简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

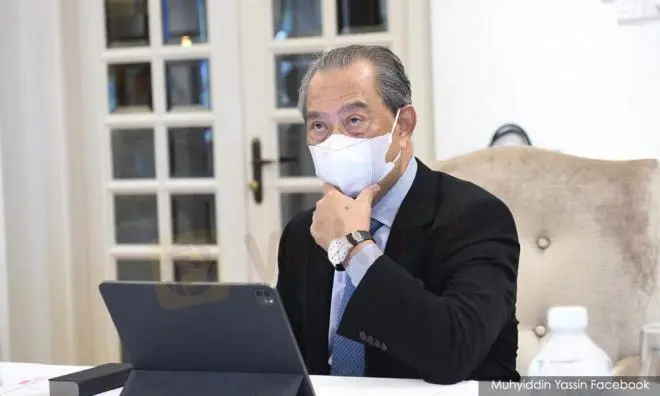

Will Muhyiddin survive?

Abstract:Political turmoil in Malaysia as Muhyiddin clashes with King

Yesterday afternoon, two speculations were rife. First, Prime Minister Muhyiddin Yassin would resign under pressure from his allies. Second, de facto Law Minister Takiyuddin Hassan and Attorney-General (AG) Idrus Harun, who were named in the royal rebuke, or even the embattled speaker Azhar Azizan Harun, may resign to take the blame.

The speculations were reasonably grounded because the royal rebuke which hit the floor of Parliament yesterday was direct and stern. With the backing of 114 MPs (excluding Gua Musang MP Tengku Razaleigh Hamzah) in the best scenario, but more likely less than 110, the government is most fragile.

Surprisingly, in a detailed reply to the royal rebuke, the government underlined the constitutional principle that the constitutional monarch should act according to the advice of the prime minister on most matters including the emergency.

Deputy Prime Minister Ismail Sabri Yaakob rallied behind him claiming that Perikatan Nasional (PN) still commanded a simple majority with more than 110 votes amongst the Parliaments current 220 members.

Muhyiddin has responded like former premier Dr Mahathir Mohamad except he does not have the same stature and strength which the latter had in 1982 and 1993. But will Muhyiddin survive?

To better answer this question, we should assess the likelihood of these three scenarios: Muhyiddin surviving till the 15th general election (GE15); Muhyiddin being replaced by a member of his cabinet; and Muhyiddin being replaced by an opposition leader.

Brewing two-in-one constitutional crises

Many have characterised the latest development as...

The ringgit opened higher against the US dollar on Friday as trading of the greenback remained sideways over the United States (US) weaker-than-expected economic data, a dealer said.

USDMYR Chart

At 9.02 am, the ringgit rose to 4.2350/2400 versus the greenback from Thursday's close of 4.2360/2410.

ActivTrades trader Dyogenes Rodrigues Diniz said although the US dollar has managed to regain some grounds, trading remained sideways as the US gross domestic product (GDP) data came in below expectations at 6.5 per cent versus the forecasted 8.5 per cent.

The fact that the GDP came in well below expectations raises questions about the efficiency of the monetary policies adopted by the US Federal Reserve (US Fed) so far, with the American central bank trying to kick-start the economy at the cost of higher inflation.

“The million-dollar question now is whether the US Fed needs to increase the stimulus, and how far can it safely go without jeopardising the purchasing power of the American consumer because of inflation,” he said.

Meanwhile, at the opening bell, the local note was traded mixed against a basket of major currencies.

The ringgit strengthened against the Singapore dollar to 3.1275/1315 from 3.1285/1324 at yesterday's close and appreciated against the British pound to 5.9066/9135 from 5.9092/9162 previously.

However, the local unit weakened vis-a-vis the euro to 5.0316/0375 from 5.0294/0353 and depreciated against the Japanese yen to 3.8648/8697 from 3.8562/8611 previously.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

ASIC Sues HSBC Australia Over $23M Scam Failures

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Understanding the Impact of Interest Rate Changes on Forex Markets

Currency Calculator