简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 cryptocurrencies to watch this week

Abstract:Top 5 cryptocurrencies to watch this week: BTC, XLM, MIOTA, XMR, XTZ.

BTC/USDT

Bitcoin soared above the $60,000 overhead resistance on April 10 and reached $61,301.21, just short of the all-time high at $61,825.84. However, the bulls continue to find difficulty in keeping the price above $60,000, indicating stiff resistance from the bears.

The price has yet to close above $60,000 which means the inverse head and shoulders pattern is still not complete.

The bears will try to capitalize on the small window of opportunity and pull the price down to the 20-day exponential moving average ($57,513). A strong bounce off this support will increase the possibility of a break above $61,825.84.

If that happens, the BTC/USDT pair could start the next leg of the uptrend that could push the price to $69,540 and then $79,566.

On the other hand, if the bears sink the price below the 20-day EMA, the pair could challenge the critical support at the 50-day simple moving average ($54,723). A break below this support will be the first indication of a possible change in trend.

XLM/USDT

Stellar Lumens (XLM) broke above the $0.60 resistance today and rose to a new 52-week high at $0.65. Whenever an asset hits a new 52-week high, it is a sign of strength because it shows that traders are in a hurry to buy as they expect the price to rise further.

The upsloping 20-day EMA ($0.46) and the relative strength index (RSI) in the overbought territory suggest the bulls have the upper hand. If the bulls can propel the price above $0.65, the XLM/USDT pair could start the next leg of the uptrend that could reach $0.72 and then $0.85.

However, the long wick on todays candlestick suggests that the bears have other plans. They are trying to trap the aggressive bulls and pull the price back below $0.60. If the bulls do not allow the price to dip below $0.55, it will suggest accumulation on dips. That will keep the sentiment positive.

MIOTA/USDT

IOTA (MIOTA) is in an uptrend. The bulls pushed the price above the psychologically important level at $2 on April 10. If bulls can sustain the breakout, the up-move could reach the next target objective at $2.35 and then $2.60.

The upsloping 20-day EMA ($1.66) and the RSI near the overbought zone suggest the bulls have the upper hand.

However, if the bulls fail to sustain the price above $2, the bears may try to pull the price down to the 20-day EMA. The bulls have successfully defended this support since the start of the current leg of the rally in March.

XMR/USDT

Monero (XMR) broke above the $268.60 resistance on April 10, indicating the possible resumption of the uptrend. If the bulls can sustain the breakout, the altcoin could rally to the next target objective at $334 and then $384.

The rising 20-day EMA ($258) and the RSI above 75 suggest the path of least resistance is to the upside.

However, if the bulls fail to sustain the price above $288.60, the XMR/USDT pair could drop to the 20-day EMA. A strong bounce off this support will suggest the sentiment remains positive and the bulls are buying on dips. The bulls will then make one more attempt to resume the uptrend.

On the other hand, if the bears sink the price below the 20-day EMA, it will suggest a possible change in sentiment. That could result in a drop to the 50-day SMA ($232).

XTZ/USDT

Tezos (XTZ) is in a strong uptrend. It broke above the stiff overhead resistance at $5.64 on April 5 and completed a successful retest of the breakout level on April 7 and 8. The altcoin resumed its uptrend and made a new all-time high at $7.21 on April 10.

The 20-day EMA ($5.42) is sloping up and the RSI is near the overbought territory, indicating advantage to the bulls. In a strong uptrend, corrections usually last between one to three days as traders buy every minor dip aggressively.

The long tail on todays candlestick suggests traders are buying at lower levels. If they can drive the price above $7.21, the XTZ/USDT pair could rally to the next target objective at $8.14.

The major support on the downside is the 20-day EMA. If the price rebounds off this support, it will suggest the sentiment remains bullish. The buyers will then again try to push the price above $7.21. Conversely, a break below the 20-day EMA will suggest the bullish momentum has weakened.

__________________________________________

WikiFX, an encyclopedia in the Finance & Forex Industry! Now you can find 26000+ broker reviews on WikiFX APP and 100 free VPS waiting for you to receive!

╔═══════════════════════╗

Website: https://bit.ly/wikifxIN

APP for Android: https://bit.ly/3kyRwgw

APP for iOS: https://bit.ly/wikifxapp-ios

╚═══════════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crypto scammers make $9 million on fake prominent channel video streams

promote fake crypto giveaways

How will CBDCs benefit economies in Southeast Asia?

Central banks around the world are exploring digital currencies

Cryptocurrency Market Value Blows Past $3 Trillion

The cryptocurrency market is now worth more than $3 trillion.

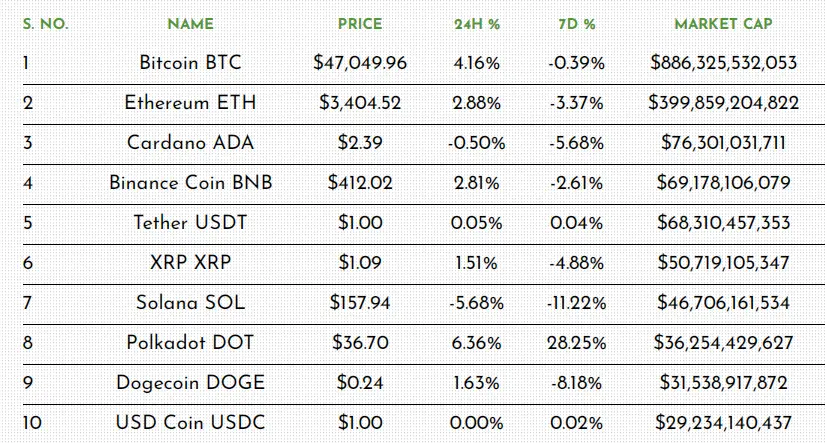

Cryptocurrency Prices Today

Cryptocurrency prices continue to be a mix of red and green on September 15.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator