简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AXI Taps FYNXT for Launching MAM/PAMM Accounts

Abstract:The broker is also stressing features like enhanced administration automation, flexible fee management, and precision in asset allocation for the newly-added services.

AXI Taps FYNXT for Launching MAM/PAMM Accounts

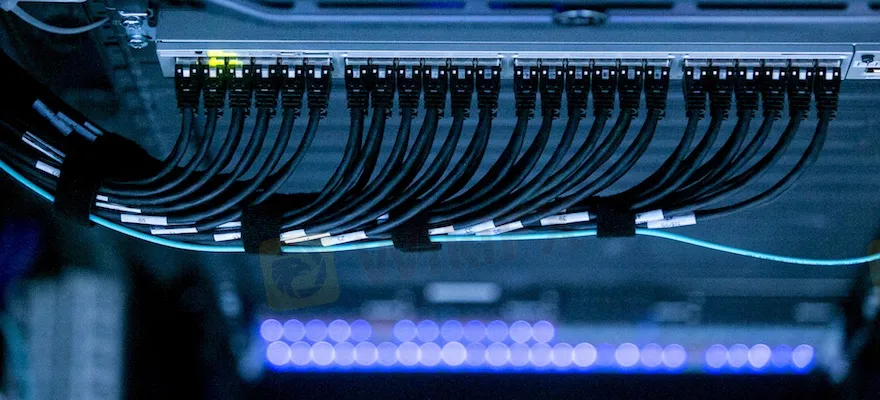

The services are based on the cloud-based infrastructure of FYNXT.

FX and CFDs broker AXI announced on Wednesday its partnership with Singapore-based fintech FYNXT (previously known as Simple2Trade) for extension of its offering with the launch of the Forex Managed Accounts Services (MAM/PAMM) platform.

The broker is also stressing features like enhanced administration automation, flexible fee management, and precision in asset allocation for the newly-added services.

Commenting on the offering, AXI‘s Chief Commercial Officer, Louis Cooper said: “We’ve long understood the limitations of traditional MAM and PAMM offerings out there; as the industry evolved to address the money and fund management sector, technology enhancements have been only piecemeal, incremental and so too, the business benefits.”

Cloud Tech Infra Is Dominating

The new services of the broker are based on the cloud-based technology infrastructure of FYNXT.

“A seriously in-depth understanding of the peculiarities and nuances within the ”managed“ sector was key for me; once we had nailed this, killer technology from our friends at FYNXT in Singapore would be the enabler for us to continue offering our clients the trading edge,” Cooper added.

FYNXT, which was recently rebranded, offers vertically integrated digital platforms that are available in both SaaS and licensed formats. It further boasts its services to have the advantages of minimal services cost, ease of use, almost infinite scalability and accelerated time to market.

“Anything we can do to help our clients better serve their clients is what drives us,” said FYNXTs Singapore-based CEO, Aeby Samuel. “We are immensely proud of our latest Social Fund Management offering and if preliminary feedback from our early clients is any guide, we look forward with a high degree of confidence and excitement.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator