简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Forecast: EUR/USD, USD/JPY Look to PMI Data & Yields

Abstract:US DOLLAR PRICE OUTLOOK: EUR/USD, USD/JPY AWAIT PMI SURVEYS DUE

The US Dollar declined -0.5% alongside a pullback in Treasury bond yields on Thursday

DXY Index drilled right back down to critical support after erasing FOMC minute gains

EUR/USD and USD/JPY eye the release of monthly PMI data from IHS Markit due Friday

US Dollar bears drove the broader DXY Index -0.5% lower on Thursday. This followed a drop in Treasury yields that completely unwound yesterdays rise sparked by FOMC minutes, which hinted at the threat of Fed tapering. Broad US Dollar weakness sent EUR/USD ripping 50-pips higher to test yearly open resistance while USD/JPY tumbled -0.41% on the session. The DXY Index now hovers back at a key area of technical support near the 89.65-price level.

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (24 DEC 2020 TO 20 MAY 2021)

US Dollar bulls might look to defend this potential area of buoyancy underpinned by Februarys monthly low. The bottom Bollinger Band could also help stymie US Dollar selling pressure. To that end, the DXY Index arguably is starting to look oversold here judging by the relative strength index. US Dollar rebound potential brings the 20-day simple moving average and descending trendline into focus.

clipsing last weeks high around 90.80 might open up the door to test the 50-day simple moving average and upper Bollinger Band. On the other hand, another round of US Dollar weakness might steer the DXY Index toward the 89.20-price level where year-to-date lows reside. Taking out that level of technical support may see US Dollar bears set their sights on 2018 swing lows deep into the 88.00-handle. This could confirm the ominous descending triangle chart pattern that appears to be forming on the DXY Index.

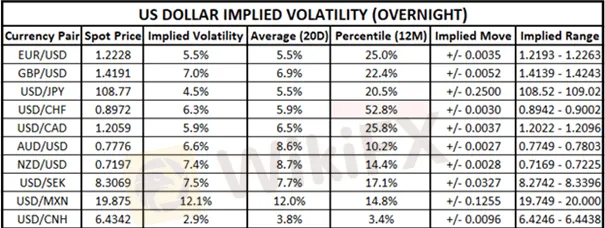

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Looking ahead to Fridays trading session on the Economic Calendar, we see notable event risk posed by the scheduled release of PMI surveys by IHS Markit. Though overnight US Dollar implied volatility readings suggest that major currency pairs are expected to have relatively little movement. EUR/USD overnight implied volatility of 5.5%, for example, ranks in the bottom 25th percentile of measurements taken over the last 12-months.

Likewise, USD/JPY overnight implied volatility of 4.5% is below its 20-day average reading of 5.5% and ranks in the bottom 20th percentile of readings over the last year. If US PMI data emphasizes persistent supply chain disruptions and corresponding price pressures, however, currency volatility could accelerate alongside a sharp spike higher in Treasury yields as markets grow more fearful of inflation and the risk of Fed tapering.

More news coming soon on WikiFX APP -

Android: https://bit.ly/3kyRwgw

iOS: https://bit.ly/wikifxapp-ios

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

One article to understand the policy differences between Trump and Harris

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

M2FXMarkets Review 2024: Read Before You Trade

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Bitcoin.com Introduces Venmo for U.S. Bitcoin Purchases via MoonPay

What Happened to NFTs?

Currency Calculator