简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXBTG-Overview Guide of This Broker

Abstract:FXBTG is a New Zealand-based online broker that offers trading in a variety of financial instruments such as forex, commodities, indices, and cryptocurrencies. FXBTG provides traders with access to the MetaTrader 4 (MT4) trading platform, which is known for its reliability and functionality. The platform is available for download on desktop, mobile, and tablet devices, allowing traders to access their trading accounts from anywhere at any time, as well as its proprietary trading platform called FXBTG App. The maximum trading leverage offered by this broker is up to 1:400. The broker offers a range of account types to cater to the needs of different types of traders, including a demo account for beginners to practice trading without risking real money. FXBTG also offers customer support to clients 24/5 via phone, email, and live chat. The broker also provides educational resources, including trading guides, webinars, and video tutorials, to help traders improve their trading knowledge

| FXBTG | Basic Information |

| Company Name | FXBTG Financial Limited |

| Registered Country/Area | New Zealand |

| Founded in | 2014 |

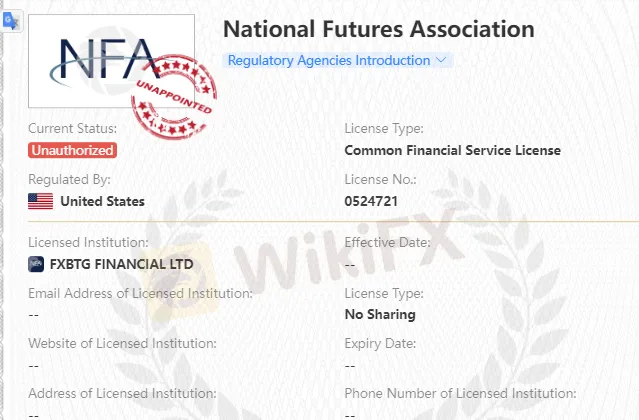

| Regulation | No Regulation |

| Account types | Mini, Standard, VIP, Pro |

| Minimum deposit | $500 for Mini Account, $2,000 for Standard account, $5,000 for VIP account, $20,000 for Pro account |

| Leverage | Up to 1:400 |

| Trading instruments | Forex, CFDs on indices, metals, and cryptocurency, Futures |

| Trading platforms | MT4, FXBTG App |

| Payment methods | Bank transfer, Credit/Debit cards |

| Customer support | Phone, Email, Live chat |

| Educational resources | Market news, Webinars |

| Bonus Offered | Yes |

Overview of FXBTG

FXBTG is a New Zealand-based online broker that offers trading in a variety of financial instruments such as forex, commodities, indices, and cryptocurrencies. FXBTG provides traders with access to the MetaTrader 4 (MT4) trading platform, which is known for its reliability and functionality. The platform is available for download on desktop, mobile, and tablet devices, allowing traders to access their trading accounts from anywhere at any time, as well as its proprietary trading platform called FXBTG App. The maximum trading leverage offered by this broker is up to 1:400.

The broker offers a range of account types to cater to the needs of different types of traders, including a demo account for beginners to practice trading without risking real money. FXBTG also offers customer support to clients 24/5 via phone, email, and live chat. The broker also provides educational resources, including trading guides, webinars, and video tutorials, to help traders improve their trading knowledge and skills.

Is FXBTG legit or a scam?

As per the information available on FXBTG's website, it appears that this broker is not regulated by any major financial regulatory authority. It is important to note that trading with an unregulated broker carries a higher level of risk as there is no oversight or protection provided by a regulatory body. Traders should carefully consider the risks involved before choosing to trade with an unregulated broker.

Pros and Cons of FXBTG

Based on the analysis of FXBTG's pros and cons, it can be concluded that the broker offers competitive leverage options, a wide range of tradable instruments, and a user-friendly platform. However, the lack of regulation and limited educational resources are significant drawbacks. Traders should carefully consider these factors before deciding to trade with FXBTG.

| Pros | Cons |

| High leverage of up to 1:400 | Not regulated, which may pose risks to traders |

| Wide range of trading instruments | Limited educational resources and tools for traders |

| Multiple account types to choose from | No negative balance protection policy |

| User-friendly and intuitive platform | High minimum deposit requirement for each account |

| Various deposit and withdrawal options | High trading fees and spreads compared to other brokers |

| No multilingual customer support | |

| Credit/Debit and Bank Transfer payment methods supported |

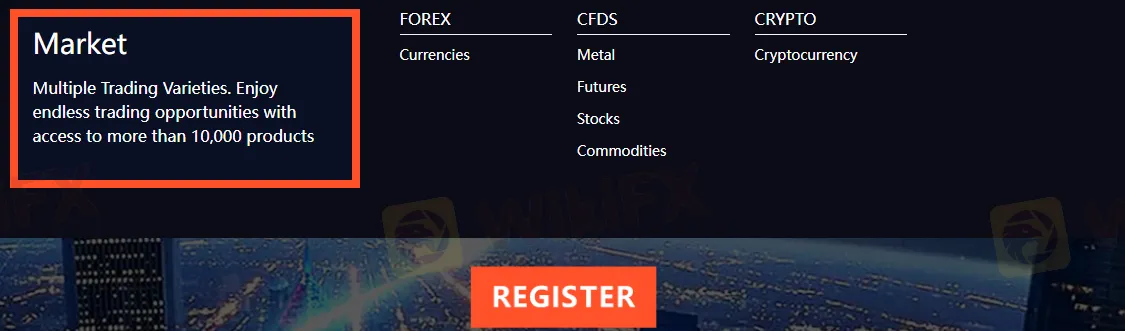

Market Intruments

FXBTG offers a variety of market instruments for trading, including currency pairs (forex), indices, commodities, and cryptocurrencies. The currency pairs available for trading include major, minor, and exotic pairs such as EUR/USD, USD/JPY, and USD/TRY. The indices available include popular indices such as NASDAQ, S&P 500, and FTSE 100. Commodities offered for trading include precious metals such as gold and silver, as well as energy products such as crude oil and natural gas. The cryptocurrency offering includes popular digital currencies such as Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

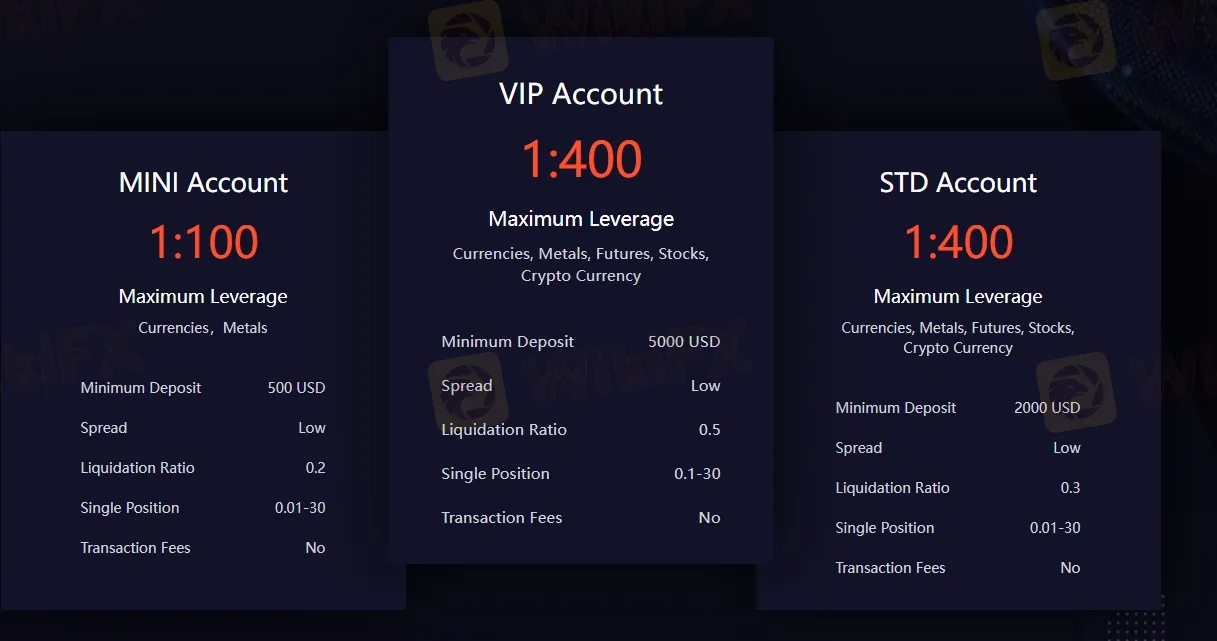

Account Types

FXBTG offers four different account types: Mini, Standard, VIP, and Pro. The minimum deposit for a Mini account is $500, for a Standard account it is $2,000, for a VIP account it is $5,000, and for a Pro account it is $20,000. Each account type offers different trading conditions and benefits.

Mini Account: This account type is designed for beginners and traders with limited trading experience. The minimum deposit required to open a Mini Account is $500. Mini Account holders have access to all the trading instruments offered by FXBTG, with a maximum leverage of 1:100. Mini Account holders also have access to the MT4 trading platform and can receive customer support 24/7.

Standard Account: The Standard Account requires a minimum deposit of $2,000. In addition to all the features available to Mini Account holders, Standard Account holders have access to more advanced trading tools and receive a personal account manager to help guide them through their trading journey.

VIP Account: The VIP Account is designed for experienced traders and requires a minimum deposit of $5,000. VIP Account holders receive all the benefits of the Standard Account, plus additional features such as lower spreads, faster execution times, and access to exclusive market analysis and trading signals.

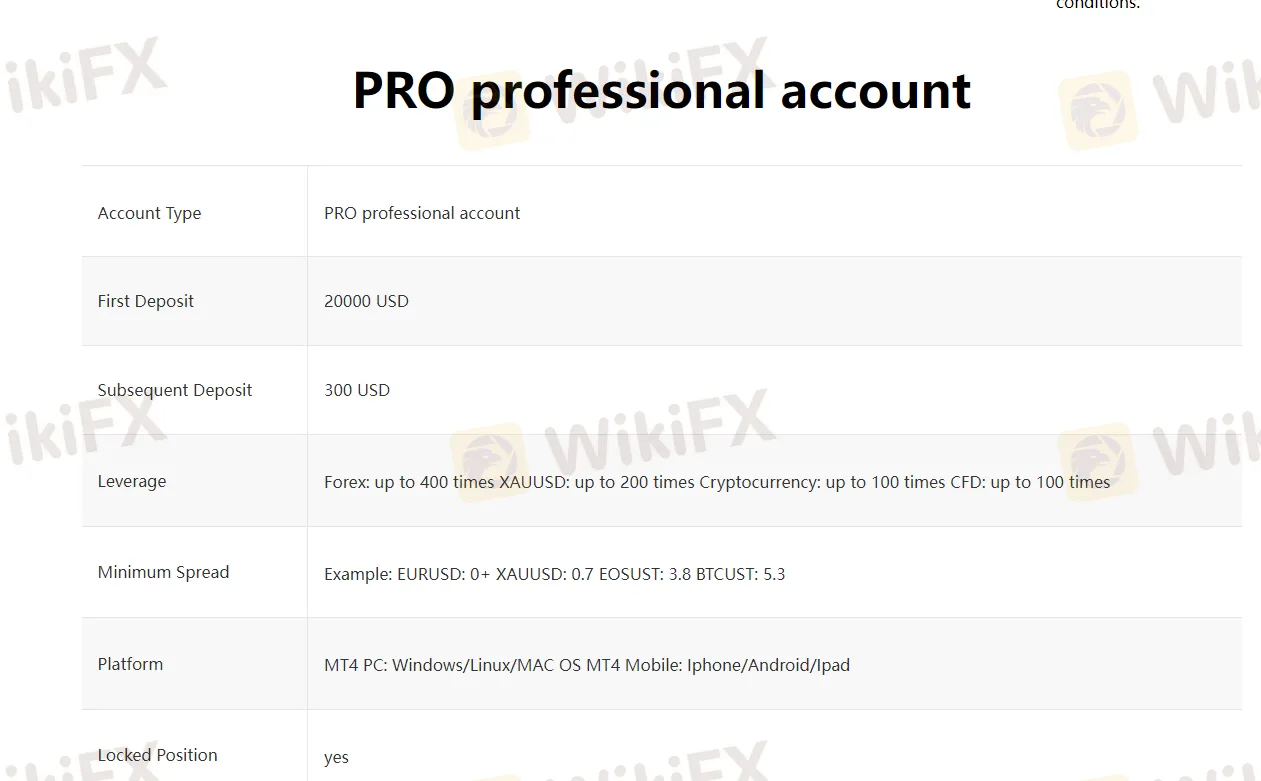

Pro Account: The Pro Account is the most advanced account type offered by FXBTG and requires a minimum deposit of $20,000. Pro Account holders receive all the features of the VIP Account, plus additional benefits such as a dedicated account manager, customized trading conditions, and access to institutional-grade trading tools and resources. It should be noted that the Pro account of FXBTG requires a minimum initial deposit of $20,000, which may not be affordable for all traders. Additionally, while subsequent deposits for the Pro account are lower at $300, this account type may still be out of reach for many retail traders.

| Pros | Cons |

| Wide range of account types to choose from | High minimum deposit required |

| High leverage up to 1:500 | Limited educational resources |

| No commission charged on trades | No additional trading tools or features |

| 24/7 customer support available | Limited research tools |

| Islamic account option available for Muslim traders | |

| Demo Account Available |

Demo Accounts

FXBTG offers a demo account for traders to practice and familiarize themselves with the trading platform and various trading instruments. The demo account comes with virtual funds that can be used to simulate real trading conditions without risking any real money. This allows traders to test out different trading strategies and improve their skills before moving on to live trading. The demo account can be accessed through the FXBTG website and is available for an unlimited period of time.

How to open an account?

Opening an account with FXBTG is a simple and straightforward process that can be completed in just a few steps.

The first step is to visit the broker's website and click on the “Signup” button, which can usually be found in the top right corner of the homepage.

Then, you will be required to provide some personal information, including your name, email address, and phone number. You will also need to choose a username and password to use for logging into your account. After you have entered your personal information, you will be prompted to read and agree to the broker's terms and conditions.

The next step is to verify your identity and residency by uploading some documents, such as a copy of your passport or national ID card and a recent utility bill or bank statement. Once your account has been verified, you can proceed to make your first deposit and start trading.

Leverage

FXBTG offers flexible trading leverage, which can vary depending on the trading account you hold. The maximum leverage available is 1:400, while the minimum is 1:100. The actual leverage you can use will depend on the instrument you're trading and the size of your position.

Please note that leverage is a double-edged sword - while it can amplify your profits, it can also magnify your losses. As such, it's important to use leverage with caution and make sure you have a solid understanding of the risks involved before trading with high leverage.

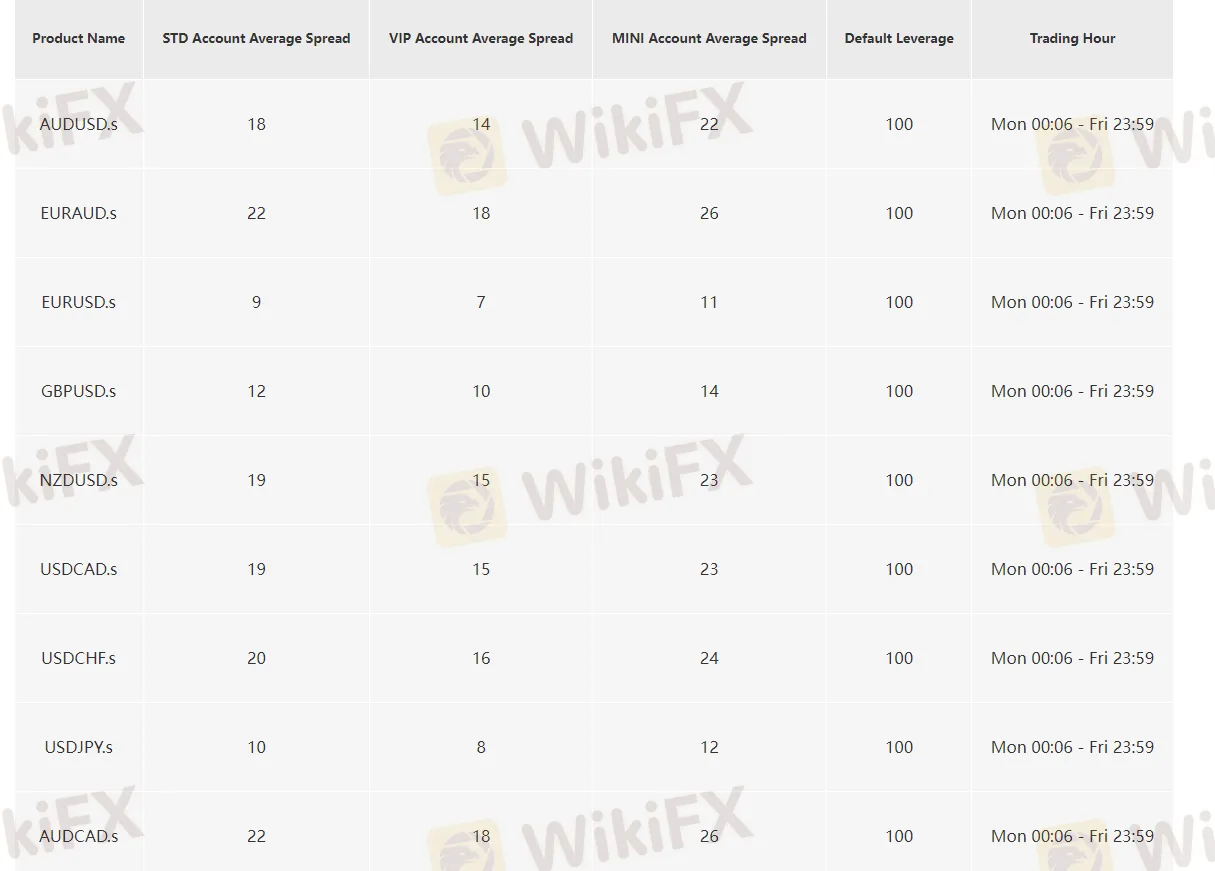

Spreads & Commissions (Trading Fees)

When it comes to spreads and commissions, FXBTG's offerings are somewhat higher than the industry average. The average spreads offered by the Standard account for EUR/USD pair is around 9 pips, which is higher than many of its competitors. The VIP account fares slightly better, with an average spread of around 7 pips on the same currency pair. Meanwhile, the Mini account has the highest average spread at around 11 pips in EUR/USD.

Spreads offered by FXBTG can vary depending on market conditions and the type of account you hold. Additionally, there are no commissions charged on trades, which may be a positive for some traders.

| Pros | Cons |

| None | High spreads, which may result in higher trading fees |

| High spreads may make it harder to profit | |

| Commissions not specific |

Non-Trading Fees

FXBTG does not charge any non-trading fees. However, traders should be aware that there may be fees associated with deposits and withdrawals, such as bank transfer fees or currency conversion fees. It is important to check with your bank or payment provider to understand any potential fees that may apply. Additionally, inactivity fees may be charged if the account is inactive for a certain period of time. FXBTG does not specify their inactivity fees on their website, so traders should contact customer support for more information.

Trading Platform

FXBTG offers its clients two trading platforms: MetaTrader 4 (MT4) and the FXBTG App, which is the broker's proprietary platform. MT4 is a widely used trading platform that is popular among traders for its user-friendly interface, advanced charting tools, and automated trading features. The FXBTG App is a mobile trading platform designed for traders who want to trade on-the-go. It offers real-time quotes, advanced charting tools, and various order types. Both platforms are available for desktop and mobile devices, allowing traders to access their accounts and trade from anywhere at any time.

| Pros | Cons |

| MT4 offers a wide range of indicators and charting tools | The proprietary FXBTG App may be less customizable than MT4 |

| MT4 has a large user community and extensive online resources for learning and support | The FXBTG App may have a steeper learning curve for those accustomed to MT4 |

| The FXBTG App is optimized for mobile trading and offers a simple, user-friendly interface | Some traders may prefer the familiarity and flexibility of MT4 |

| The FXBTG App allows for one-click trading and easy access to market news and analysis | MT4 may offer more advanced features for experienced traders |

| Both platforms offer access to a variety of trading instruments and support multiple languages | The FXBTG App may not be available on all devices or operating systems |

Deposit & Withdrawal

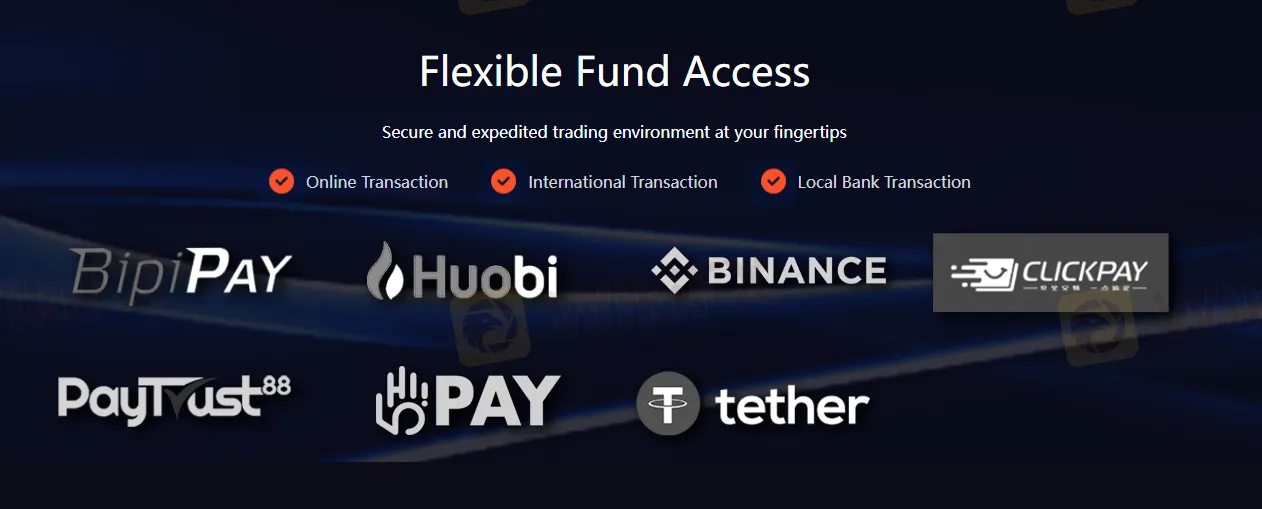

FXBTG offers several deposit and withdrawal methods, including Bipipay, Huobi, Binance, Clickpay, Paytrust, Hi pay, and Tether. These methods provide clients with a range of options for transferring funds in and out of their trading accounts. The use of cryptocurrency payment options, such as Binance and Tether.

However, it is important to note that some of the common payment methods like credit/debit card and bank transfer are not available. This may be inconvenient for some traders who prefer using these methods. Additionally, traders need to be aware that some of these payment methods may have their own transaction fees, which could add up to the overall cost of trading.

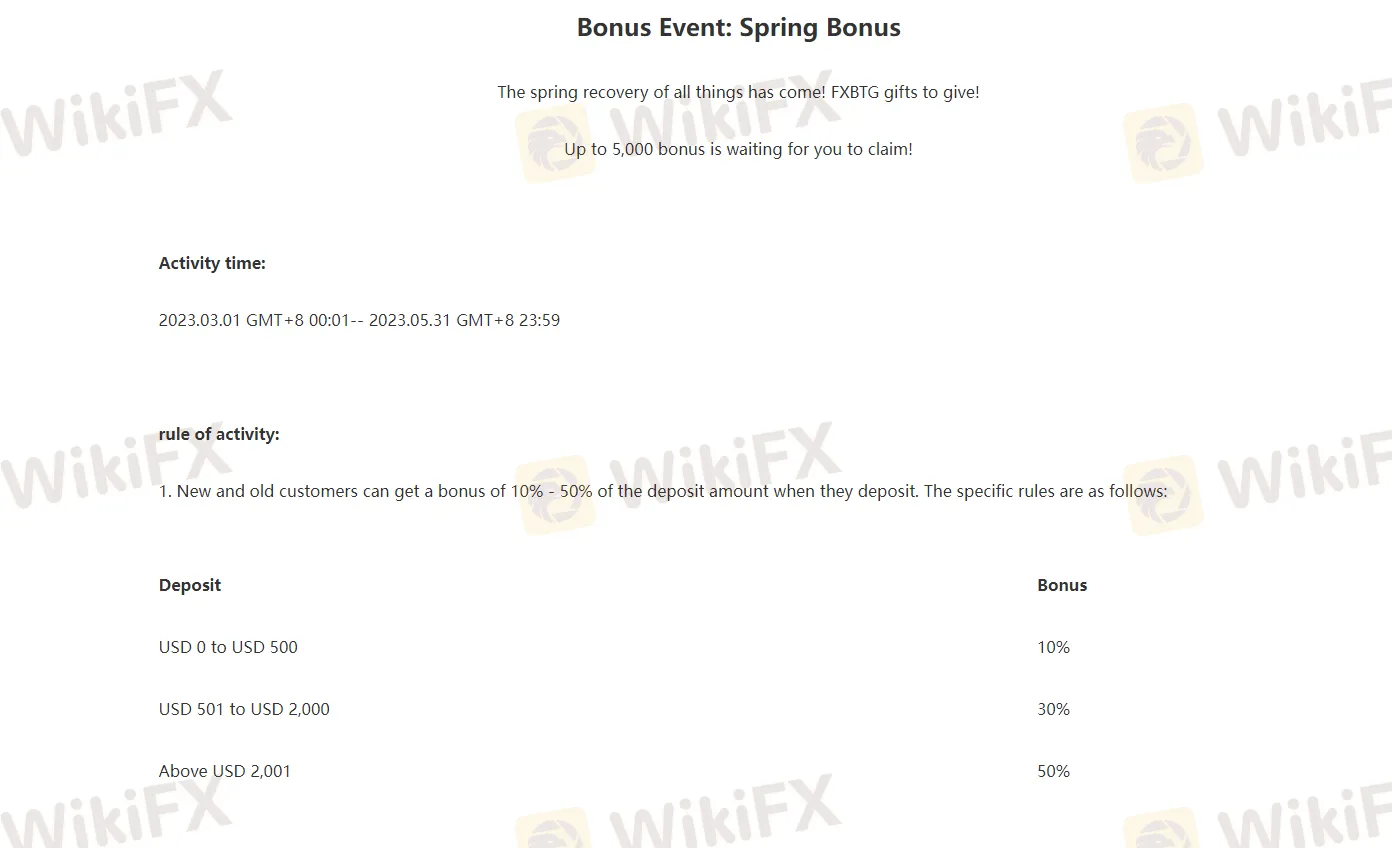

Deposit Bonus

It seems that FXBTG offers a deposit bonus to its clients. The bonus amount varies based on the amount of deposit made by the trader. For deposits between USD 0 and USD 500, a 10% bonus is given. For deposits ranging from USD 501 to USD 2,000, the bonus is 30%. For deposits exceeding USD 2,001, the bonus is as high as 50%. However, it is important to note that there may be terms and conditions associated with these bonuses, such as a minimum trading volume requirement before being able to withdraw the bonus funds. Traders should thoroughly review the terms and conditions before taking advantage of the deposit bonus offer.

Customer Support

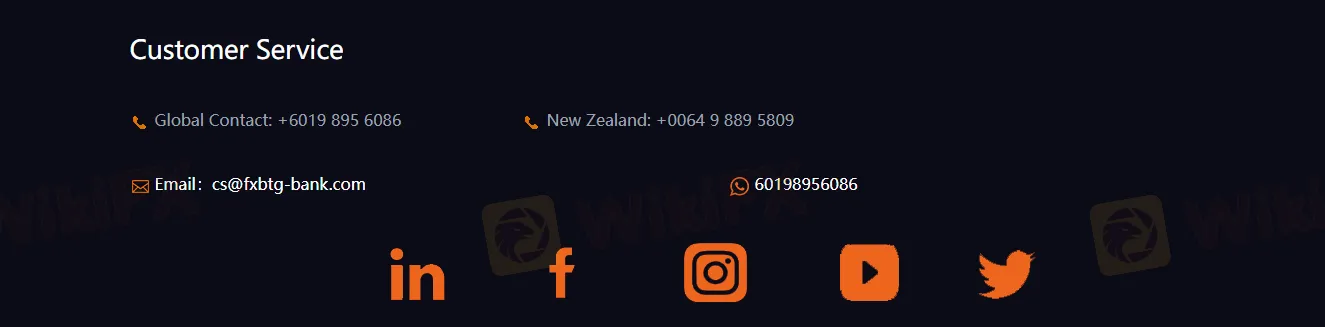

FXBTG offers customer support services through various channels, including email, phone, and live chat. The broker provides a dedicated customer support team available 24/5 to assist clients with any inquiries or issues they may have. The email support is accessible through a form on the website, and the broker promises a response time of 24 hours. Phone support is available for different countries, and the support team is knowledgeable and responsive. Live chat support is also available on the website, and clients can quickly get their queries addressed in real-time.

| Pros | Cons |

| Onlive Chat supported | No phone support available |

| Social media contact supported | Limited customer support resources during weekends and holidays |

| Personal account managers for VIP and Pro accounts | No FAQ section available on the website |

Educational Resources

It appears that FXBTG does not provide any educational resources. They are not easily visible on their website. There is no dedicated educational section, and the website does not seem to offer any tutorials, webinars, or other educational content. This could be a drawback for beginner traders who may need additional resources to improve their trading skills.

Conclusion

In conclusion, FXBTG is an unregulated broker that offers a range of trading instruments and account types, including a demo account for traders to practice their trading strategies. The broker offers flexible leverage options, but traders should be aware of the high spreads and commissions charged. The trading platforms offered by FXBTG are the popular MetaTrader 4 and the broker's proprietary FXBTG app. However, the lack of educational resources and the limited payment options may be a drawback for some traders. Customer support is available 24/5 but there have been mixed reviews about the quality of their service.

FAQs

Q: Is FXBTG a regulated broker?

A:Answer: No, FXBTG is not a regulated broker.

Q: What is the minimum deposit to open an account with FXBTG?

A:Answer: The minimum deposit for a Mini Account is $500, for a Standard Account it is $2,000, for a VIP Account it is $5,000, and for a Pro Account it is $20,000.

Q: What are the trading platforms offered by FXBTG?

A:Answer: FXBTG offers the popular MetaTrader 4 (MT4) platform and its proprietary FXBTG App.

Q: Does FXBTG offer a demo account?

A:Answer: Yes, FXBTG offers a demo account for traders to practice and test their trading strategies.

Q: What is the leverage offered by FXBTG?

A:Answer: FXBTG offers flexible trading leverage ranging from 1:100 to 1:400, depending on the trading account held.

Q: What are the deposit and withdrawal options offered by FXBTG?

A:Answer: FXBTG offers several deposit and withdrawal options, including Bipipay, Huobi, Binance, Clickpay, Paytrust, Hi Pay, and Tether.

Q: Does FXBTG offer any deposit bonus?

A:Answer: Yes, FXBTG offers a deposit bonus ranging from 10% to 50% based on the deposit amount.

Q: Does FXBTG provide customer support?

A:Answer: Yes, FXBTG provides customer support via email, phone, and live chat.

Q: Does FXBTG offer any educational resources for traders?

A:Answer: No, FXBTG does not offer any educational resources for traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator