简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Plus500 Kicks Off Buyback Program Purchasing a Small Batch of Shares

Abstract:The company will repurchase $12.5 million worth of its ordinary shares by the end of February 2022.

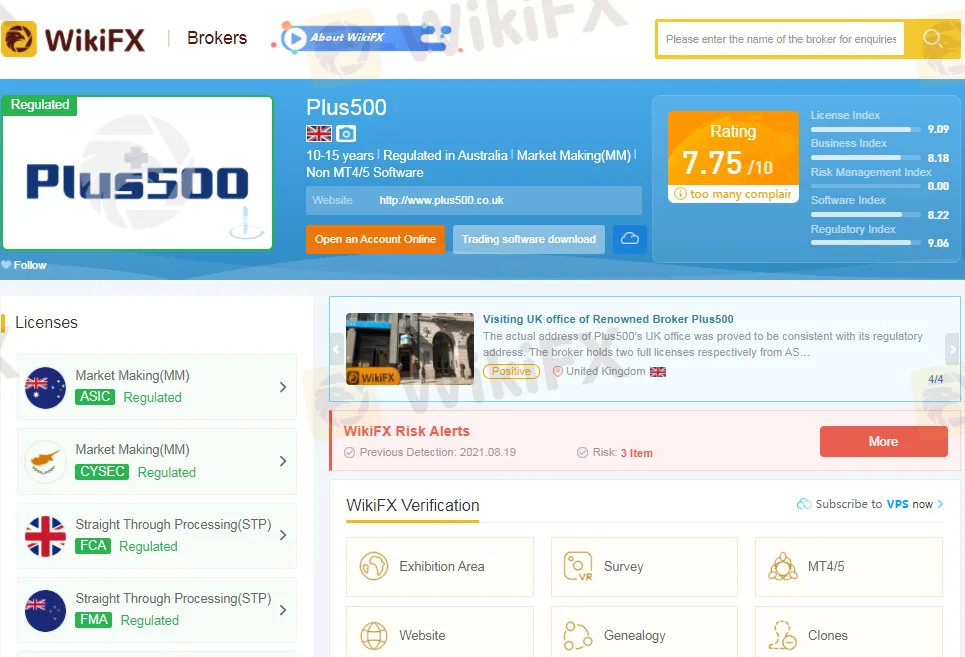

London-listed Plus500 (LON: PLUS) has purchased a small batch of its ordinary shares from the open market on Tuesday, thus initiating buyback under the recently launched program.

According to an RNS filing with the London Stock Exchange (LSE) on Wednesday, the FX and CFDs broker has purchased 220 ordinary shares that were listed on the stock exchange. The company paid an average price of £14.74 for each share, meaning the total value of the transaction was £3,242.

“The Company will hold the repurchased shares in treasury,” Plus500 stated. “Following the purchase of these shares, the remaining number of ordinary shares in issue will be 101,331,310 (excluding treasury shares), and the company will hold 13,557,067 ordinary shares in treasury.”

Another Buyback Program

Plus500 ran multiple buyback programs over the past few years. In the first two quarters of 2021, the company repurchased $25 million worth of its shares from the open market. Now, it has kicked off a new share buyback program, which was announced on Tuesday, allocating a total of $12.5 million.

The Israeli broker has set a closure deadline for the ongoing buyback program at the end of February 2022, but it can be closed earlier if the total quota of the buyback is fulfilled.

Though the volume of the recent transaction is too small, it is an indication that the company has started a repurchase program. Earlier, the broker bought even half a million pounds worth shares a day at the peak of the repurchase efforts.

“The purpose of the programme is to reduce the share capital of the Company, and all ordinary shares repurchased by the Company under the above programme shall be classified as shares held in treasury (dormant shares),” the broker specified earlier.

Meanwhile, Plus500 disclosed that it ended the first six months of 2021 with a revenue of $346.2 million and $165.1 million in net income. Furthermore, the market reacted to the figures and the latest buyback program, as the shares prices of the broker jumped almost 5 percent by the end of Tuesdays session.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator