简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

British Pound (GBP) Outlook: GBP/USD, FTSE 100 Power Ahead as UK Re-Opening Continues

Abstract:BRITISH POUND (GBP) PRICE OUTLOOK

Strong local election results, vaccination data, boost interest in UK plc.

GBPUSD takes out multi-week resistance.

FTSE 100 pushing ever higher.

UK PM Boris Johnson is expected to outline further plans to re-open the UK economy later today, in a further boost to UK assets. The government made further gains in last week‘s local elections, buoying the faith in PM Johnson, while Labour leader Sir Keir Starmer re-shuffled his team over the weekend as dark clouds loom over the leader of the opposition. In Scotland, the SNP kept hold of power, as expected, but just missed out on winning a majority. The First Minister of Scotland, Nicola Sturgeon, has already said that a new independence referendum is a case of ’when not if but the SNP is unlikely to set out further plans until next year.

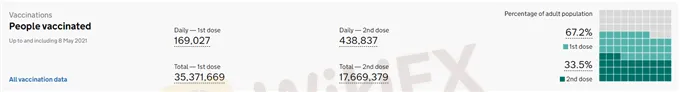

The latest UK covid-19 and vaccination data show the governments program continuing to forge ahead with over 67% of the population having had at least of jab, while 33.5% have received two jabs.

GBP/USD currently trades at its best level in two-and-a-half months, driven higher by a combination of positive Sterling sentiment and a weak, post-NFP, US dollar. Friday‘s US Jobs Report missed expectations of one million new jobs by a wide margin, while last month’s number was also revised sharply lower. The greenback fell on the release as traders pushed back expectations of taper talk to the backend of the year. The daily chart shows little in the way of strong resistance before the February 24 high at 1.4242. This level will need further positive data readings and sentiment flows before it comes under pressure. The CCI warns that GBP/USD is heavily overbought.

GBP/USD DAILY PRICE CHART (OCTOBER 2020 – MAY 10, 2021)

Retail trader data show 40.67% of traders are net-long with the ratio of traders short to long at 1.46 to 1. The number of traders net-long is 1.99% higher than yesterday and 37.68% lower from last week, while the number of traders net-short is 2.69% higher than yesterday and 51.79% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

The FTSE 100 has seemingly broken its inverse relationship with Sterling and is also pushing higher. The UK big board continues to make a fresh 14-month high and is now testing the bullish channel that has dictated price action since late-January. Again, the market looks overbought and may need a period of consolidation before further gains are made.

FTSE 100 DAILY PRICE CHART (SEPTEMBER 2020 – MAY 10, 2021)

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

ASIC Sues HSBC Australia Over $23M Scam Failures

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Understanding the Impact of Interest Rate Changes on Forex Markets

Currency Calculator