简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Markets Q4 Outlook: Dow Jones, US Dollar, Gold, Fed, Euro, ECB, Oil, Volatility Returns?

Abstract:As investors head into the fourth quarter, the VIX Volatility Index - often referred to as the market‘s ’fear gauge - is in an uptrend. In September, US benchmark stock indices saw some of the worst monthly performance since March 2020. In fact, the S&P 500 and Nasdaq 100 finished the third quarter little changed. More importantly, they trimmed most of their gains. The Dow Jones declined.

Markets Q4 Outlook: Dow Jones, US Dollar, Gold, Fed, Euro, ECB, Oil, Volatility Returns?

As investors head into the fourth quarter, the VIX Volatility Index - often referred to as the market‘s ’fear gauge - is in an uptrend. In September, US benchmark stock indices saw some of the worst monthly performance since March 2020. In fact, the S&P 500 and Nasdaq 100 finished the third quarter little changed. More importantly, they trimmed most of their gains. The Dow Jones declined.

Most of the market jitters unfolded into the tail end of the third quarter. That is also in line with historical standards. September tends to be dismal month for sentiment as traders come back online from the summer lull. A lot of attention was on the Federal Reserve, where Chair Jerome Powell signaled that policy tapering could be completed by the middle of next year.

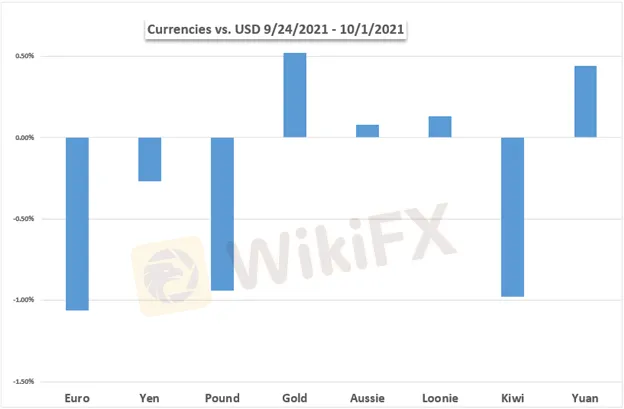

This pushed the 10-year Treasury yield, and front-end government bond rates, higher. A combination of this and volatility aided the haven-linked US Dollar. The Greenback outperformed most of its peers in Q3, especially against the sentiment-linked Australian Dollar. Fears of a Chinese economic slowdown, especially amid the fluid environment around Evergrande, weighed against growth-linked assets.

Gold prices weakened in September, trimming gains from earlier in the third quarter. A rising US Dollar and bond yields could make it a difficult environment for XAU/USD. Meanwhile, crude oil prices trimmed losses in the third quarter. Robust demand estimates, coupled with supply constraints, are bolstering energy prices. OPEC doesnt seem poised to increase output into the end of the year.

All eyes are on the US government as the fourth quarter gets underway. While a shutdown has been avoided for now, the debt ceiling has not yet been raised as Democrats and Republicans struggle to come to terms. September‘s non-farm payrolls report will also be closely watched. A materially lower outcome risks derailing the central bank’s lose policy unwinding.

Meanwhile in Europe, the European Central Bank could remain relatively dovish compared to the Federal Reserve. That could leave EUR/USD biased lower as policymakers stick to the script that inflation could be transitory. In the coming months, this narrative will be increasingly tested. What else is in store for financial markets in the fourth quarter?

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

Upbeat U.S. GDP Spurs Dollar Strength

The U.S. GDP released yesterday surpassed market expectations, which has tempered some speculation about a Fed rate cut and spurs dollar's strength.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

Oil Price Soar on Geopolitical Tension

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, oil prices surged nearly 3% in yesterday's session. creating significant unease in the broader financial markets.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator