简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Here’s why cryptocurrency crashes on weekends

Abstract:Here’s why cryptocurrency crashes on weekends

Investors may trade cryptocurrency outside of the work week, allowing for after-hours price swings.

Fluctuations happen on weekends due to less volume, margin trading and other factors, experts say.

Weekend drops may have significant effects as regulators weigh long-term plans for digital currency.

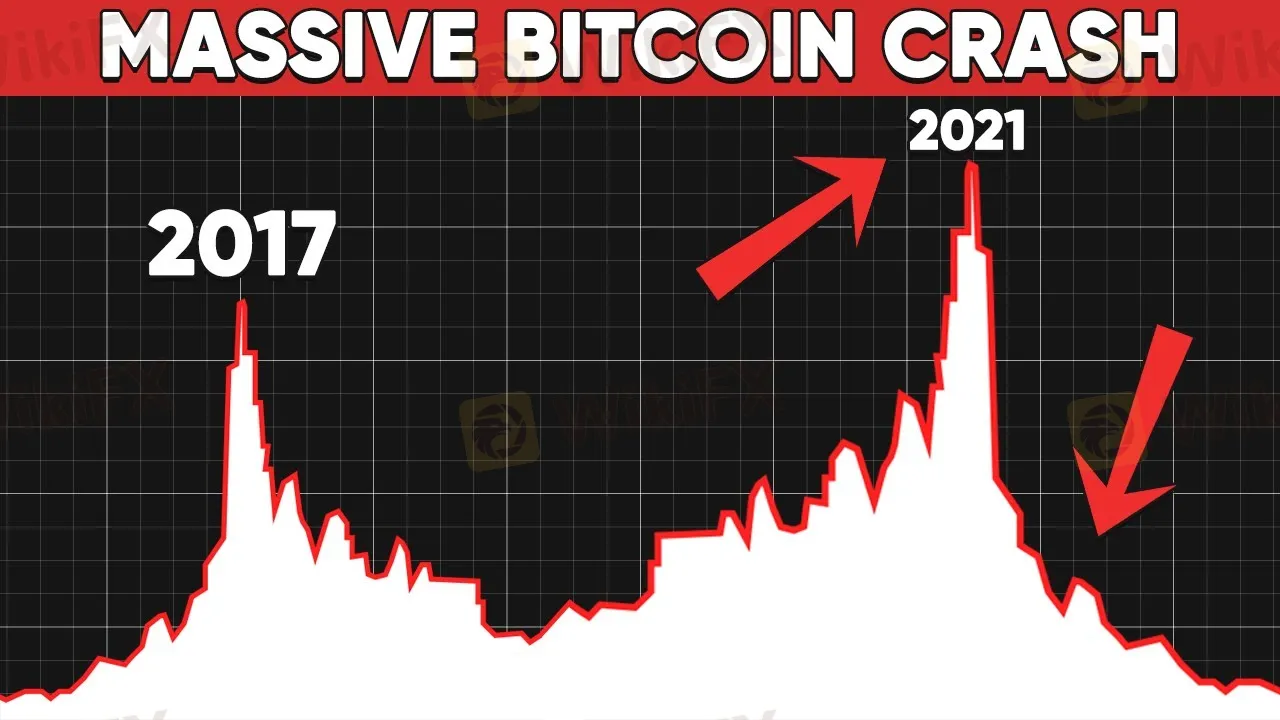

Cryptocurrency is known for volatility and some experts say crashes tend to happen on weekends.

“This has been a phenomenon in crypto for several years,” said Stephen McKeon, associate professor of finance at the University of Oregon in Eugene, and partner at Collab+Currency, a cryptocurrency-focused investment fund.

These weekend dips may have significant effects as regulators weigh the future of digital currency, experts say. Heres why these crashes may be happening.

Less trading on weekends

One of the reasons for weekend cryptocurrency volatility is there are fewer trades, said Amin Shams, assistant professor of finance at Ohio State University in Columbus, Ohio.

“When the volume is low, the same trade size can move prices a lot more,” he said.

With banks closed over the weekend, there is less trading because investors may not be able to add money to their accounts, McKeon said.

“You get moments of market panic where theres a lot of selling pressure,” he said.

Typically, theres a rebound on Sunday night as Asian banks open and into Monday as U.S. banks follow, McKeon said.

Plus, there are cryptocurrency influencers like Tesla CEO Elon Musk who “wave a heavy hand over the crypto space,” said Tyrone Ross, CEO of Onramp Invest in New York.

When Musk tweets something negative about bitcoin after-hours, it may spark a wave of activity.

Trading on margin

Another reason for weekend price swings may be investors trading cryptocurrency on margin, which is borrowing money from the exchanges to buy more assets, Shams said.

When digital currency prices dip below a certain level, traders must repay the loan, known as a “margin call.”

But if investors dont cover the loan, exchanges may sell the digital currency to ensure they receive the borrowed money back.

With banks closed over the weekend, some traders may struggle to pay off the borrowed funds because they cant move money into their accounts, triggering sell-offs from exchanges, Shams said.

“Thats going to drop the price further,” he added.

Market manipulation

Its also possible those trying to artificially influence cryptocurrency prices may be a factor.

“There are a lot of studies that show there is [market] manipulation,” said Shams.

For example, 2019 research shows how tether, a digital currency tied to the U.S. dollar, may have artificially inflated bitcoin and other cryptocurrency prices during the 2017 boom.

But researchers still dont know the extent to which it happens, he said.

Some believe this happens more often during the week, causing digital currency prices to rise. But this theory may only be speculation, he said.

Other experts say there are “mixed views” on these practices.

“I have not personally seen any conclusive evidence that suggests manipulation,” McKeon said.

Crypto ETFs

Regardless of the reason for weekend volatility, it presents challenges for regulators weighing the approval of cryptocurrency-based exchange-traded funds.

While ETFs trade during the work week, investors can buy or sell cryptocurrency 24 hours per day, seven days per week, and may create a mismatch for crypto ETFs, Shams said.

For example, if the digital currency market drops by 20% on a Sunday, those eager to sell may be stuck with their crypto ETFs until the markets open again on Monday.

Securities and Exchange Commission Chair Gary Gensler has called for greater investor protections for cryptocurrency, signaling more regulation may be necessary before the agency approves crypto ETFs.

The SEC is currently reviewing bitcoin and ethereum ETF applications from several companies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why Additional Tax Laws Surrounding Cryptocurrency AND How?

In March of 2021, the IRS issued new guidance that affects individuals or companies that transact online trading of cryptocurrency.

This unknown cryptocurrency soared by 164,842% in hours, only to crash 99%

This unknown cryptocurrency soared by 164,842% in hours, only to crash 99%

China sends another warning on cryptocurrency risks amid ‘wild fluctuations’

China sends another warning on cryptocurrency risks amid ‘wild fluctuations’

What is the future for the new Facebook’s cryptocurrency Libra?

What is the future for the new Facebook’s cryptocurrency Libra?

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator