers, credit/debit cards, and e-wallets available |

| Minimum deposit requirement of only $10 | Withdrawal fees apply, with a 2% fee charged for most methods and a maximum fee of $25, €30, or £25 depending on the currency |

| Low withdrawal amount | Some users have reported longer than expected withdrawal processing times |

| No deposit fees | Only one free withdrawal per month, with subsequent withdrawals subject to a fee |

| Ability to deposit and withdraw in multiple currencies, including USD, EUR, and GBP |

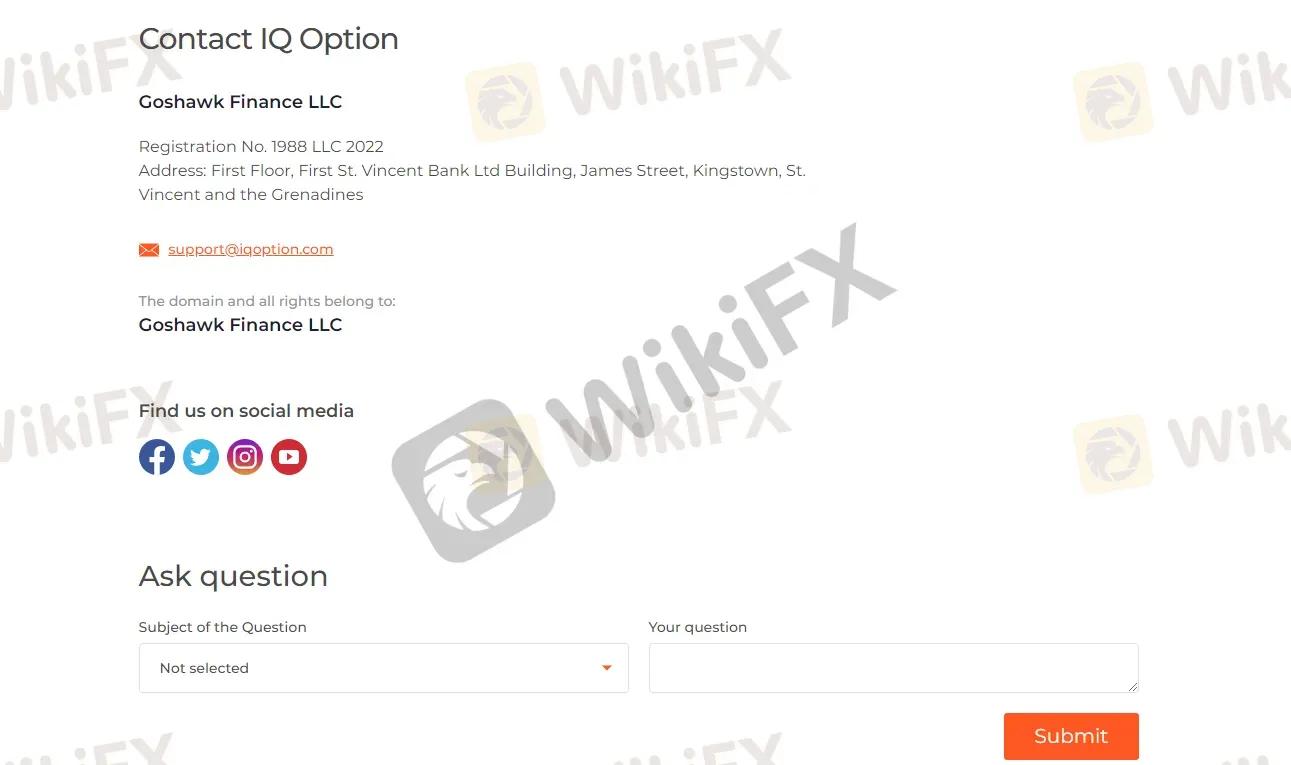

Customer Support

IQ Option offers multilingual customer support via email, social media platforms such as Facebook, Twitter, and Instagram, and live chat. However, there is no dedicated FAQ section on the website for customers to browse through common questions and answers.

IQ Option's customer support team is available 24/7 to assist with any queries or issues that traders may encounter. The support team is known for being responsive and helpful, which is a positive aspect of the broker.

However, the lack of a comprehensive FAQ section on the website could be a downside for traders who prefer to find solutions to their problems independently. It would be beneficial for IQ Option to add a dedicated FAQ section on their website to enhance the customer experience.

Educational Resources

IQ Option does offer educational resources to its traders. The broker provides a section on its website dedicated to educational resources, including tutorials, webinars, and trading strategies. These materials are designed to help traders of all skill levels improve their knowledge and skills in trading.

Additionally, IQ Option has a blog where it publishes market analysis and news related to trading. This can also be a helpful resource for traders to stay up to date with the latest market trends and news.

Conclusion

While IQ Option has some advantages such as low minimum deposit and high leverage, it also has some drawbacks such as limited educational resources and a history of customer complaints. The trading platform is user-friendly and offers a range of features, and the customer support team is available in multiple languages.

FAQs

Q: Is IQ Option regulated?

A: Yes, IQ Option is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Q: What is the minimum deposit required to open an account with IQ Option?

A: The minimum deposit required to open an account with IQ Option varies depending on your location and the type of account you choose. In general, it ranges from $10 to $3000.

Q: Does IQ Option offer a demo account?

A: Yes, IQ Option offers a free demo account with virtual funds to practice trading strategies and test the platform.

Q: What trading instruments are available on IQ Option?

A: IQ Option offers a range of trading instruments, including Forex, stocks, cryptocurrencies, commodities, and options.

Q: What is the maximum leverage offered by IQ Option?

A: The maximum leverage offered by IQ Option is 1:500.

Q: What are the trading fees on IQ Option?

A: IQ Option charges a spread on trades, which is the difference between the buy and sell price. There are no commissions or hidden fees.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator