简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

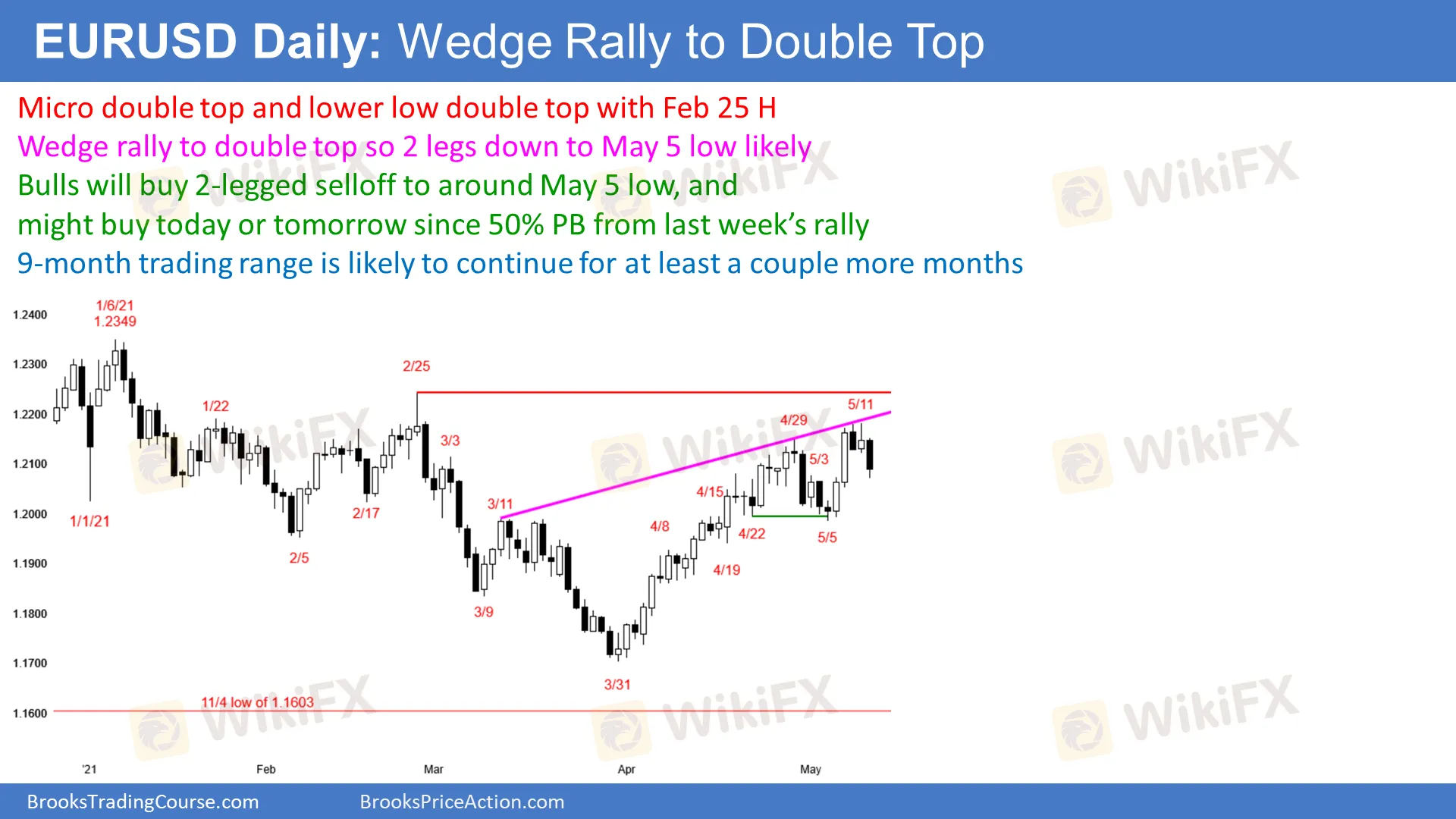

EUR/USD: Wedge Rally To Double Top

Abstract:EUR/USD: Wedge Rally To Double Top

EUR/USD saw an overnight selloff after a buy climax. Traders are deciding if was just a brief pullback in the bull trend, or if it signals the start of a trend reversal down. Todays close will help traders decide. The single currency was turning down from a micro double top and wedge rally, to a double top with the Feb. 25 high.

If EUR/USD closes today near its low, then the selloff will probably reach the May 5 low, which was the bottom of last weeks buy climax, as well as the bottom of a 4-week trading range.

Because of last weeks strong rally, a close today in the middle range or above will probably provide bulls with at least one more leg up to Feb. 25.

EUR/USD Forex Chart

Overnight EUR/USD forex trading on the 5-minute chart

Sold off overnight, but big reversal up in past 10 minutes. Now, in middle of days range.

Sell climax and reversal up were strong enough for this to be low for rest of day.

Bears need today to reverse back down and close near low of day, but currently have only 40% chance.

Bulls want today to close in the middle of the range, or near the high of the day. That will increase the chance of today being just a pullback in the 6-week rally.

At the moment, the bulls are winning and day traders are buying aggressively.

Bulls want today to close here or higher, but Big Down, Big Up creates Big Confusion. That typically leads to a trading range. Therefore, day traders will expect the bull trend reversal to either weaken into a bull channel or evolve into a trading range.

If there is a 20-pip pullback, day traders will again sell, but probably only for scalps.

Today will probably be sideways or up for the rest of the day.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Currency Calculator