简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dollar's near-term outlook bright, but to fade in a year: Reuters poll

Abstract:Dollar's near-term outlook bright, but to fade in a year: Reuters poll

Near-term bets in favour of the dollar should be increased, a majority of analysts in Reuters polls said, who however were split on the duration of the greenback's bullish trend and forecast its allure to fade in a year.

Tracking the Federal Reserve's surprisingly hawkish outlook at the June meeting, the dollar ended its two month losing streak and gained about 3% against a basket of currencies last month, marking its best monthly performance in 4-1/2 years.

What has also supported the dollar and other safe-haven assets - including Treasuries and the yen - is the spread of the highly contagious Delta variant of COVID-19, which is threatening the global reopening.

Still, the June 28-July 1 poll of over 70 foreign exchange analysts showed the U.S. currency would broadly weaken against most major currencies in 12-months' time, a view held for well over a year.

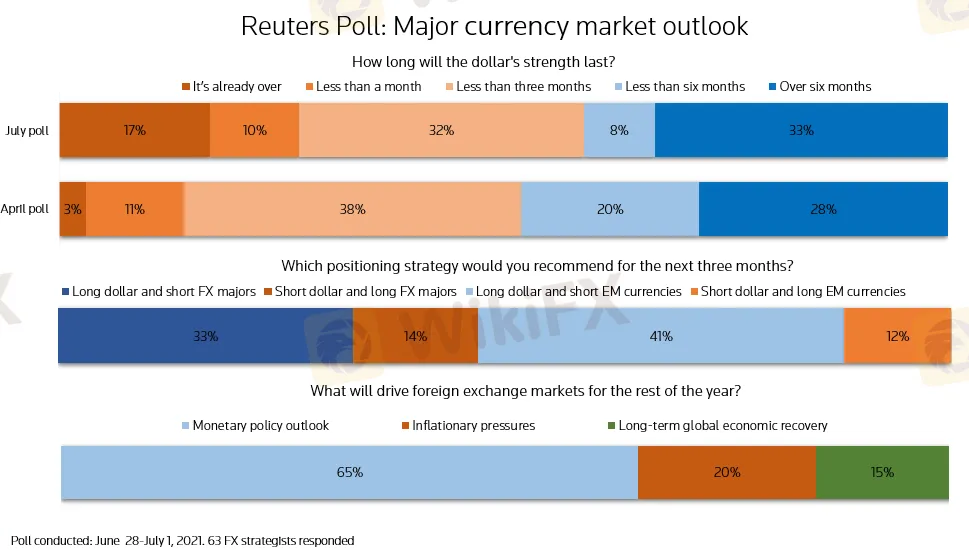

But in response to an additional question, about 75% of analysts, or 38 of 51, suggested long dollar bets and short other major currencies or emerging market ones in the next three months as a positioning strategy.

“We are in a dollar positive regime for the next few months, which will generate some dollar strength in the near-term. But over a longer time horizon, we expect the dollar to remain in a fairly broad-based range,” said David Adams, head of G10 FX strategy North America at Morgan Stanley (NYSE:MS).

“This summer we see an opportunity for a tradable dollar rally as real rates rise and break-even inflation rates fall. The CFTC data and our conversations with investors suggests the market is still bearish on the dollar, both in actual positioning and in sentiment.”

(Graphic: EUR/USD and U.S. 10-year Treasury yield outlook - https://fingfx.thomsonreuters.com/gfx/polling/ygdpzzmmrpw/EURUSD%20and%20U.S.%2010-year%20Treasury.PNG)

When asked how long the dollar's strength would last, 37 of 63 analysts said less than three months, including eleven who predicted it was already over. The remaining 26 said more than three months.

That underscores the uncertainty from the pull and push in expectations between the Fed's taper plan announcement - which separate Reuters polls forecast to come by September - and the outlook the U.S. central bank won't start scaling back its stimulus until next year. [ECILT/US][US/INT][ASSET/WRAP]

“With equity markets at elevated levels and housing markets hot in a host of countries, we've got fertile grounds for people to worry. COVID and the Fed are the focus...the Fed is making us focus on economic data which is hard to interpret,” said Kit Juckes, head of FX strategy at Societe Generale (OTC:SCGLY).

“The Queen in Alice in Wonderland said she sometimes believed six impossible things before breakfast and I suspect we are all going to be guilty of that this summer...The fundamental picture though, is still that FX is a battle between global economic recovery, and Fed tightening talk.”

(Graphic: Currency market outlook)

The long-held view for a weaker dollar in the year-ahead was once again the broad consensus in the latest poll, with the euro predicted to gain 2.6% to $1.22 in a year from a 4-1/2-month low of about $1.18 on Thursday.

While that 12-month ahead consensus is lower than predicted last month, it only reflects the single currency's significant fall in June, driven by the Fed's hawkish tone on robust economic recovery expectations, supporting the dollar.

But that has already been priced-in by financial markets.

“No one is going to pay a premium for a safe-haven currency when you've got the best global growth we've seen in decades,” said Brian Rose, senior economist Americas at UBS Global Wealth Management.

“Right now you have the worst of all worlds: the Fed is extremely loose, inflation is high and real interest rates are more negative in the U.S. than they are in other places...what you really need to turn the dollar around is the prospect of Fed raising rates.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Wall Street Dip on AI Jitters

The U.S. equity market experienced one of its worst trading days this year, with the Nasdaq leading the decline, plunging more than 700 points in the last session. Investor concerns over the AI sector surged following Tesla's earnings miss and Google's higher-than-expected spending, both of which saw sharp declines.

Dollar Calm ahead of FOMC Minutes

The dollar index steadied in the last session, trading above the $105 mark, ahead of the highly anticipated FOMC meeting minutes. Market expectations are leaning towards a more hawkish stance from the U.S. central bank due to a tight labour market. Analysts predict that the Fed is likely to implement two 25 bps rate cuts toward the end of the year, contingent on further evidence that inflation is slowing.

Oil Plummet on U.S. Crude Inventory Surge

Oil prices experienced their steepest decline of 2024, dropping over 5%, following the release of the American Petroleum Institute (API) weekly crude data, which revealed an unexpected inventory build-up exceeding 4 million barrels. This surprise data, coupled with OPEC+'s decision to increase oil supply in the fourth quarter, exerted significant downward pressure on prices.

Yen Drop on Japan FX Officials Comment

The U.S. equity market continued its upward trajectory, buoyed by growing optimism surrounding potential interest rate cuts by the Federal Reserve later this year, following the release of softer-than-expected nonfarm payroll data last Friday, indicating a slowdown in economic performance.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator